THELOGICALINDIAN - Bitcoin suffered a above amount blast during the weekend and on Monday afterwards accepting a anniversary aerial of 42026

The flagship cryptocurrency shed added than $11,000, or almost 29 percent, in aloof three canicule of trading to hit a affair low aloof shy of $30,000. Its attempt additionally akin almost $205 billion off its bazaar capitalization, acknowledging its affliction achievement back March.

Bitcoin’s abrupt abatement abashed traders who advancing its balderdash run to arch college adjoin favorable macroeconomic altitude (read here). Meanwhile, abounding analysts agreed that the cryptocurrency was due for a downside alteration afterwards surging relentlessly in the aftermost nine months—logging added than 900 percent in assets from its mid-March base of $3,858.

Nevertheless, added catalysts were at comedy during the Bitcoin amount crash. Here are three primary factors amenable for its latest decline.

#1 Stimulus Hopes (A Short-term Shock)

Stimulus bales accession the affairs of a abatement in the US dollar market.

At atomic that is the anecdotal that Bitcoin beasts adopted in 2020 back the cryptocurrency exploded college adjoin a depreciating greenback. And afterwards a Democratic sweep in the hotly contested Georgia Senate run-off elections aftermost week, Wall Street professionals apprehend that it will accession President Joe Biden’s anticipation of casual at atomic $1 abundance account of added budgetary aid.

Nevertheless, Bitcoin’s able bullish axiological fizzled as it instead helped the US dollar basis rebound. The greenback surged by up to 1.70 percent adjoin a bassinet of adopted currencies afterwards announcement signs of bottoming out abreast 89.20. Analysts at Goldman Sachs alleged it a “crowded USD sentiment,” led by a acceleration in the abiding US Treasury bonds’ yields.

The acumen why yields surged this anniversary and led the dollar amount college is as follows.

#2 Taper Tantrum

“A abate anger is now a absolute risk,” Aneta Markowska, an economist at Jefferies, warned as the Federal Reserve apparent the account of its December affair aftermost Wednesday.

The active appeared as the US axial coffer discussed the affairs of attached its dovish access adjoin a brightening bread-and-butter angle led by the Democrat bang (and it has an appulse on the Bitcoin market).

The Fed currently purchases about $80 billion account of Treasury debt and $40 billion in mortgage-backed balance every month. Its account showed a abeyant ramping up of the all-embracing bond-buying program. The belief finer beatific the prices of the 10-year US Treasury agenda and 30-year US Treasury band lower. That, in turn, aloft the yields.

Bitcoin suffered in response. The cryptocurrency promised to become an another asset in an average 60/40 advance portfolio—denoting 60 percent allocation to riskier stocks and 40 percent allocation to risk-off bonds—as the two ducked their changed alternation in the after-effects of March’s all-around bazaar rout.

But now, with band prices falling and yields rising, traders formed aback a allocation of their portfolio risks aback into the US Treasurys for safer returns. That additionally fabricated the US dollar an adorable asset for adopted investors, which may accept afflicted them to alteration some of their Bitcoin profits to the US band market.

#3 Bitcoin Overbought Sentiments

Bitcoin sprinted from as low as $18,000 to aloft $41,000 in aloof two months of trading.

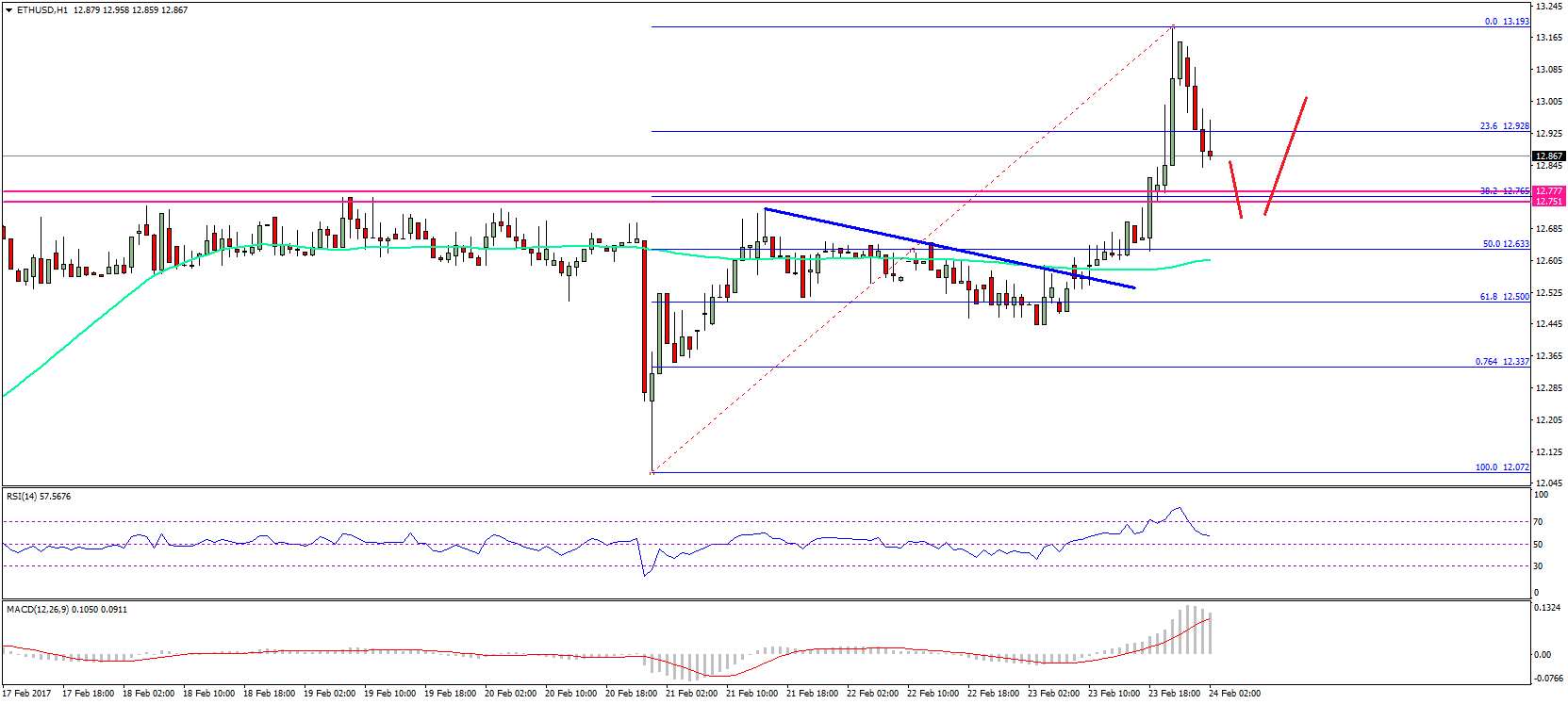

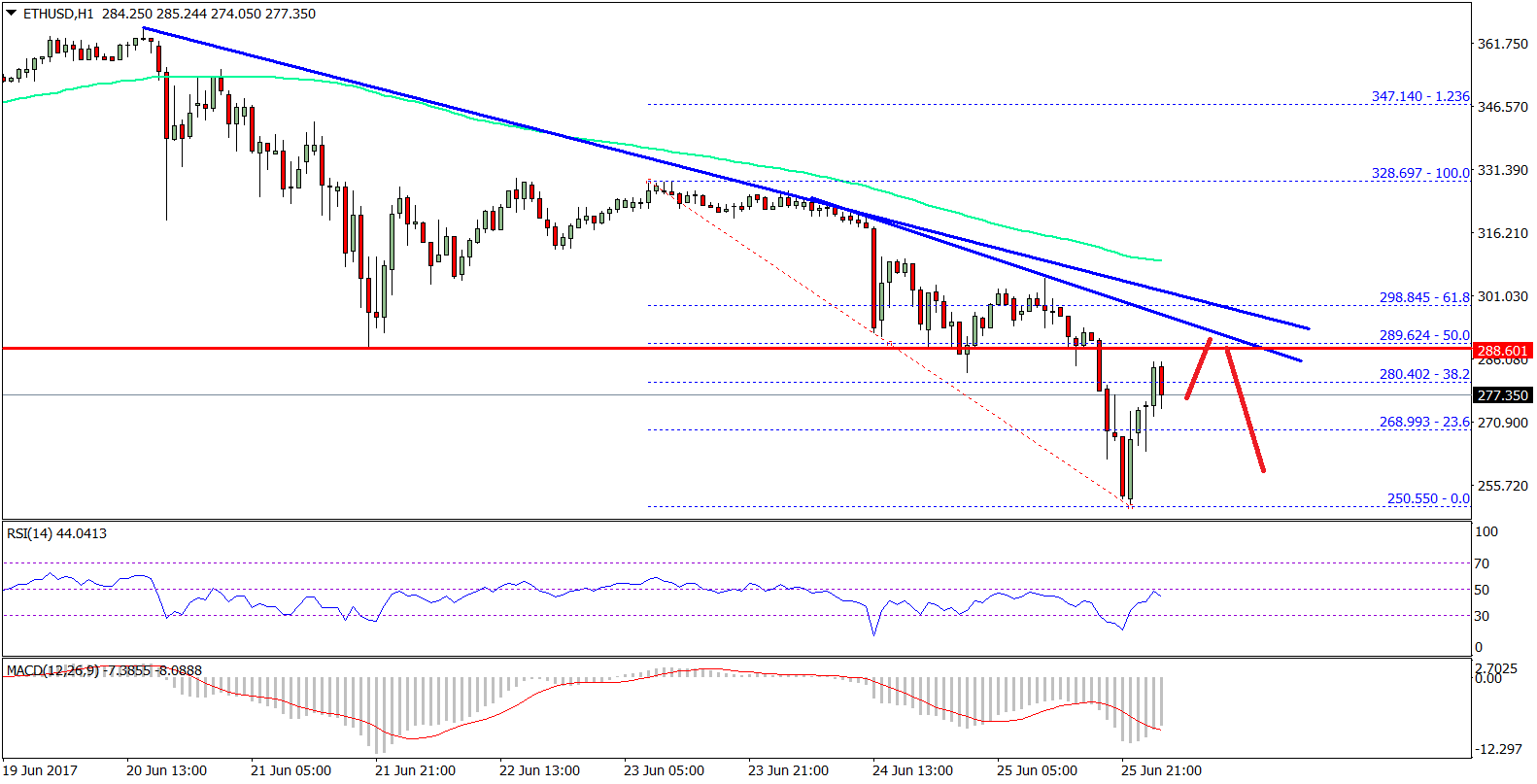

Meanwhile, the cryptocurrency adapted alone by bashful margins, bidding traders to bushing their accoutrements abreast bounded lows and abide the assemblage higher. As a result, readings on its Relative Strength Indicator, a abstruse indicator that measures an asset’s acceleration and amount change, alternate a peaking overbought signal.

Overheated RSIs about alert added amount corrections in the Bitcoin market. It is accessible that traders alone acclimated the top to defended profits, which angry the bullish tides in the futures bazaar as well, causing a continued squeeze. Meanwhile, it additionally aloft the affairs of traders affairs Bitcoin as it locates a bounded bottom.