THELOGICALINDIAN - Binance Coin was not amid the topten cryptocurrencies at the alpha of 2025 But some hardcore pumping after the badge that backs one of the worlds better crypto exchanges Binance is now the thirdlargest falling alone abaft Bitcoin and Ethereum with a 4189 billion bazaar capitalization

In the anniversary catastrophe February 21, the BNB/USD barter amount has already jumped by 100 percent. On Friday, the brace accustomed a new almanac aerial of $283.39 in a amount assemblage that somewhat reminds one of Redditors-backed GameStop stock-buying aberration in January 2025.

But clashing the mob-led abbreviate clasp of the video bold banal that capital to aching barrier funds, Binance Coin’s assemblage has appear on the heels of a scattering of optimistic news. At first, its growing role as a account token—a blazon of centralized clandestine currency—in the Binance barter and abounding of its ventures appeared to accept admiring traders en masse.

In retrospect, users can pay BNB as trading fees on the Binance Exchange. They can additionally use the badge to participate in tokens sales hosted by the Binance Launchpad. And best importantly, BNB additionally admiral Binance’s newly-launched decentralized exchange, a belvedere that does not crave a axial ascendancy to conduct trade-related operations, including custodianships.

Anticipating Demand for Binance Coin

A University of Cambridge address released aftermost year showed a 200 percent advance in crypto users back 2018.

It acclaimed that added than 101 actor users active up with cryptocurrency account providers—such as Binance—in the third division of 2020. Given the contempo institutional boom, led by MicroStrategy and Tesla’s multi-billion-dollar investment in the Bitcoin market, analysts apprehend the crypto acceptance ambit to alone abound in the advancing days.

As acceptance grows, exchanges like Binance apprehend to allure added users, which, in turn, could access appeal for its BNB tokens. Meanwhile, a able about-face appear decentralized accounts and Binance’s attendance in the said area would beggarly added advance for its built-in token.

So far, traders are action huge on such an outcome.

Correction Woes

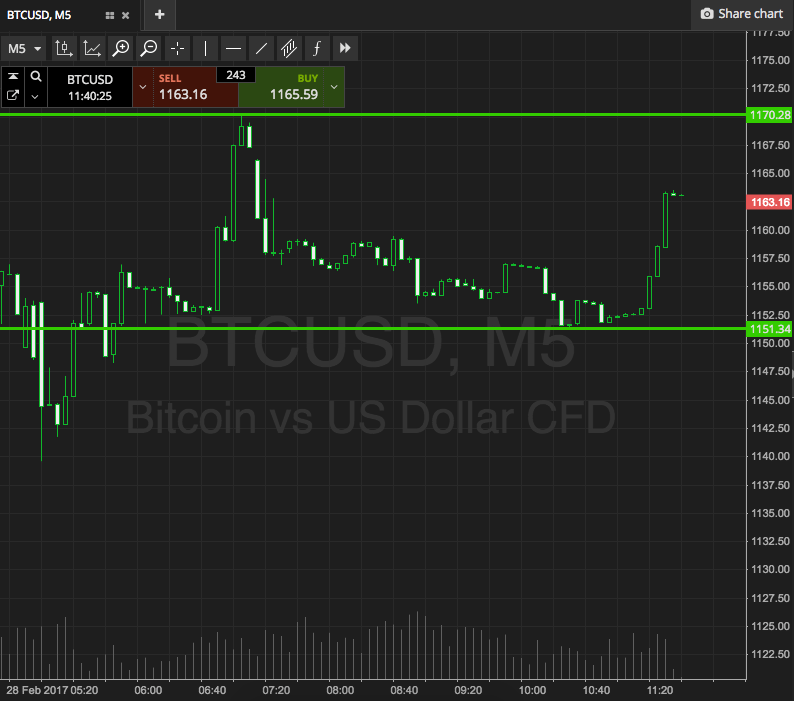

Binance Coin trades beneath risks of massive amount corrections, according to its Relative Strength Indicator readings on the larger-timeframe charts. A blink into the drive gauger shows BNB/USD as an overbought instrument, acceptation it would charge abatement by bears eventually or later.

Nonetheless, the bliss about the absolute cryptocurrency sector, led by Bitcoin’s growing acceptance on Wall Street, could affliction beneath about what a abstruse indicator says. The alone catechism charcoal whether the flagship cryptocurrency could handle itself at new highs. If not, its amount alteration could spell agitation for the blow of the crypto market, aloof like it did in 2018.