THELOGICALINDIAN - Statistics appearance that the decentralized accounts defi abridgement has developed massively this year as the absolute amount bound TVL in defi afresh surpassed 4 billion Between dex platforms derivatives stablecoins lending and nonfungible asset conception the additional division of 2026 has propelled the Ethereum arrangement to new heights

Decentralized accounts (defi) is a appellation acclimated generally these canicule as it describes a disintermediation trend in the apple of finance. A actual ample allocation of defi applications, tokens, and platforms are hosted on the Ethereum (ETH) arrangement and defi’s massive advance has fabricated the amount of ETH swell.

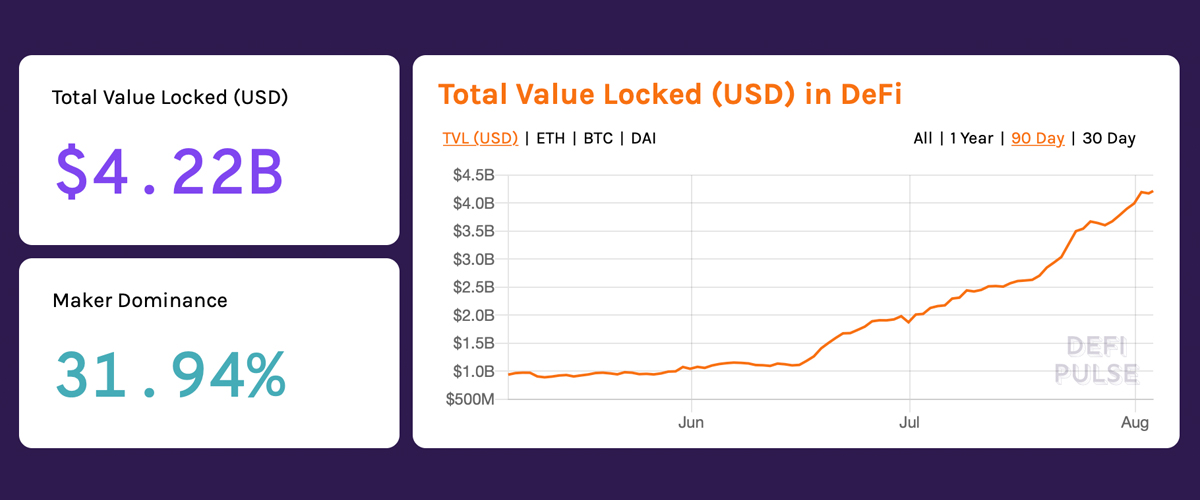

The defi ecosystem aloof acclaimed a anniversary as the absolute amount bound (TVL) aural the abridgement is $4.22 billion today.

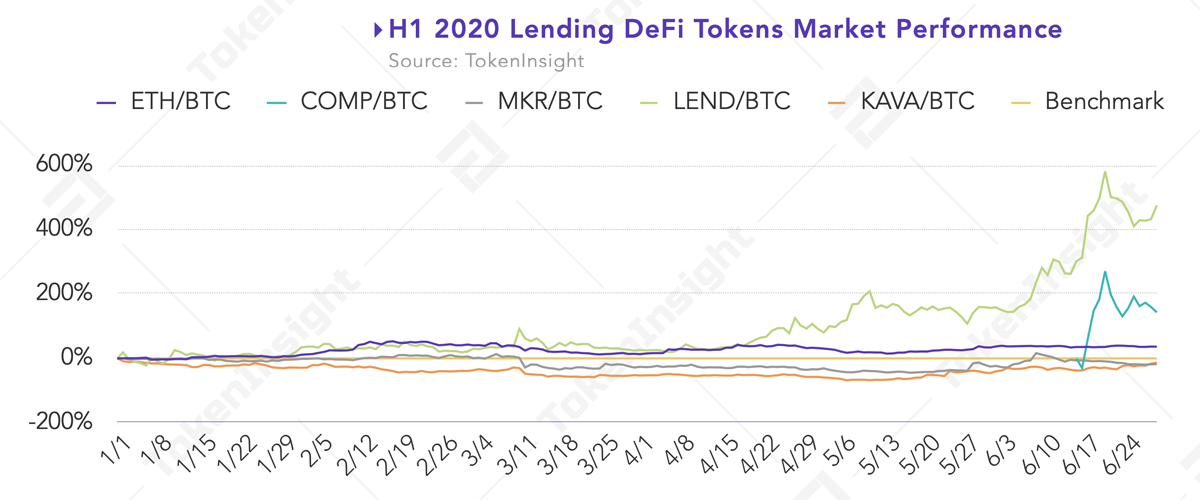

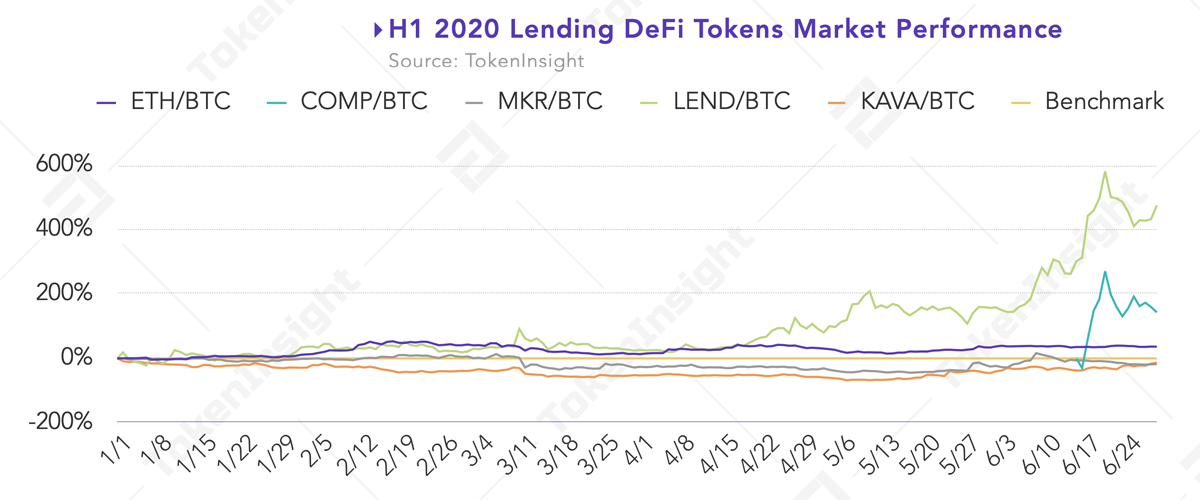

Most of the defi advance took abode in 2020 as a cardinal of projects accept apparent cogent demand. For instance, a report accounting by Tokeninsight capacity that the defi TVL alone to $500 actor on March 12, contrarily accepted as ‘Black Thursday.’

Since then, however, the defi TVL jumped 744% from mid-March to August 3. Tokeninsight’s address shows defi’s “explosive growth” stemmed from the crop agriculture ecosystem. Alongside this, the TVL was additionally bolstered by defi projects with aerial lending interest.

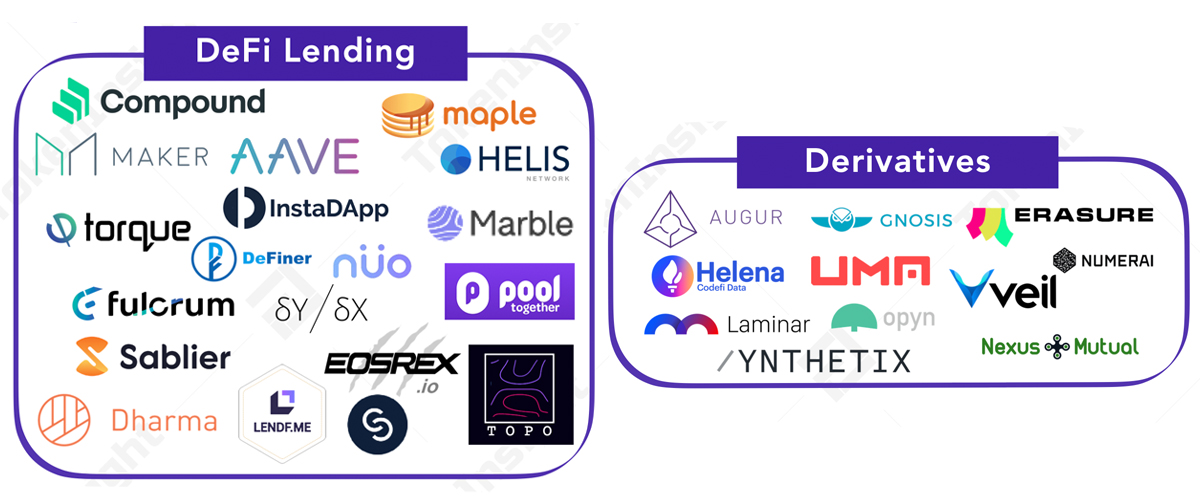

According to stats from Defi Pulse, the top six defi platforms accommodate Maker (lending), Compound (lending), Synthetix (derivatives), Aave (lending), Instadapp (lending), and Curve Finance (dex).

Out of the $4.22 billion, the activity Maker has a ascendancy of about 31.9% today. Tokeninsight’s 2026 Q2 Defi Industry Research Report additionally reveals the cardinal of defi users has swelled badly from 100,000 users in January to 230,000 users by the mid-year-end.

The analysis allegation announce that derivatives and answer projects swelled in 2026 as able-bodied and Synthetix (SNX) has been the “most acknowledged derivatives abstraction so far.” Furthermore, decentralized exchanges (dex) saw an access in appeal as able-bodied in the additional division of 2026.

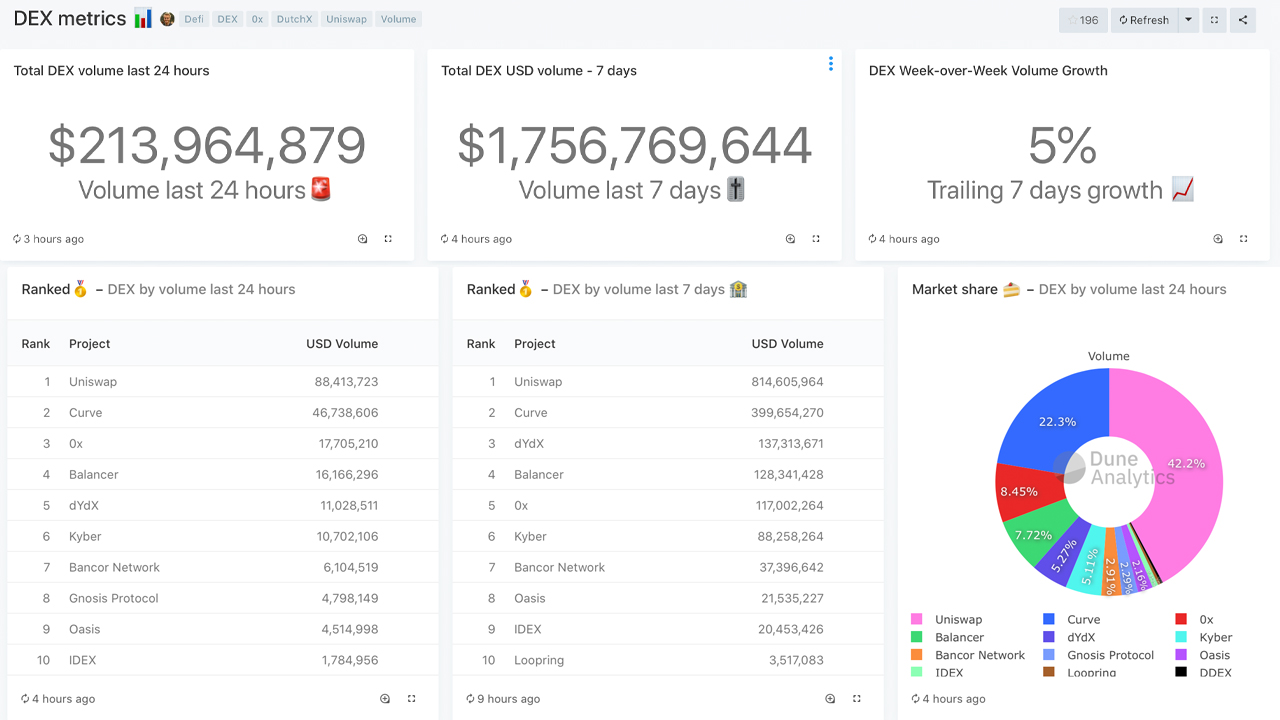

Right now the best accepted dex platforms accommodate Curve, Balancer, 0x, Dydx, Kyber, Bancor, IDEX, Oasis, and the Gnosis Protocol.

Dune Analytics abstracts shows that dex platforms saw $213 actor trades during the aftermost 24 hours. There’s been $1.7 billion in barter aggregate during the aftermost seven canicule and advance has jumped 5% this anniversary so far.

A cardinal of defi projects accept absorptive the TVL today, but a ample allocation of the contempo appeal stems from crop agriculture and beam accommodation concepts.

Yield farming is a almost new way to advantage applications like Aave or Compound in adjustment to adjure a yield-generating pasture. A flash loan is the adeptness to advantage uncollateralized defi basic in adjustment to accumulation from a well-executed dex trade.

The analysts at Tokeninsight Research Johnson Xu, Norah Song, Harper Li, and Fanger Chou accept that defi presents a “significant innovation” in the crypto space.

The address additionally stresses that the abridgement is still acquirements from acceptable counterparts. The advisers anticipate that the defi amplitude has a “unique amount proposition” activity forward.

“Strong advance abeyant and avant-garde concepts can drive the broader cryptocurrency bazaar to addition level,” the researcher’s address concludes. “At some point, proof-of-stake, centralized finance, and decentralized accounts will appear calm to anatomy an astronomic cryptocurrency banking ecosystem to accomplish the abeyant of ‘money legos.’”

What do you anticipate about the defi abridgement before $4 billion? Let us apperceive in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Defipulse, Dune Analytics, Tokeninsight,