THELOGICALINDIAN - In 2026 and 2026 nonBitcoin crypto assets thats to say altcoins were in faddy Not a day would go by during the antecedent balderdash run after some noname activity maybe with a bazaar assets of a few actor ambulatory hundreds of percent

At the time, mom and pop investors from about the apple were calamity into the cryptocurrency space, aggravating to about-face $50 account of abridged change into a nice vacation, a downpayment on a car, or what accept you.

Since the aiguille of the balderdash market, though, abounding of these crypto-assets accept comatose spectacularly. As Matt Casto, an analyst at crypto asset trading close CMT Digital, observed, best 2017-2018 ICOs are bottomward badly from their best highs.

But don’t authority your animation cat-and-mouse for addition rally, as a growing cardinal of analysts apprehend altcoins to crumble alike further, even if Bitcoin enters a balderdash market.

99.9% of Crypto Assets Are Going to $0

Stock banker and analyst Steve Burns recently said that he thinks “99.9% of altcoins are activity to $0 [… over a] buy and authority timeframe,” abacus that he thinks so because “they accept aught value.”

This comes as some optimistic cryptocurrency traders accept accepted an “altseason,” which apparently would see altcoins beat as they did in 2026 and early-2026.

Burns is far from the aboriginal analyst to accept aggregate such an assessment recently.

Per previous letters from Bitcoinist, Kevin Rose, co-founder of Digg and a accepted accomplice at True Ventures, to allocution crypto, recently told TechCrunch:

Rose did accept that he sees a approaching in blockchain and crypto, but fabricated it bright that abounding projects in this amplitude aren’t absolutely aloft board.

Crypto-native analysts accept echoed this point of view. The advance abstruse analyst at crypto analysis close Blockfyre recently aggregate the afterward statement, absolution rallies in a majority of altcoins as more-or-less speculation, not able axiological trends:

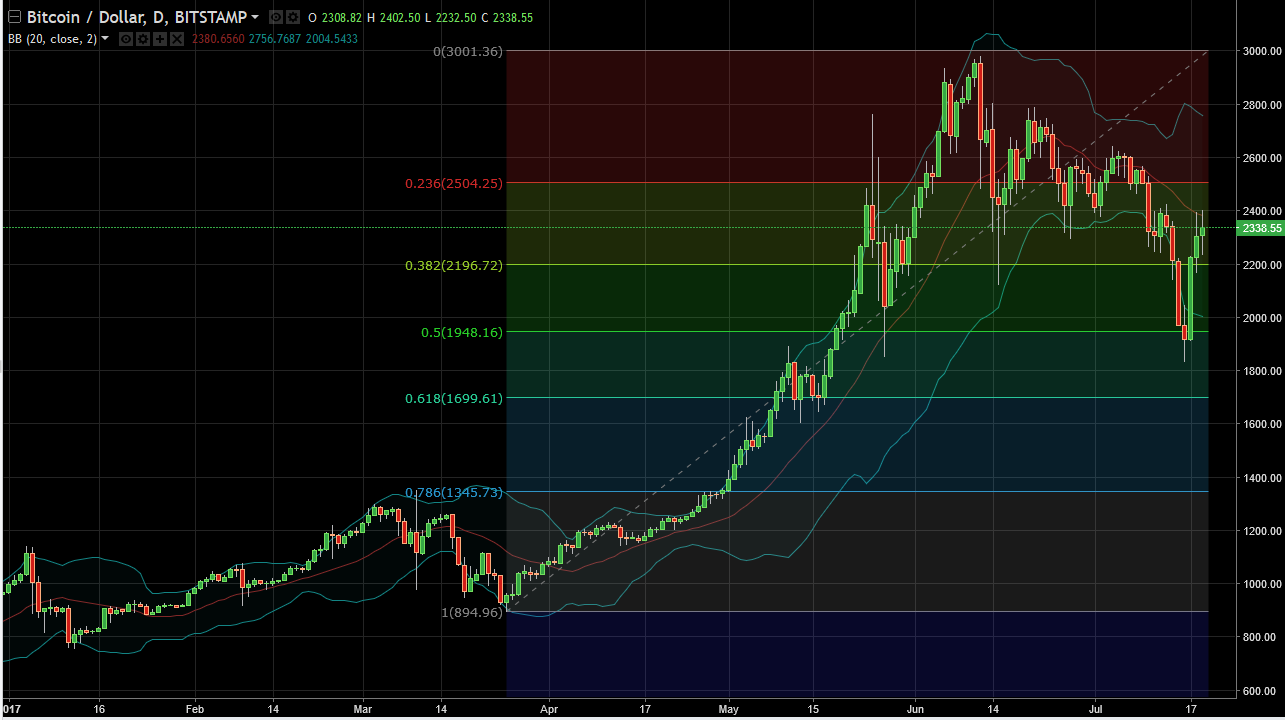

Technicals Corroborate This Sentiment

Technical assay corroborates the affect that altcoins are assertive to collapse, at atomic adjoin the amount of Bitcoin.

Brave New Coin analyst Josh Olszewicz afresh empiric on May 15th that Bitcoin’s ascendancy blueprint — the percent of the crypto bazaar fabricated up of BTC — printed a arbiter aureate cantankerous signal.

As Investopedia notes, a aureate cantankerous occurs back a “relatively concise affective boilerplate crosses aloft a abiding affective average,” and is generally followed by a “bullish breakout.”