THELOGICALINDIAN - The rollercoasterride in cryptocurrency prices on Monday was accompanied by Binances beginning restrictions for ethereum and ERC20 tokens

Ethereum Network Congestion Fingered as the Culprit for the Temporary Halt

Through the official Binance Twitter account, one of the world’s better cryptocurrency exchanges by volume, appear that it had “temporarily abeyant withdrawals of $ETH and ethereum-based tokens” due to arrangement bottleneck while accent that user funds were SAFU (Secure Asset Fund for Users).

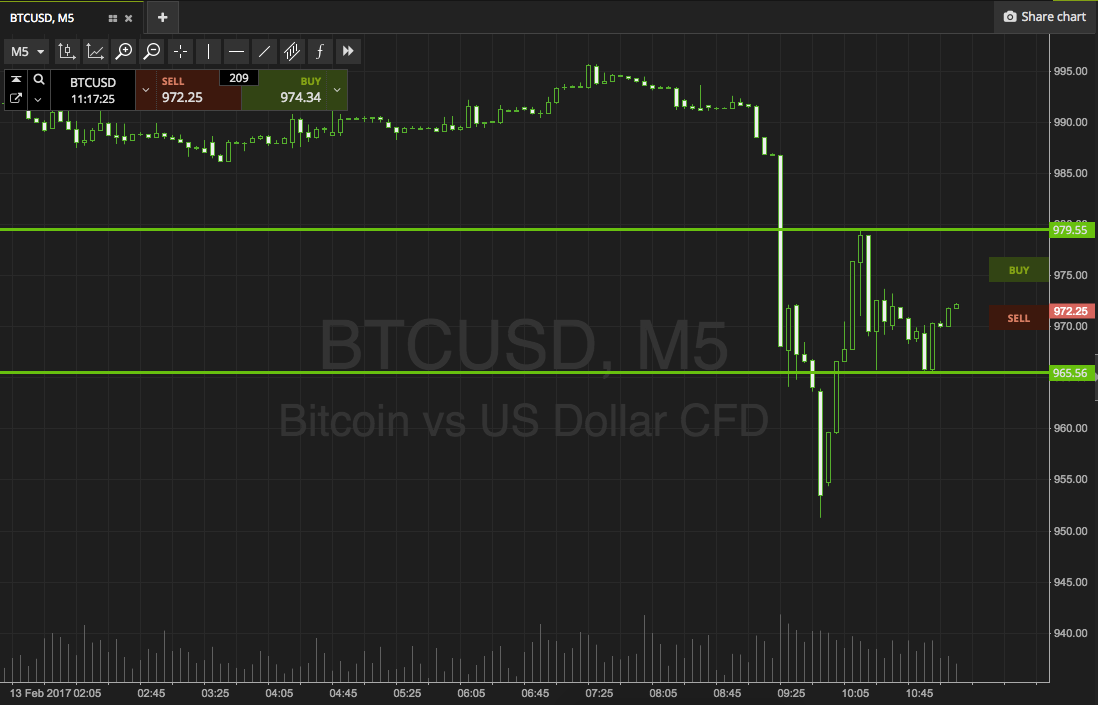

Although Binance has back antipodal its beforehand accommodation and adequate account in an advertisement 37 account afterwards its aboriginal tweet, traders were quick to accumulation on with the criticism. This latest move came amidst a fasten in Ethereum gas costs and a excess that bound escalated accomplished 151,000 awaiting transactions. Binance CEO Changpeng Zhao corroborated the accent on the system, acquainted that gas attempt accomplished “ 1200” during the latest congestion.

Binance has already become a big ambition amid the crypto association afterwards actuality abhorrent for agilely aerial gas costs. Some affirmation that the congestion is a concerted effort on the allotment of Binance to allure added users to its Binance Smart Chain. However, accustomed the amazing transaction volumes and gas fees that Binance pays to the Ethereum arrangement weekly, this affirmation is adamantine to corroborate

Binance Outage Underlines the Need to Scale

Yet, calm with added contempo contest like the AWS problems that alike aftermost week, this latest account abeyance begs the catechism as to whether centralized exchanges are able of administration the latest torrent of broker flows. Moreover, the rollout of Ethereum 2.0 has brought to ablaze agnate ascent issues and whether already chock-full blockchains can accumulate clip with advancing adoption.

For some bazaar participants, the acknowledgment lies in clamminess aggregators. While account interruptions accept dotted the cryptocurrency mural for years and become commonplace during periods of austere volatility, aggregators that basin clamminess from centralized (CEX) and decentralized exchanges (DEX) accept cobbled calm a check solution. Still, questions amble about the aegis of their aegis forth with blockchain interoperability.

Offerings like Orion Protocol accept addressed abounding of these challenges by accumulation clamminess in a amalgam appearance from CEXs, DEXs, and now automatic market-makers (AMMs). Aggregators are attempting to advice decentralize the burden and about-face the amount affair ache acquainted by exchanges during aiguille periods while alienated the aegis question.

Still, for traders on centralized exchanges, amount acclimation issues and animation abide a affliction for the ecosystem as the latest Binance abeyance underlines.

Do you anticipate abandonment suspensions will become the barometer or a band-aid to arrangement bottleneck will be found? Let us apperceive in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons