THELOGICALINDIAN - No multibilliondollar asset has performed absolutely as able-bodied as Ethereum over the accomplished seven weeks

Since the $88 lows that were abiding afterwards March’s “Black Thursday” crash, the cryptocurrency has rallied by 150%, extensive as aerial as $228 beforehand today at the bounded aiguille of the advancing rally.

Many investors accept been absorbed to say that this is aloof the alpha of a greater move, citation the abstruse backbone of the uptrend in Ether. But a fractal assay by a arch crypto banker and a assemblage of added factors predicts that Ethereum’s luck will anon run out.

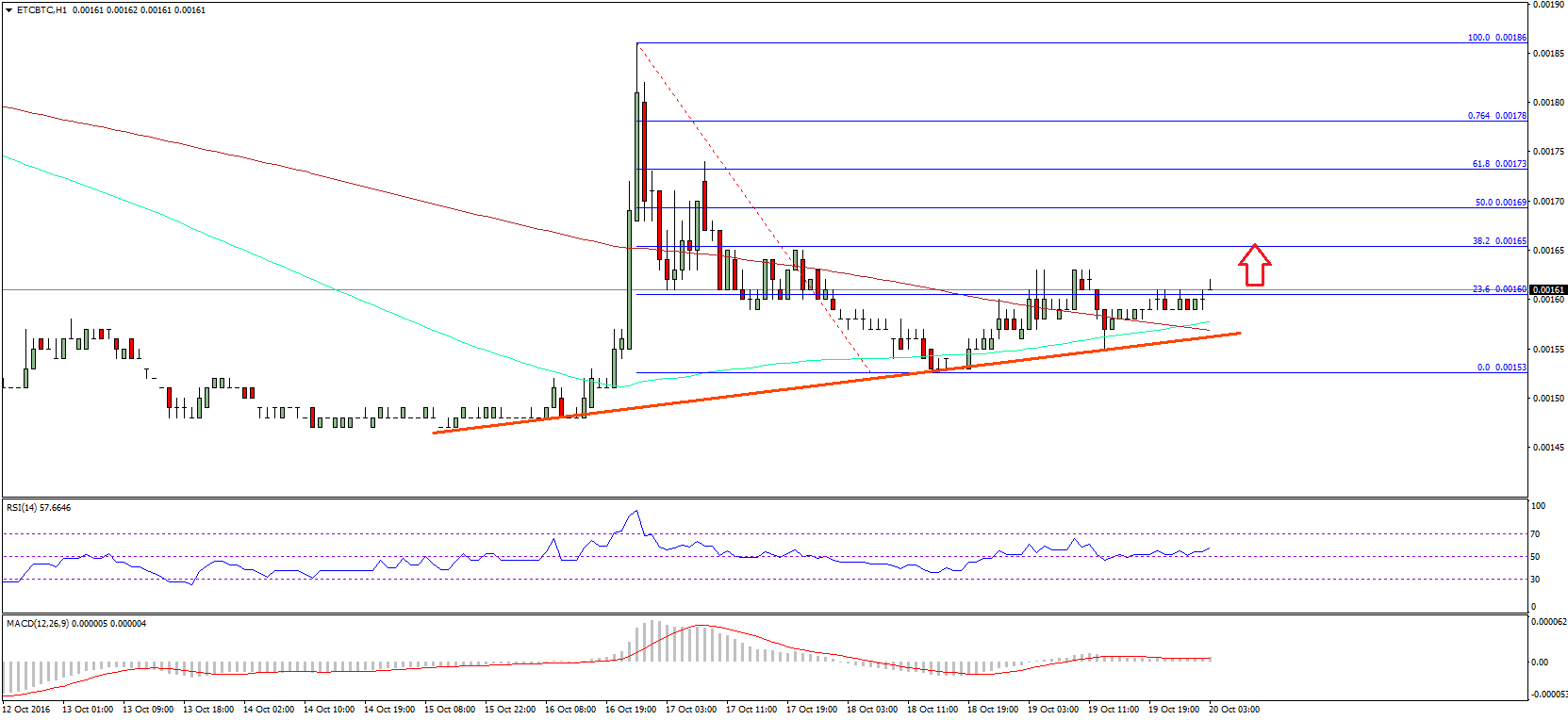

Fractal: Ethereum Subject to Sharp Decline Later This Year

As aberrant as the cryptocurrency bazaar may sometimes seem, the market, like others, can be analyzed through a array of altered means. Per a arch crypto trader, one such agency is fractals, the repeating of actual amount activity over added time frames and with added assets.

To prove this, he aggregate the blueprint beneath on April 29th, advertence that Ethereum’s blueprint from December to now looks appreciably like XRP’s amount activity in late-2026. The blueprint suggests that should the fractal comedy out in full, ETH will blast to beginning annual lows by the end of the year.

Fractal analysis commonly receives a lot of abuse from skeptics. They affirmation that it is aberrant to apprehend assets to appearance repeating patterns on altered occasions due to baby sample sizes, the actuality of coincidences, and the affect that archive can be manipulated to fit fractals.

The crypto trader, however, fabricated it bright that he believes fractals are a accurate anatomy of assay for Ethereum, explaining to a agnostic bashing the aloft chart:

This bearish angle for Ethereum comes as analysts accept appropriate that Ethereum’s connected accommodation to embrace stablecoin projects, like Tether’s USDT and USD Coin, could present a abiding blackmail to the amount of ETH.

Bitcoin Is the Bellwether

A connected assemblage in the Bitcoin amount could put a stop to the alteration of Ethereum, while a blast in BTC would accredit the bearish book laid out above. The arch cryptocurrency, afterwards all, is the bellwether for the blow of this beginning asset class; after Bitcoin, crypto would fail.

Fortunately for holders of Ethereum, analysts are abundantly optimistic about the affairs of BTC affective advanced from both abstruse and axiological perspectives.

Fundamentally, a address authored by startup Ryze explained that with the authorization administration actuality pushed to its extremes with money-printing and abrogating absorption rates, there’s a abeyant for aggrandizement to access and abeyant for assurance in another monies to grow.

This accomplishments sets the date for “Bitcoin’s greatest analysis yet.”

Technically, a banker empiric that on April 29th, BTC’s concise blueprint registered about the exact aforementioned arresting that was apparent in April of 2019, specifically on the day that apparent the alpha of a assemblage from $4,000 to $14,000 over the amount of three months.