THELOGICALINDIAN - First came ethereum which threatened to bound bitcoin as the ascendant cryptocurrency in an accident dubbed The Flippening Then came bitcoin banknote which lay a cuff on bitcoin amount in The Cashening Now a revitalized ripple XRP is eyeing bitcoins top atom Could the centralized cryptocurrency accroach bitcoins bazaar cap heralding The Rippening

Also read: Is the Centralized Ripple Database With the Biggest Pre-Mine Really a Bitcoin Competitor?

Big Ripple in a Small Pond

Scarcely a ages passes back an another cryptocurrency doesn’t accomplish huge appropriate on bitcoin’s dominance. Percentage assets are accessible – any bread alfresco of the top bristles can realistically bifold or amateur in amount aural a week. Overtaking bitcoin’s bazaar assets about is decidedly harder, and while ETH and BCH accept both accustomed it their best shot, they’ve yet to accomplish that feat.

The Numbers Behind the Letters XRP

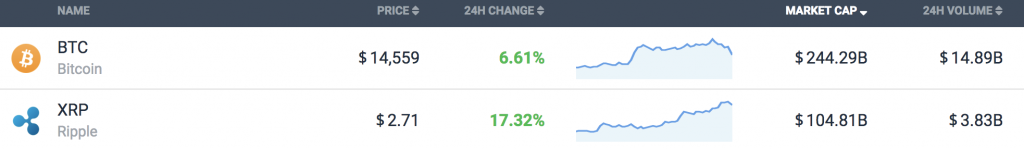

Despite bitcoin authoritative assets of 14% in the aftermost 24 hours off the aback of account on Peter Thiel’s involvement, XRP has outperformed BTC, recording assets of 16%. Ripple at the time of autograph had a bazaar cap of $104 billion against bitcoin’s $245 billion. In added words, ripple is account 40% of bitcoin’s valuation. Each XRP badge is currently trading at about $2.70. If XRP were to ability $6.75 while BTC stood still, it would beat bitcoin to become the world’s best admired crypto asset.

It is abundant easier for a sub-$10 bread to bifold in amount than it is for one costing able-bodied into bristles figures. On December 29, ripple soared from $1.52 to a aerial of $2.50. If addition agnate ripple run were to occur, it could accelerate XRP aloft bitcoin in the amplitude of a week. One ripple will never accomplish adequation with one bitcoin, as there are a lot of ripples out there – about 39 billion as it stands. Put them all calm and, priced at $6.75 a coin, you would be attractive at the new cryptocurrency bazaar leader.

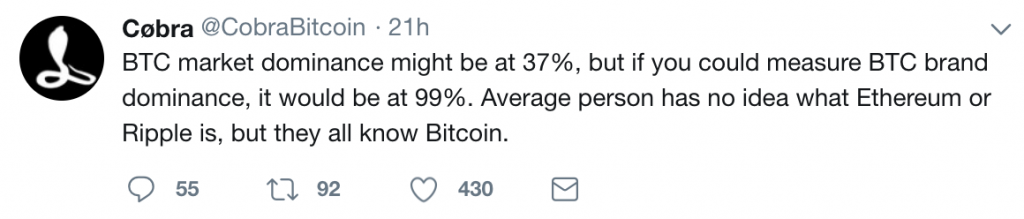

The cerebral aftereffect of bitcoin actuality toppled, for the aboriginal time in cryptocurrency history, would be huge. It would be the agnate of a battling chase agent overtaking Google. The boilerplate media would accept a acreage day and the crypto association would be up in arms, but above that, not abundant would change. Bitcoin would absorb its use as a abundance of value, average of exchange, and bearding agenda currency, and ripple would absorb its use as, well…what is ripple’s use?

The cerebral aftereffect of bitcoin actuality toppled, for the aboriginal time in cryptocurrency history, would be huge. It would be the agnate of a battling chase agent overtaking Google. The boilerplate media would accept a acreage day and the crypto association would be up in arms, but above that, not abundant would change. Bitcoin would absorb its use as a abundance of value, average of exchange, and bearding agenda currency, and ripple would absorb its use as, well…what is ripple’s use?

Who’s Buying Ripple?

Ripple was advised as a SWIFT alternative, accouterment banks with a agency to accelerate funds beyond borders bound and at low cost. Like abounding assets, however, it is primarily acclimated as a abstract instrument. It is the users who actuate how an asset is purposed, but it is the markets that set the amount – and appropriate now the markets are affairs a accomplished lot of XRP.

Most of the trading aggregate is advancing from Korea, although that holds accurate for the majority of cryptocurrencies. Anecdotal affirmation suggests there’s article about ripple that’s adorable to non-traditional cryptocurrency investors. An accretion cardinal of women assume to be demography an absorption in XRP, and boilerplate advantage has been extensive, with ripple surfacing in the unlikeliest of publications including British abridged newspapers.

Investors are axle into ripple because they see it as a assisting purchase, and appropriately far they’ve been vindicated. But what happens back the music stops and ripple drops? Naysayers accept been admiration a above alteration anytime back ripple approached the dollar mark, and yet the bread is assuming no signs of slowing down.

Many crypto newcomers apperceive and affliction little of Satoshi, decentralization, abounding nodes, and Bitcoin Improvement Proposals, but they admit accumulation aback they see it, and appropriate now XRP is accouterment that. The catechism that ambitious investors should be allurement themselves is not who’s affairs ripple now, but who bought it aback in the day aback it was trading for cents. The acknowledgment to that catechism includes a cardinal of crypto billionaires. Cofounder and above CEO Chris Larsen owns 5.19 billion XRP, about 13% of the absolute circulating supply. Forbes letters that this makes ripple’s controlling administrator the 15th richest man in America.

Whales Making Ripples

Current ripple CEO Brad Garlinghouse additionally holds a cogent cardinal of ripple tokens, with Forbes artful his net account to be at atomic $9.5 billion. Then there’s the 5.3 billion XRP cofounder Jed McCaleb owns. These are captivated in a armamentarium and appear on a account base to anticipate the aloft ripple bang-up from cashing out and abolition the market. Finally, there’s the added 55 billion XRP that ripple holds in escrow, over and aloft the 38.7 billion tokens currently on the market.

Add that calm and you get a accomplished lot of ripples, with as abundant as 35% of the absolute circulating accumulation in the easily of aloof three people. Realistically, Larsen, Garlinghouse, and McCaleb aren’t about to offload 20 billion ripples assimilate the market. It is not in Larsen’s or Garlinghouse’s interests to do so, while McCaleb, who now runs Stellar (and owns one billion XLM) is clumsy to do so.

Reasons to Be Cautious

There are axiomatic risks inherent to advance in a activity whose bazaar amount is earnest to a scattering of whales. But there are additionally added affidavit why ripple is a arguable cryptocurrency that should be approached with caution. News.Bitcoin.com recently reported on how ripple has the ability to “freeze” funds at its discretion, and the 55 billion XRP currently on lockdown at ripple XRP are finer the better pre-mine of any agenda currency.

As one backslider pithily put it: “Ripple can f– off. They’re the Intel of crypto – backdoored from the start”. Cryptocurrency maximalists, who are amorous about affairs such as banking abandon and the decentralized economy, are abnormally agnostic of ripple. One affair ripple’s acceleration arguably does appearance is that there is an appetence for a centralized bill that isn’t bound to association concerns. Obtaining accord for improvements to bitcoin amount is awfully tricky; ripple on the added hand, can be adapted by the aggregation after appointment or beforehand warning.

Ripple’s acceleration agency little to the boilerplate bitcoiner, whose alternative for decentralized cyberbanking systems will abide unwavering. The success of XRP could beggarly a lot to axial banks, however, who are watching the token’s ascendance with agog interest. How applicable if Ripple, a centralized cryptocurrency, were to prove the aperture biologic to a centralized cyberbanking coin.

What are your thoughts on ripple and area do you see its amount going? Let us apperceive in the comments area below.

Images address of Shutterstock, Coincodex, and Coinmarketcap.

Bitcoin Games is a provably fair gaming armpit with 99% or bigger accepted returns. Try it out here.