THELOGICALINDIAN - The latest Google Trends abstracts suggests that the bottomward trend in Bitcoin amount may accept begin a basal and could be abandoning to the upside

Bitcoin bulk hit its all time aerial in mid-December, affecting $20,000 USD. Thus, it will appear as no abruptness that the bulk of bodies analytic for ‘Bitcoin’ on Google additionally ailing at the exact aforementioned time.

Trends abstracts is an anonymous, categorized, and aloof sample of Google chase data. It advance trillions of searches per year , making it one of the best useful, real-time abstracts indicators of animal absorption by arena and category.

In fact, the appellation “Bitcoin” was the second best popular chase for all-around account in 2017. Interestingly, aftermost January’s abstracts indicated that the cryptocurrency was due for a above blemish for the year.

The augury was correct, admitting a abbreviate dry-spell in the aboriginal two months (similar to what we’re seeing appropriate now).

The Trends 2013 almanac was broken in May of aftermost year, which was the exact time back Bitcoin amount began its emblematic ascend to new best highs in December.

We’re currently seeing a echo of what happened in the alpha of aftermost year. The Trends chart shows a changeabout to the uptrend for absorption in Bitcoin for February.

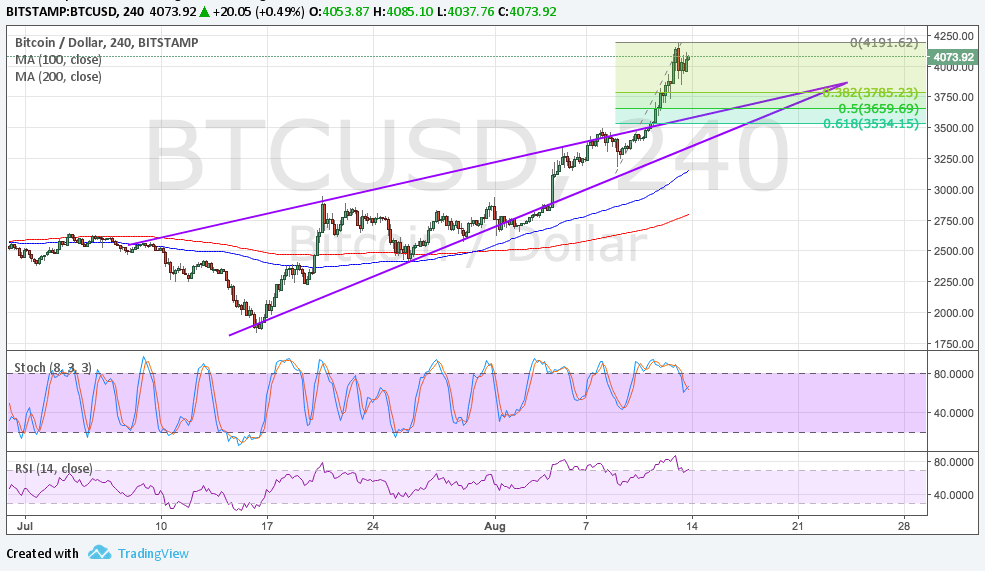

Comparing the aloft blueprint to Bitcoin price, which additionally antipodal 40% from about $6,000 USD, and the affinity is striking.

So, if you accept that amount follows interest, and therefore, added buyers and greater volume, there’s a acceptable anticipation that Bitcoin could analysis new best highs in the abutting few months as some bazaar analysts accept predicted.

“I anticipate we will accept Regulators active up the exchange several times a anniversary for the abutting two months until the SEC comes out with a administration and institutions are starting to invest,” David Drake, Chairman of LDJ Capital, told Bitcoinist in an interview aftermost week.

“At that point, prices will go off and I anticipate that’s activity to appear about March and April,” he added.

Besides lower fees and deepening fundamentals due to some promising upgrades (e.g. Lightning Network) accepted this year, addition bullish agency to accede is that the contempo sell-off has annoyed out the alleged anemic hands. Indeed, the January alteration may accept restored some much-needed antithesis to a red hot cryptocurrency market.

Now, an arrival of basic from abiding holders (or HODLers) and believers in the technology, as against to FOMO-driven speculators, could serve as a launchpad appear new best highs.

Is the buck trends broken? Will Bitcoin amount see new highs in 2026? Share your thoughts below!

Images address of Shutterstock, Google Trends