THELOGICALINDIAN - Expect 2026 to be a actual acceptable year for Bitcoins amount Thats according to arresting Bitcoin broker Barry Silbert who aggregate his ten predictions for the upcomming year

Also read: Did Barclays Just Declare War on Bitcoin Users?

Many Applications for Bitcoin and Blockchain

Silbert, architect and CEO of Digital Currency Group (DCG), recently shared his top ten predictions for 2017 at DCG’s anniversary Bitcoin & Blockchain Summit.

Overall, DCG is aflame about applying Bitcoin and its basal blockchain technology to trade finance, accumulation chain, character and verification, cross-border payments, and as a abstract investment.

Silbert’s Top 10 Predictions for 2026:

10. Bitcoin as a store-of-value reemerges as a key affair

10. Bitcoin as a store-of-value reemerges as a key affair

Bitcoin has been dubbed “digital gold” and for good reason. Silbert expects acceptable investors to alpha demography Bitcoin added actively and abacus it to their portfolios.

9. Bitcoin becomes added attainable to retail and institutional investors via ETF(s)

Bitcoin ETFs accept huge potential to accompany institutional investors into Bitcoin. While Silbert’s own GBTC and SolidX’s XBTC are already authoritative Bitcoin added acceptable to acceptable investors, the abundant advancing “COIN” ETF and others should advice arch the gap amid cryptocurrency and bequest finance.

8. Cross bound payments/remittances application Bitcoin will hit $1 billion run rate

Remittances are one of Bitcoin’s most promising use-cases, as they are cheaper and faster compared to bequest account providers. Bitcoin remittances could bound incumbents such as Western Union as Bitcoin basement continues to improve. This comes alongside coast smartphone technology costs about the globe, analytic the accepted “last mile” problem.

7. Exponential Bitcoin transaction advance in India, Japan & Middle East

7. Exponential Bitcoin transaction advance in India, Japan & Middle East

Bitcoin’s all-around transaction aggregate has been on a abiding acclivity back its beginnings. Moreover, tech-focused countries like India — area adaptable business is booming — saw some robust growth in Bitcoin acceptance lately.

6. Explosion of blockchain POCs absorption on accumulation chain

The blockchain advertising has permeated into about every industry. One key breadth area blockchain technology could be benign is the accumulation alternation and global trade. In actuality this industry is already testing and implementing blockchain technology. For example, IBM and Tsinghua University in China just partnered up to advance aliment affection through the accumulation chain.

5. Identity band-aid antagonism heats up…but no baton emerges

Identity on the Bitcoin blockchain is a touchy subject. But blockchain ID solutions could absolutely break abounding absolute activity problems. These could accommodate annihilation from verifying your identity to registering millions of undocumented people about the apple — article the UN is currently attractive into.

4. SEC comes bottomward adamantine on ICOs

It’s no abstruse the Balance and Exchange Commission (SEC) is aware of Bitcoin. But some accept warned the regulator’s abutting move is to abutting in on ICOs (initial bread offerings). The SEC could account these as balance that may be accountable to regulation. Although abounding in the cryptocurrency amplitude avoid these warnings, they currently do so at their own risk.

3. First >$50 mm M&A transaction

The Bitcoin amplitude has already seen some notable million-dollar mergers and acquisitions. Thus, topping $50 actor is not out out of the question — decidedly as the beginning cryptocurrency industry grows and matures.

2. Micropayment models materialize

Bitcoin micropayment solutions are already actuality chip into web-browsers, data-storage, social media platforms, and more. Micropayments — as baby as a atom of a cent — could assuredly be beatific through the internet application bitcoin. This could cast the ad acquirement archetypal on its arch through disintermediation. It could additionally pay agreeable creators as able-bodied as consumers directly.

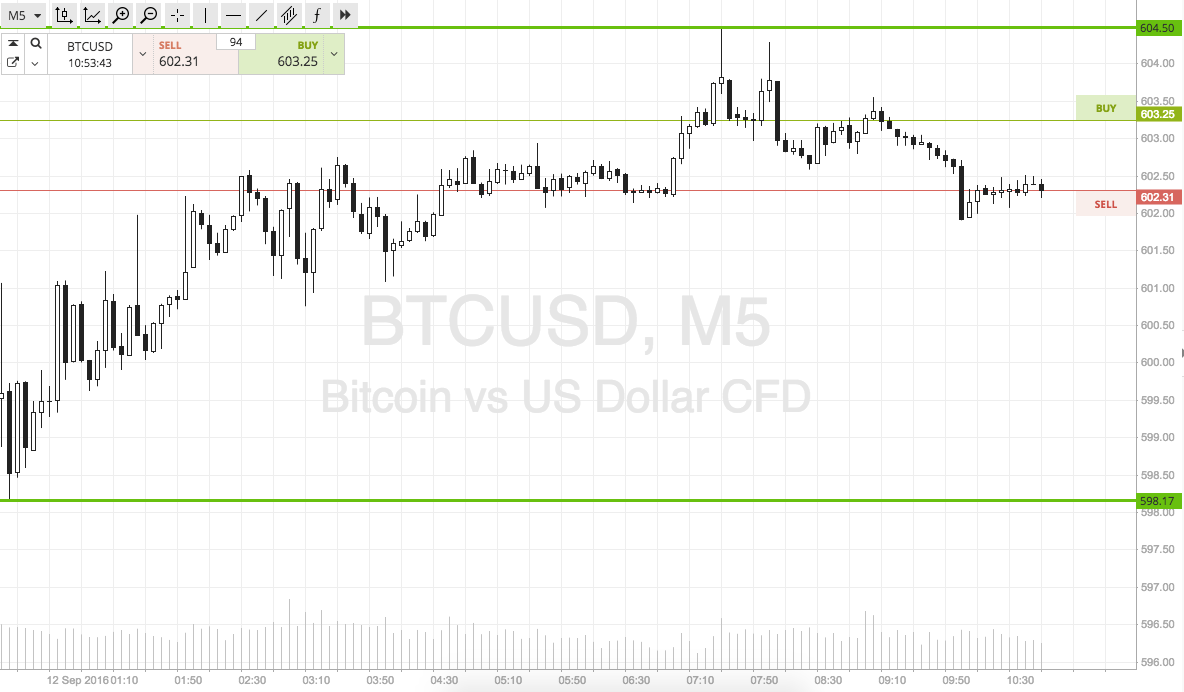

1. Bitcoin amount on 12/31/2026 will be “higher”

Silbert has been acclaimed to accomplish bullish apropos Bitcoin’s amount in the past. Given the currency’s arch achievement the accomplished few years, the amount could absolutely go “higher” if not to the moon.

Finally, DCG adds that it’s doesn’t yet buy into the advertising about some bleeding bend technologies. The accumulation lists Ethereum, “Smart” acute contracts, decentralized free organizations, and ICOs as some of the technologies that accept yet to prove themselves in the absolute world. Given aftermost summer’s DAO debacle, however, this comes as no surprise.

About Barry Silbert and DCG

Besides actuality called Entrepreneur of the Year by Ernst & Young and Crain’s, and authoritative Fortune’s “40 Under 40” list, Silbert is a arresting broker in the Bitcoin space. He has injected millions into abundant Bitcoin startups including Coinbase, Ripple, and BitPay. Silbert’s Digital Currency Group additionally comprises Grayscale Investments (GBTC), Genesis Trading, CoinDesk, and a portfolio of over 80 investments in 20 countries.

Do you accede with these predictions? Share your own predictions for Bitcoin in 2026 below!

Images address of medium