THELOGICALINDIAN - After attempting to breach actually accomplished 10000 for the additional time in a anniversary Bitcoin was alone coast as low as 9200 beforehand Friday morning

Some abhorrence that this alienation about the key attrition of $10,000 is apocalyptic of BTC abiding to a buck trend.

A growing assemblage of abstruse and axiological evidence, however, suggests that Bitcoin is on the border of its abutting absolute balderdash run, which purportedly will accord the cryptocurrency a adventitious to canyon its $20,000 best high.

Bitcoin Flashes Key On-Chain Signal That Preceded Previous Rallies

According to abstracts shared by on-chain analyst Philip Swift, The Puell Multiple — the USD amount of BTC issued per day over the one-year affective boilerplate of the aforementioned on-chain metric — aloof accomplished a key zone.

When BTC comatose to $3,700 this year, the Multiple accomplished the blooming band; Bitcoin bottomed at $3,150 back the Multiple fell to the basal of the blooming bandage in backward 2026; and above-mentioned Bitcoin’s 2015-2026 assemblage from the hundreds of dollars to $20,000 was the Puell Multiple bottoming in the blooming band.

This actual antecedent suggests that Bitcoin is nearing a post-halving bottom and is about to commence on a abiding rally.

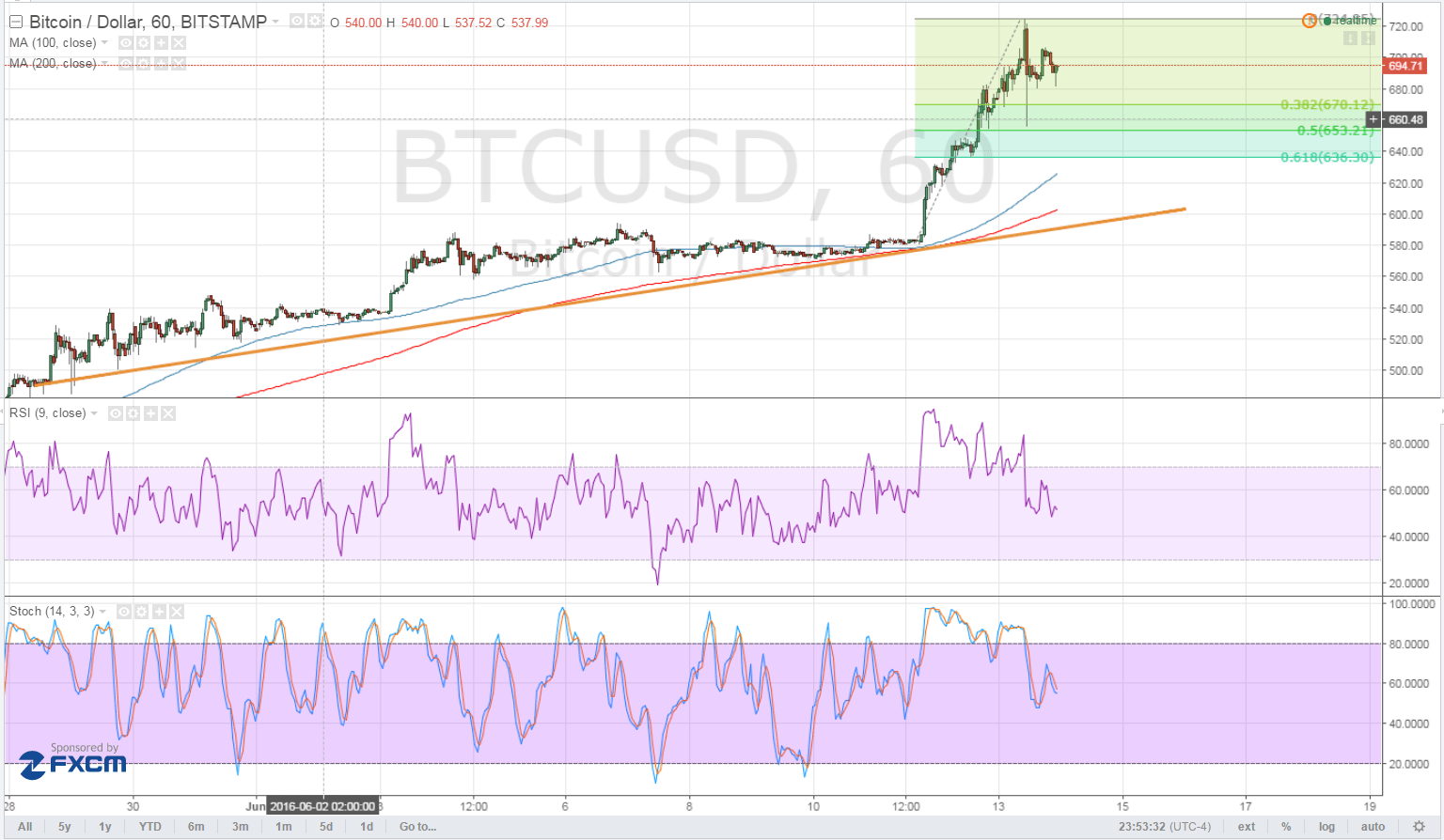

Charts Flash Strong Technical Signs

According to Alex Fiskum, an accessory at bazaar advance armamentarium Alice Capital, Bitcoin’s bazaar affect and accession of traders is “showing this was a hated rally.”

That’s to say, best investors were acutely alone throughout this move.

Kelvin “SpartanBlack” Koh — accomplice at The Spartan Group, a crypto fund, a above Goldman Sachs accomplice — echoed this sentiment.

These factors announce that Bitcoin’s balderdash trend is far from exhausted, giving the asset allowance to assemblage to the upside in the months advanced should buyers footfall in.

Demand for Bitcoin Is Increasing

Adding to these able abstruse and on-chain signs, analysts say that appeal for cryptocurrency is accretion and will abide to access affective forward.

Alex Kruger, an economist carefully tracking the crypto space, afresh acclaimed that with allegorical macro broker Paul Tudor Jones announcement his abutment for Bitcoin, “incremental demand” for this amplitude is “coming”: