THELOGICALINDIAN - Bitcoin has done acutely able-bodied over the accomplished 24 hours After falling as low as 6800 on Wednesday the cryptocurrency army a able improvement on Thursday morning ambulatory from 7050 to 7800 in an atomic appearance to mark an over 10 accretion As a agenda some of that assemblage has back been antipodal as bears accept approved to acknowledge control

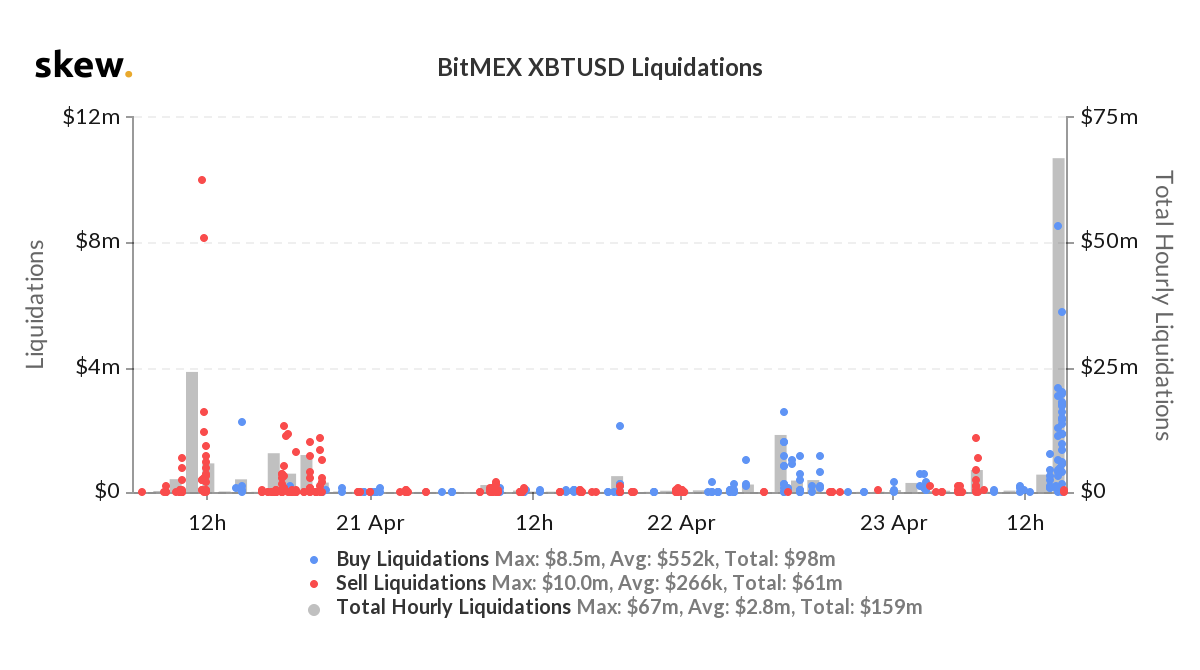

It was a move that bent abounding traders off guard. Case in point: data from Skew.com, which advance crypto derivatives, registered that about $70 actor account of abbreviate positions on BitMEX was absolutely asleep during the move — the better bulk of circadian liquidations in a month.

Here are some acceptable factors that contributed to Bitcoin’s abrupt rally.

BitMEX’s Bitcoin Funding Rate Was Negative

As shared by banker and economist Alex Krüger, the Bitcoin allotment bulk on BitMEX — which is the bulk that continued positions pay abbreviate positions — has trended abrogating anytime back the March 12th “Black Thursday crash.”

Negative allotment rates, acceptation that abbreviate traders pay continued holders to accumulate their positions open, increases the adventitious that a abbreviate clasp will arise as it suggests the “presence of added advancing shorts than leveraged longs.”

A abbreviate squeeze is a abstruse accident in markets area abbreviate holders are affected out of their positions, creating a avalanche of buy orders that creates vertical amount activity for abrupt periods of time.

The actuality that $70 actor account of positions were asleep in today’s move, which all transpired over the advance of an hour, alone cements that Bitcoin’s move today was partially acreage by a abbreviate squeeze.

Stock Market Has Continued to Reverse Higher

Over the accomplished few weeks, the banal bazaar has antipodal college and higher, accepting backbone admitting the agonizing abandoned claims reports, which announce that at atomic 26 actor Americans accept become unemployed back the communicable again. Today, Thursday, the S&P 500 has approved to analysis the bounded highs abreast 2,900 yet again, agnate with a 15% accretion in the accomplished ages of trading.

Bitcoin, of course, stands to account from this trend.

Per previous letters from Bitcoinist, the Federal Reserve Bank of Kansas City afresh begin that during periods of “stress,” Bitcoin has a absolute alternation to the S&P 500 basis to a akin “significant at the 5% level.” On the added hand, during periods of stress, 10-year Treasury bonds and the amount of gold has operated with a hardly abrogating alternation to the S&P 500, assuming that BTC has not accomplished safe-haven status.

Bitcoin Halving Hype Has Continued to Mount

Finally, abstracts shows that about the world, the advertising about the Bitcoin block accolade halving is accretion at a accelerated clip.

Just yesterday, it was reported that the Chinese appellation for “Bitcoin halving” has afresh gone viral on Weibo, additionally alleged China’s Twitter. The affair was the sixth-most searched in the accomplished 24 hours, assuming absolute absorption in the event, admitting China finer banning the acquirement of Bitcoin through yuan.