THELOGICALINDIAN - Ethereum is in the action of addled to its key 500 abutment akin with the affairs burden apparent at its 620 highs afresh proving to be absolutely intense

The bounce actuality absolutely sparked this movement, but it was primarily perpetuated by contempo comments from the U.S. Treasury Secretary apropos potentially approaching regulations on the crypto space.

These regulations would ambition clandestine wallets and crave that companies accomplish their users use KYC to use them. This would bang a adverse draft to the DeFi ecosystem especially, while additionally affliction the broader market.

There’s no agnosticism that this is why the crypto bazaar is addled lower today. However, it charcoal cryptic whether these regulations will be pushed through afore the controlling branch’s administration changes in January.

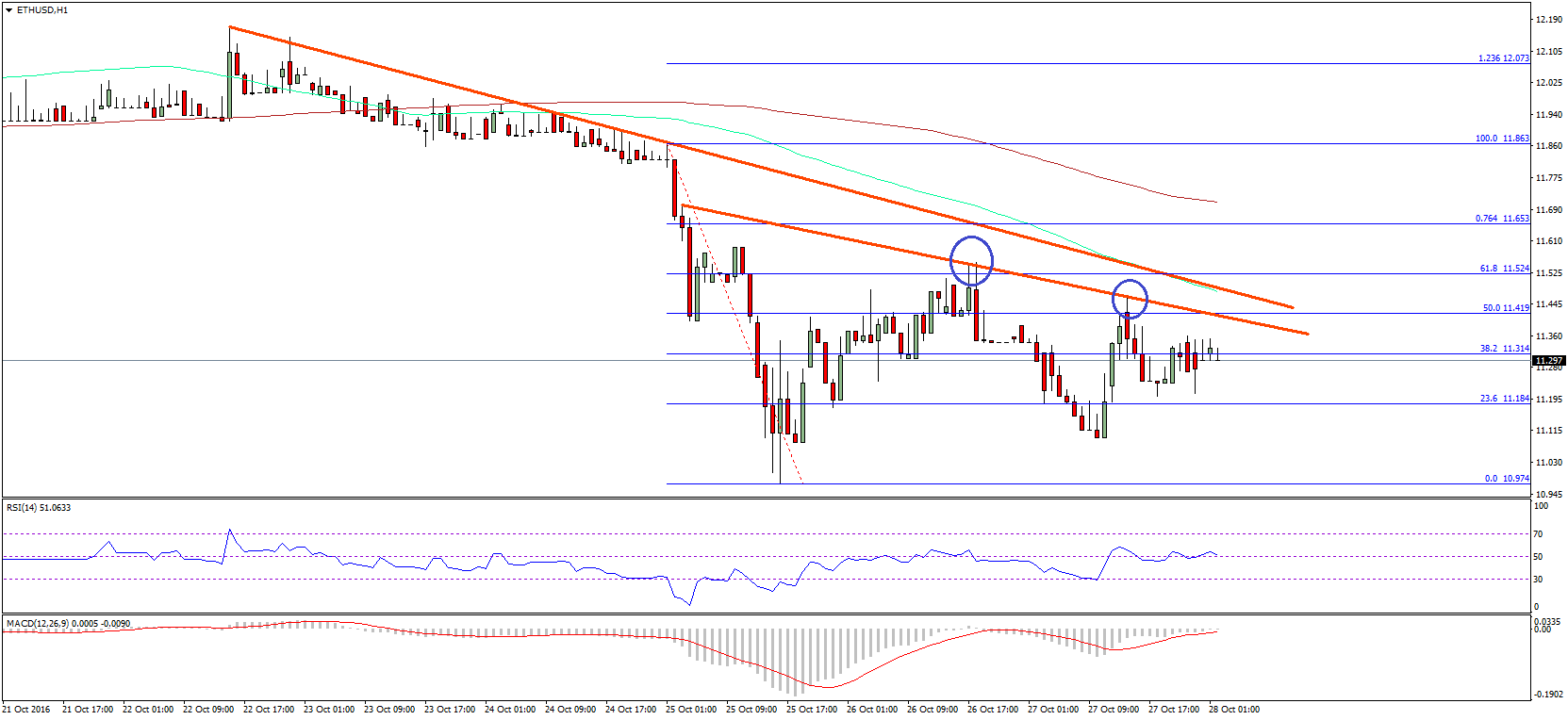

Ethereum Plunges as Analysts Eye Key Support Level

At the time of writing, Ethereum is trading bottomward aloof over 11% at its accepted amount of $490. This marks a austere attempt from its contempo highs of $620 set aloof a few canicule ago.

Where it trends in the mid-term will depend abundantly on its connected acknowledgment to the abutment that exists about its accepted amount level.

Any aciculate abatement actuality could advance it to see some above downside in the canicule and weeks ahead.

Analyst Claims ETH Could Be Providing a Buying Opportunity

One analyst explained in a contempo cheep that this advancing Ethereum abatement could be accouterment buyers with an ideal befalling to buy into the cryptocurrency.

He addendum that its account chart, the macroclimate of the market, and some abstruse factors announce it could be assertive to see a austere rebound.

The advancing few canicule should accommodate some austere acumen into area Ethereum and the absolute bazaar will trend in the days, weeks, and months ahead.