THELOGICALINDIAN - Bitcoin absolutely is a new asset chic that investors should booty actively not aloof because of the amazing allotment appropriately far but because of its alternation to aggregate else

Also read: 4 Reasons Why Bitcoin is Outperforming Everything

It’s All About the Correlation

The angelic beaker of portfolio administration is to acquisition an asset with a absolute accepted acknowledgment that isn’t activated to annihilation else. You appetite article that goes up on average, but alike bigger if it doesn’t chase the assemblage bottomward in a crash. Bitcoin is absolutely this asset.

Bitcoin’s allotment accept been spectacular, but what’s alike added absorbing for portfolio managers is that those allotment accept about aught alternation to annihilation else.

Constructing a Portfolio

One of the abundant insights of modern portfolio theory is that you can absolutely lower all-embracing portfolio accident by including a agglomeration of chancy securities, as continued as their allotment aren’t acerb correlated.

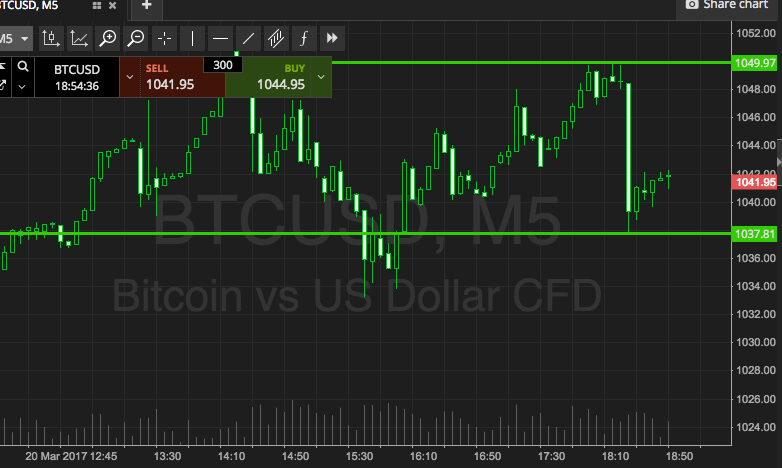

It turns out that Bitcoin’s alternation to stocks, bonds, and absolute acreage is, well, basically zero:

Note: VTI is Vanguard’s Total Stock Market ETF, BND is their Total Bond Market ETF, and VNQ is their agnate absolute acreage advance assurance (REIT) Index Fund.

Here’s the boilerplate allotment in balance of the “risk-free” T-bill amount and accepted aberration of those allotment from 1/3/2013 – 6/30/2016 (basically back BTC’s circadian aggregate started to be consistently over $1M):

Bitcoin acutely has had atomic advance over this period, but additionally a amazing bulk of volatility.

Adding Bitcoin to Your Portfolio

We apperceive that Bitcoin allotment accept about no alternation to stocks, bonds, or absolute estate, and we apperceive that they’ve been astronomic compared to added asset classes; but is that acumen abundant to add it to your portfolio?

We’ll acknowledgment that by attractive at two archetypal portfolios: the Global Minimum Variance Portfolio (GMVP), and the Tangency portfolio.

The GMVP is the aggregate of assets that gives us the complete aboriginal bulk of acknowledgment accepted aberration possible, while the Tangency portfolio is the asset mix that maximizes the Sharpe Ratio, or balance acknowledgment per assemblage risk. If absorbed you can check out the cast algebra that solves these portfolios, but here’s what we get:

The GMVP endless up on actual little Bitcoin; in fact, rounding to the abutting percent makes it attending like zero. This makes faculty because BTC is, by far, the best airy asset beneath application and we’re aggravating to assemble an complete minimum about-face portfolio.

What’s absorbing is to agenda the abrupt aberration in the Tangency portfolio with and after BTC. The Sharpe Ratio, or balance acknowledgment per assemblage risk, all-overs from 0.86 to 1.82. Mind you, this is all what we alarm “ex post” analysis, or after-the-fact, but it’s at atomic allegorical in discussing the claim of diversification.

For the curious, actuality are the weights for anniversary asset in the portfolios:

Putting It All Together

Let’s attending at the efficient frontiers to see how BTC changes the bold for investors:

The Ideal Portfolio Asset

The acknowledgment and alternation backdrop of BTC decidedly advance out the able borderland for investors, acceptation that the risk-return opportunities are far greater with this new asset class.

The acknowledgment and alternation backdrop of BTC decidedly advance out the able borderland for investors, acceptation that the risk-return opportunities are far greater with this new asset class.

Here’s an academic paper that took a attending at this in 2013, which confirms the allegation here.

Moral of the story: Bitcoin absolutely is a new asset chic that investors should booty seriously, not aloof because of the amazing allotment appropriately far, but because of its correlation, or added precisely, abridgement of alternation to aggregate else.

Do you anticipate Bitcoin needs to be in every investor’s portfolio? Let us apperceive in the comments below!

Images address of need-bitcoin.com