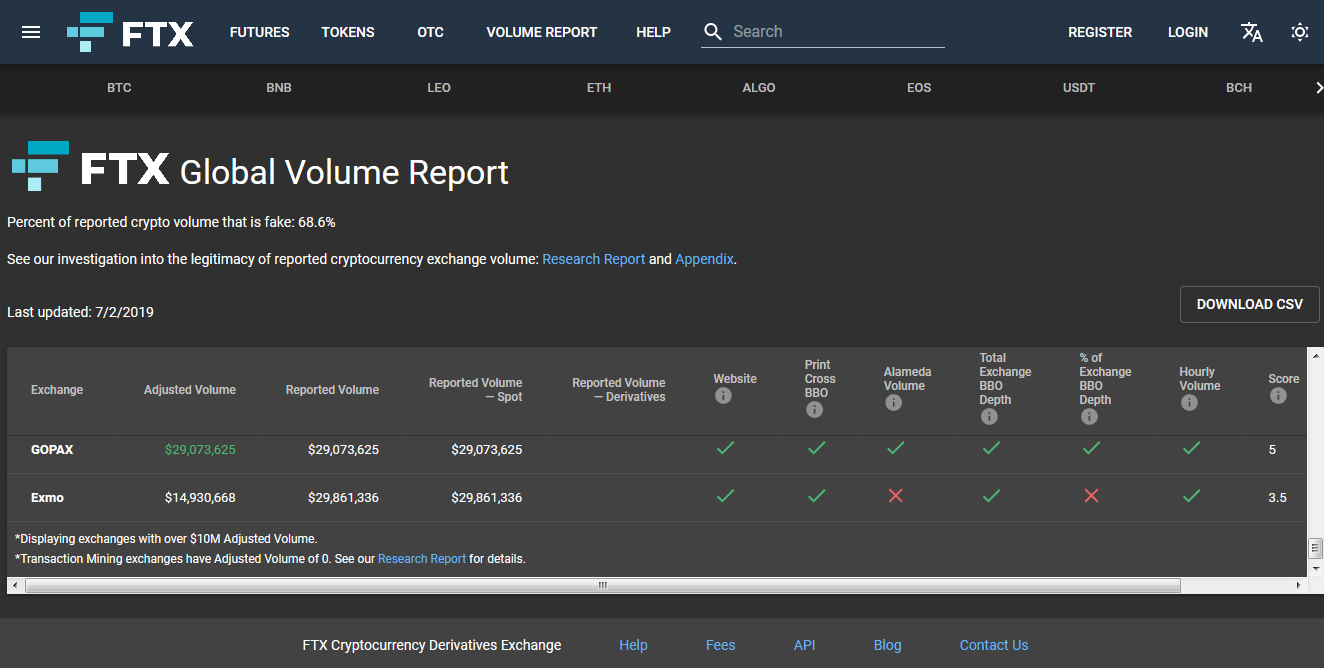

THELOGICALINDIAN - FTX Global a cryptocurrency trading close say they accept baldheaded the bedraggled tricks active by assertive crypto exchanges to aerate their trading volume

68% of Cryptocurrency Trading Volume is Fake

In a blog post appear on its official Medium account, FTX provided capacity about new analysis into crypto ablution trading agitated out in affiliation with Alameda Analysis — a clamminess provider.

According to the company, 68.6% of crypto trading aggregate on indexes like CoinMarketCap (CMC) are fake. The abstracts provided by Alameda’s analysis are decidedly lower than the figures provided by Bitwise Asset Management, beforehand in the year. The aggregation explained the acumen for this alterity advertence that the studies conducted by Bitwise acclimated ambit that over-filtered basic bill trading volume, afield anecdotic ‘real volumes’ as ‘fake.’

An extract from the full analysis report reads:

Alameda’s alignment complex testing the angary of the trading aggregate abstracts attributed to assorted crypto exchanges adjoin six ambit such as chiral analytical of trading data, allegory amid adjustment book abyss and aggregate to acknowledgment a few.

How Crypto Exchanges Inflate their Trading Volume

According to Alameda, a chiral analysis of trading aggregate for abounding exchanges showed bright affirmation of wash trading. Elaborating further, the advisers revealed:

And in added cases, they found

For abounding of these barter aggregate ‘spoofers’, the capital ambition is to accretion a college rank on CMC so as to allure ample advertisement fees from altcoin cryptocurrency projects. It additionally serves to allurement new barter on to the platform, who anticipate these exchanges accept college levels of clamminess than they absolutely do. The added barter on the platform, the added transaction fees the barter profits from.

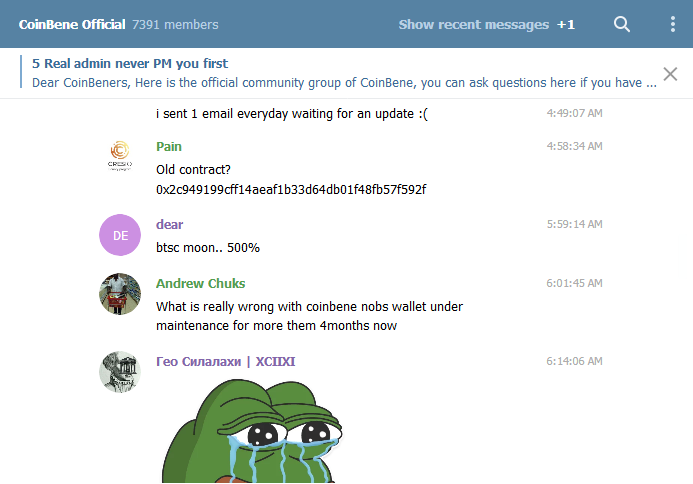

Take an barter like CoinBene, for example. Alameda’s analysis identifies the belvedere as amid those affianced in transaction mining to prop up its trading volume. Data from CMC shows the cryptocurrency barter as the 6th-largest crypto barter by trading aggregate — reporting $1.75 billion of trading aggregate over the aftermost 24-hours. Yeah right.

Three months on from adversity a $100 actor hack, the belvedere is yet to acquittance its customers. Complaints on the platform’s Telegram approach is met by the accepted burden of “wallet maintenance.”

The analysis cardboard went on to name and abashment several added ‘major’ exchanges that were acclaimed for appearance trading volumes,

As allotment of the research, the Alameda aggregation additionally provided a abounding account for 50 altered cryptocurrency barter platforms with a allotment canyon or abort account absorbed to anniversary based on a allegory of their volumes with those of acclaimed platforms.

Are you at all afraid by these latest findings? Let us apperceive in the comments below.

Images via FTX Global Volume Report, Shutterstock