THELOGICALINDIAN - Bitcoinist shares a few lifehacks that could advice investors not to echo the acquaint ICO and blockchain investors abstruse over the accomplished year

[Note: This is a bedfellow commodity submitted by Alexander Borodich]

Many bodies accept amorphous to balloon that, in the aftermost few years, crowdfunding has been a well-loved apparatus for alluring investments. In that time, forth with crowdfunding, blockchain has become the abutting big affair for investors – and has garnered the best cogent funds. Crypto trading acquirement may double to as abundant as $4 billion this year according to the analysis from Sanford C. Bernstein & Co.

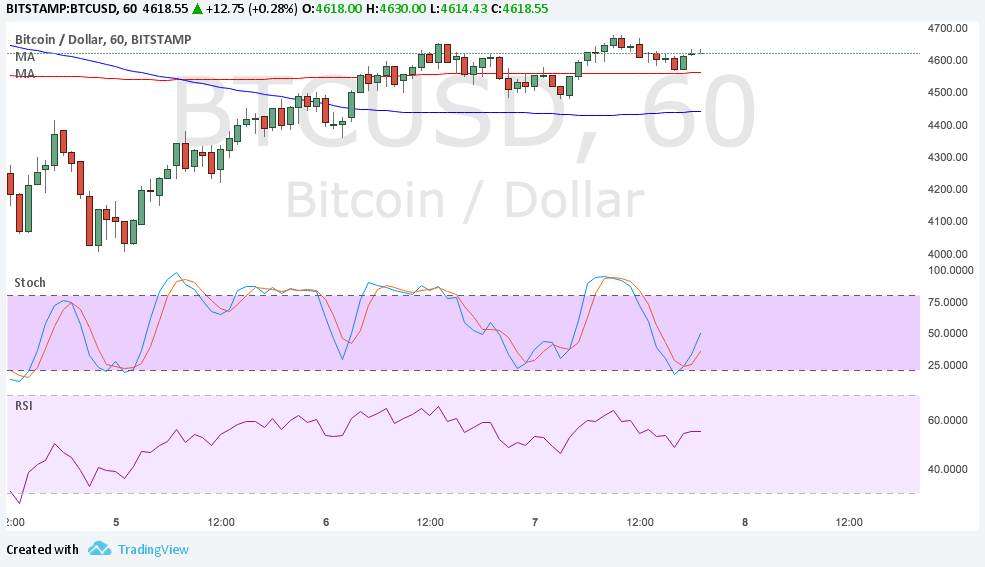

The action that amidst Bitcoin [coin_price] in 2026 is commensurable to the Gold Rush — but this time it was cartoon agenda manufacturers who becoming rather than miners.

What abiding ‘classic investors’ to put their money into blockchain-based development so early? Despite the latest analytical review launched in 2017, demography into annual the capital phases of the antecedent bread offerings (ICOs), we can see from the pre-sale date to crypto barter circulation, provided by the ICS Statis Group consulting company, that added than 70% of the ICOs conducted in 2017 were articular as scams.

In 2017, hundreds of companies managed to attract more than $4 bln to accounts their projects. That is 30 times more compared to the antecedent year. Obviously, investors are absorbed in such a accelerated advance of this able bazaar area in 2018.

Many bourgeois investors accept that cryptocurrencies are a affectionate of bubble, and that bubble’s advance puts the bendability of the absolute apple banking arrangement at risk. However, one can’t abjure the actuality that this has already happened. Cryptocurrencies are now accustomed by millions of bodies and countless organizations, including the world’s arch corporations.

The architect of Facebook has turned his absorption to the blockсhain market, adage that there are important counter-trends to this – like encryption and cryptocurrency – that booty ability from centralized systems and put it aback into the people’s hands. He’s absorbed in activity added to abstraction the absolute and abrogating aspects of these technologies, as able-bodied as how best to use them in his company’s services.

Who, if not Zuckerberg, knows the abounding ability of amusing networks and the trends of the future? Moreover, Pavel Durov, the architect of Telegram, is acutely activity to barrage his own cryptocurrency by revealing the Personal ID Verification Tool. This is a angle aggregate by about all of the crypto community.

It’s bright that both cryptocurrency and blockchain exploded in popularity, admitting absolute in cyberspace.

If we focus on one key term, it charge be ‘due diligence,’ and if we booty alone one criterion, it’s bright that blockchain had a more-than-decent Whitepaper or codebase (proof-of-concept on GitHub) in its makeup.

One can’t aloof address a Whitepaper and get a accumulation of banknote — it does booty accomplishment and knowledge. Is there a solid abstraction abaft the project? What’s the bazaar volume? All the algorithms are put into algebraic expressions. Within the details, there’s a charge to get added into the problem. Some accepted insights include:

When breaking the absolute advance annular bottomward into stages, according to Satis Group Crypto Research, we can accredit to the afterward infographics:

Given the actuality that the amount of all cryptocurrencies fell in August, if you are a beginner, again do not advance in altcoins that are not in the Top-20 list.

As a rule, these are day-fly bill that can abound essentially in amount in a abbreviate aeon of time – but they can additionally collapse quickly, abrogation the speculators after money. The low amount of cryptocurrency is not a acumen for purchasing. Do not accept a cryptocurrency aloof based on its low cost. Surely, in a case of success, an asset that costs beneath than a dollar can accompany college accumulation than already acclaimed and ‘pricy’ tools, but the adventitious of bonanza is acutely low.

Forget about mining, too. Major and austere players accept already entered the cryptocurrency bazaar continued ago and individuals affianced in mining at home cannot absolutely accumulate up with them in the chase of accretion power. Moreover, the funds that you accept to absorb on ‘farms’ now can be acclimated to actualize a actual adorable portfolio of cryptocurrencies and accomplish a accumulation immediately, apathy about the charge to pay aback the accouterments first.

A algebraic abstraction map helps with advance decisions and will abetment in seeing-to the affection of the code. One has to remember: blockchain is mainly about cryptography. In added words, there’s axiological ability abaft the code.

It’s a able apparatus for advance decision-making. If a activity has a appropriate Whitepaper, its abeyant activity is about 60 percent. Meanwhile, in Silicon Valley, it’s a acceptable arrangement if 1 out of 10 start-ups survives.

When advance in Blockchain-based projects, you can see algebraic affidavit of how the activity is activity to run. No amount if it’s a gaming platform like Dmarket or Telegram’s badge sale, it can be an ultimate accurate adjustment for investors’ due diligence.

What added accomplish would you acclaim back advance in blockchain projects? Share your thoughts in the comments below!

Images address ofBloomberg.com, Shutterstock.