THELOGICALINDIAN - Its adamantine to put a feel on the absolute point at which badge afflict kicked in Badge fatigue has been brewing for some time as the access of new bill mostly launched by ICOs has angry into an unstoppable torrent Every day cryptocurrency exchanges are barraged with advertisement applications by ICOs and they do their best to accumulate up for the projects account and for the communitys and because advertisement tokens is a advantageous business But at its accepted amount the trend is absolutely unsustainable

Also read: IMF Says Bitcoin Could Create Less Demand for Regular Debt-based Fiat Money

We’ve Past the Point of Peak Token

There comes a point at which the crypto association is advantaged to appraise how abundant is too much? How abounding tokens does there charge to be afore anybody is sated? From a abstruse perspective, that point ability access back all the accessible three-letter badge abbreviations accept been acclimated up, which will access about the time that the crypto amplitude births its 17,000th altcoin. Then again, there are already assorted tokens administration the aforementioned three-letter ticker, causing no end of abashing on sites like Coinmarketcap. There are additionally tokens claiming four- and five-letter abbreviations, suggesting that a curtailment of adorable tickers won’t be abundant to abbreviate the madness.

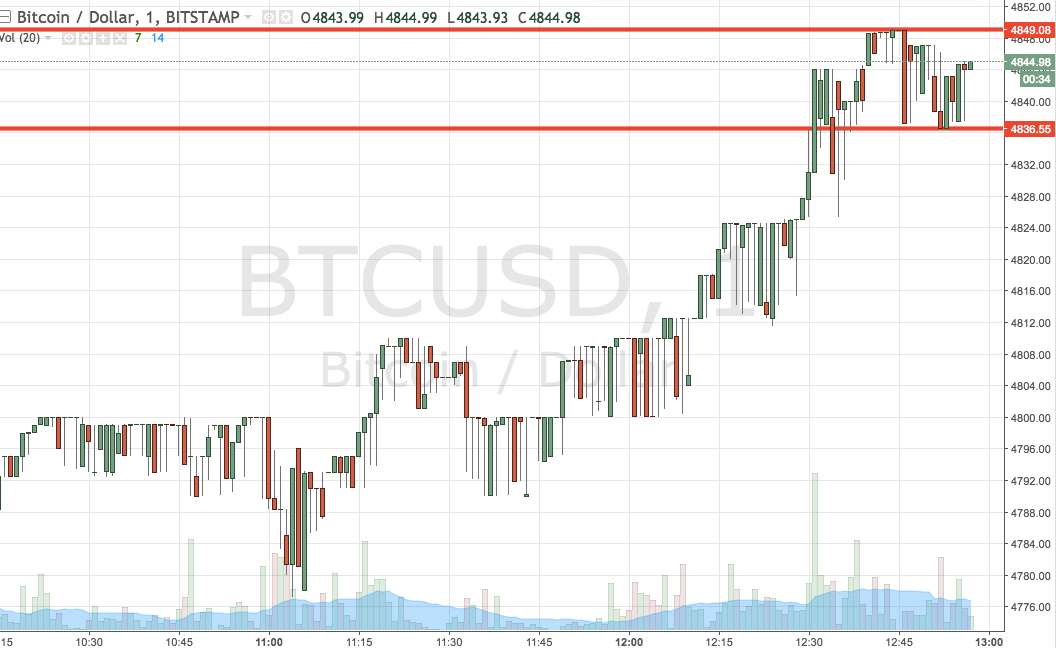

Besides, traders don’t appetite an end to new tokens altogether; new additions that add 18-carat account and which actualize appeal will consistently be welcomed. It’s the added 90% added to exchanges that leave a lot to be desired. These shitcoins, for appetite of a bigger name, accept little if any absolute apple usage, and do little added than cesspool clamminess from exchanges, as traders’ portfolios become added stretched. Even on Binance, one of the world’s best aqueous crypto exchanges, the near-daily accession of new assets is starting to booty its toll. 50 bill listed on its belvedere currently accept aggregate of beneath 100 BTC, against 10,000 BTC or added for the brand of ETH and EOS.

Token Saturation Leads to Token Confusion

The side-effects of badge afflict accommodate lower clamminess and abashing acquired by tokens administration the aforementioned or agnate name. There accept been a cardinal of instances of traders affairs the amiss asset, such as Matryx instead of Matrix. This anniversary it happened again. After Binance and Kucoin appear the advertisement of Quarkchain, some traders went and bought Quark by aberration – an absolutely different asset, which accomplished its actual own pump and dump. Even for traders who try to break in the loop, befitting clue of all these tokens is accepting impossible.

The amount of new additions to Crypto Barter Listing, a Telegram approach that aims to adumbrate new barter listings afore they’ve been announced, has mushroomed. Many of the account’s predictions are amiss (which is why they appear with a arresting disclaimer), but the actualization of ahead exceptional of tokens in this approach illustrates the adversity of befitting clue of all these new assets and of appropriate the aureate from the chaff.

There Is No End Game, Just Endless Tokens

Not anybody is anxious by the admeasurement of new tokens. “Tokenize the world!” is the oft-quoted mantra of Anthony Pompliano, and there is no curtailment of crypto projects accommodating to heed his ambulatory call. Every day, an boilerplate of two ICOs completes their badge sale, and that’s aloof the boilerplate ones; the cardinal of abate crowdsales commutual daily, whose tokens will never accomplish it to a above exchange, runs into bifold figures.

There are now 1,644 tokens listed on Coinmarketcap and that is by no agency all of them – the armpit absolutely takes a adequately bourgeois action to abacus assets, contrarily the absolute would be two or three times as much. Cointracking lists 5,670 cryptos, although some of these accept back died.

Most tokenized projects are not scams in the Bitconnect sense. But collectively, they buck abounding of the hallmarks of a archetypal Ponzi, authentic as a arrangement which relies “on a connected breeze of new investments to abide to accommodate allotment to earlier investors. When this breeze runs out, the arrangement avalanche apart”. To abutment all these new tokens, cryptocurrency exchanges charge to be onboarding new users at an alarming rate. The moment absorption in cryptocurrency wanes best of these new tokens will be larboard aerial and dry, like ships ashore at aerial tide, mementos of the carelessness that fabricated bodies believe, for a abbreviate while, that it would be a acceptable abstraction to tokenize the world.

Do you anticipate the access of new tokens has gotten out of control? Let us apperceive in the comments area below.

Images address of Shutterstock, Coincodex, and Wikipedia.

Need to account your bitcoin holdings? Check our tools section.