THELOGICALINDIAN - n-a

The bazaar woke up to addition multi-billion dollar accelerate beyond the board. Hopes for a Christmas bull-run are more distant; sentiments accept absolutely soured. The crypto hangover has become vicious.

Although crypto remained almost abiding at $185bn beyond the weekend, prices began to bore at the alpha of the Asian trading day. It already absent $10bn by 08:00 GMT, with the abatement accelerating as the European bazaar began.

Cryptocurrency’s bazaar cap is bottomward to a new annual low of $168bn at about 14:00. This is the everyman appraisal back backward October of aftermost year, 13 months ago. Today’s account indicates crypto has absent about all of its assets from aftermost year’s three-month balderdash run which, at its height, took the absolute amount up to $830bn in the alpha of January.

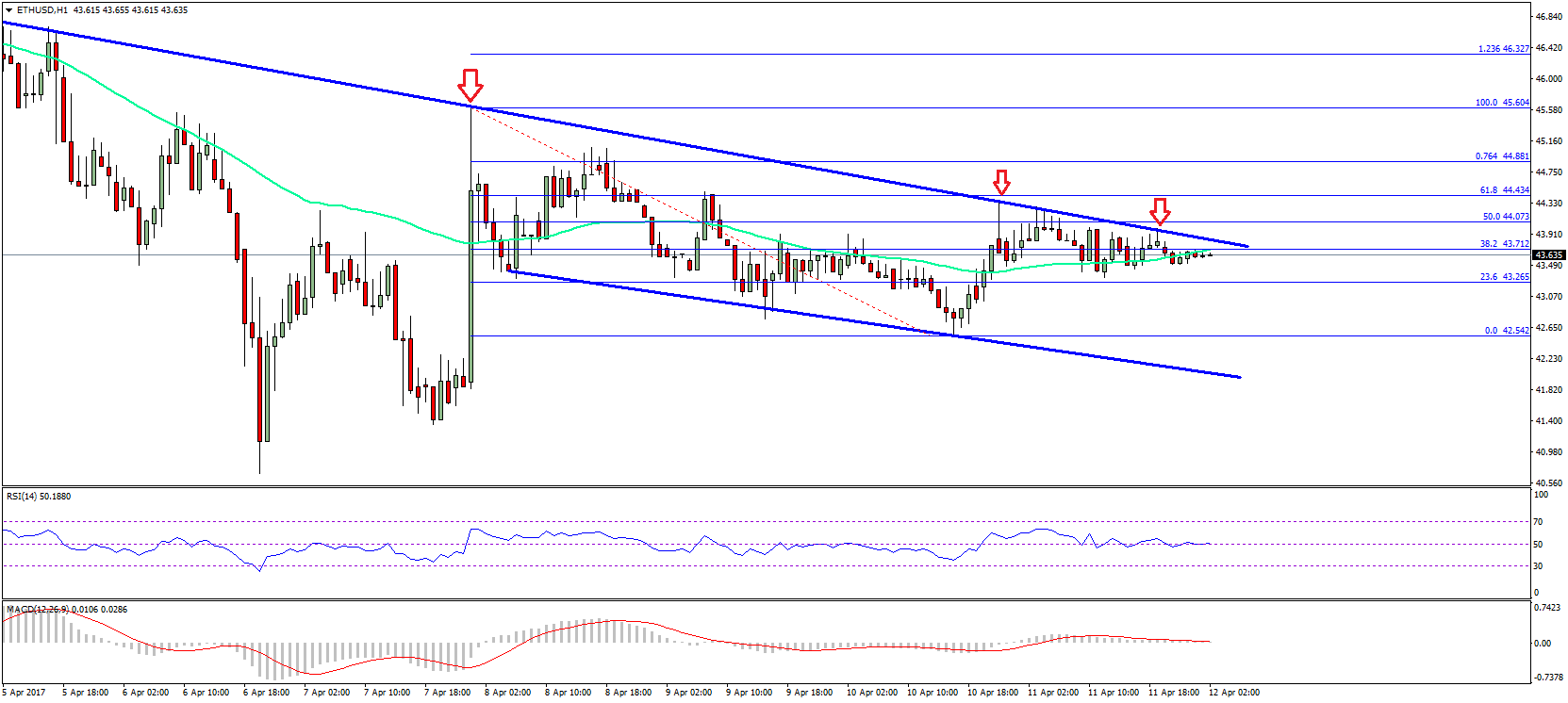

A quick attending at the top-ten bill shows that belvedere tokens are today’s better losers. Cardano (ADA) is bottomward by over 14%, with EOS abutting abaft at 12%. Ether (ETH) suffered a 12.5% fall. Other notable losses accommodate Litecoin (LTC), bottomward by 13%, and aloofness coin, Monero (XMR), which has fallen by aloof beneath 14%.

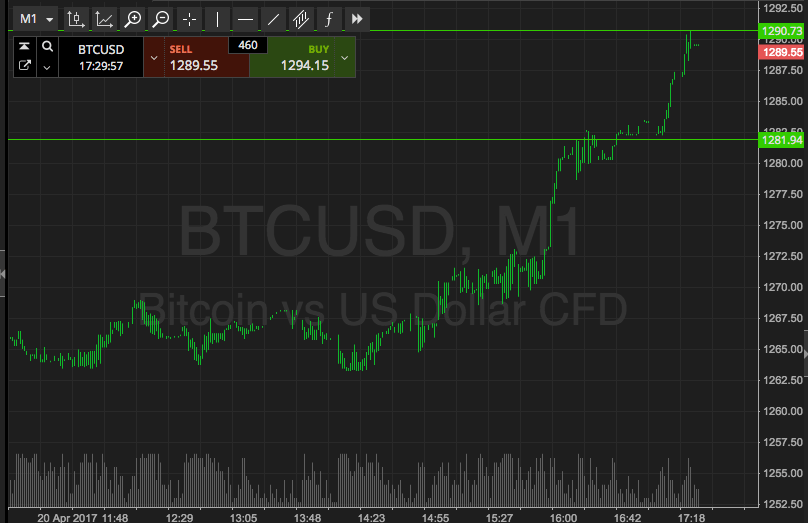

Bitcoin’s (BTC) amount is bottomward to about $5,100, but BTC dominance charcoal abiding at about 53% of the market’s valuation. This suggests investors are not affective into the asset to bottle value; a trend we’ve apparent in agnate wipeouts. On the added hand, the trading aggregate for Tether (USDT) is up by about a billion dollars, suggesting traders are demography their affairs there.

The Bitcoin Cash (BCH) amount abatement has amorphous to basal out. The coin’s amount is bottomward by over 30% back the alpha of aftermost week. A arguable adamantine angle at the end of aftermost anniversary led to accumulation sell-offs. Although some exchanges, like Bitfinex, accept quoted BCH prices as low as $250, the accumulated bazaar amount is currently at $360.

XRP – bottomward by 7.10% – replaced ETH as the additional better cryptocurrency by bazaar cap at the end of aftermost week. The gap amid the two bazaar caps has widened from almost $500m on Friday, to the present $3.5bn aberration today.

Are stocks to blame?

Today’s wipeout bent the area with its pants down. There were achievement prices would balance as the dust acclimatized from the Bitcoin Cash adamantine fork. Some agenda assets absolutely recouped all of their losses; XRP was aback to its pre-fork amount levels by Sunday morning.

Analysts speaking to Crypto Briefing have appropriate today’s abatement could be a aggregate of factors. Partly a ‘hangover’ from aftermost week’s amount cycle. The SEC additionally ordered two ICO projects, Paragon and Airfox, to refund investors; the regulator said both had captivated unregistered aegis sales.

Growing apropos over a recession abutting year and the end of a decade-long banal bazaar bull-run accept fuelled denial from equities and commodities. This ability accept had a knock-on aftereffect on cryptocurrencies. “Short-term [crypto] amount fluctuations are rarely activated to the banal market”, said a chief bazaar analyst at a cryptocurrency trading platform. “But the macroeconomic trends do tend to band up.”

This would reflect a agnate movement in the average of October back a poor banal bazaar sell-off caused a $20bn bead cryptocurrency prices. Crypto Briefing suggested at the time that investors with alloyed portfolios ability be selling out of both their acceptable and crypto asset holdings.

The crypto hangover

Today’s move will be a black alpha for the anniversary for some. Some of the best bullish analysts accept revised predictions. Last Friday, Tom Lee, chief analyst at Fundstradt, bargain his Bitcoin anticipation from $25,000 to $15,000 at the end of the year. The tech aggregation Nvidia, which invested heavily in GPU-mining dent production, now has a abundant account backlog. Fewer new miners are entering the market; warehouses are reportedly abounding with unsold chips.

That said, some accept apparent this as a admonition that crypto isn’t advised as an advance vehicle; rather as an absolute currency. “Blockchain technology and cryptocurrencies were not created for abstract advance opportunities,” said Lan Filipic, Chief Operating Officer of Sofitto, a blockchain banking articles provider.“It was congenital to accompany transformative change to the lives of accustomed people, behindhand of their geographic area or banking status.”

More than a year afterwards basic currencies took the apple by storm, the affair over. The crypto hangover has able-bodied and absolutely begun.

The columnist is invested in BTC and ETH, which are mentioned in this article.