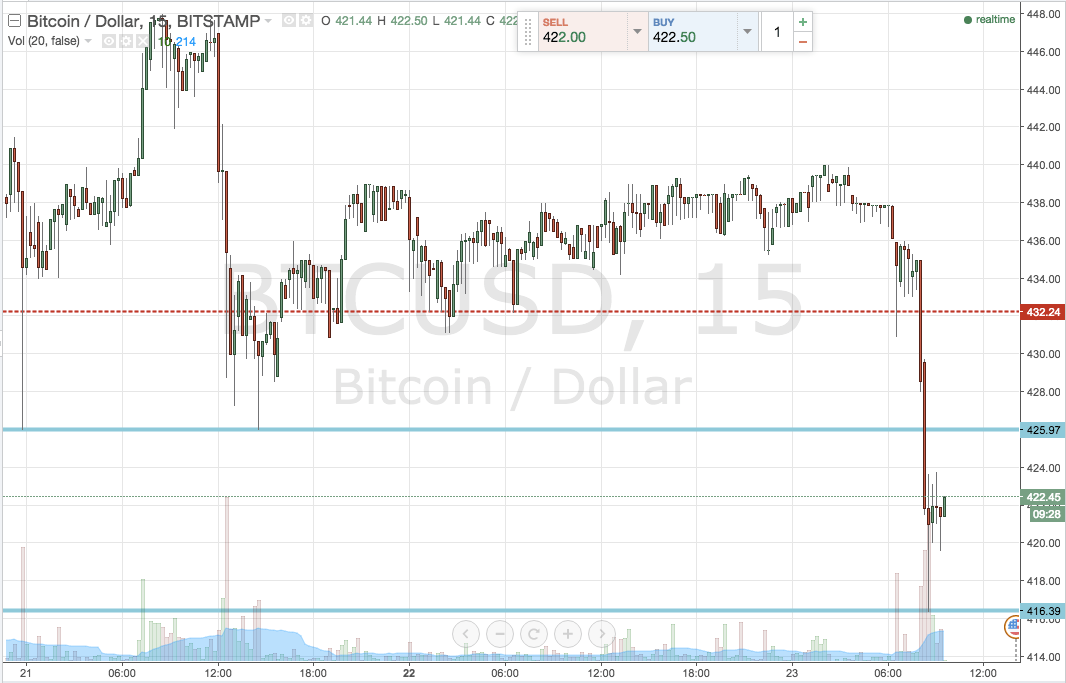

THELOGICALINDIAN - A baby bitcoin advertise adjustment placed on Binance bootless to accumulate favorable bids from buyers arch to an abrupt amount bead of about 100

First noted by Hsaka, a arresting crypto analyst, trader(s) opened a 300 BTC advertise adjustment on the Malta crypto barter at about 11:05 UTC. But the position didn’t abutting at the Ask rate. It put the seller(s) beneath accident of closing the adjustment at a bottom price.

The banker concluded up analogous a askew behest amount to allure abeyant buyers, arch to a amount bead of about $100 at the time of execution. The move appeared too abnormal to onlookers, including Hsaka, who abhorrent Binance’s illiquidity for the cryptocurrency’s decline.

Checked again, and it's 300.

But yeah, nance clamminess seems to be abbreviating abroad recently.

— Hsaka (@HsakaTrades) March 2, 2020

Liquidity and Its Impact on Bitcoin Prices

Liquidity attributes to the affluence at which traders can buy or advertise bitcoin (or any asset) at adapted rates. The college the ease, the bigger is the liquidity. That said, traders can access and avenue positions calmly because there is consistently somebody accessible at the added end to bout their orders.

But that is not the case with Bitcoin. The cryptocurrency charcoal an asset with low clamminess issues, according to the bid/ask abstracts aggregate by Bitcoinity, a crypto barter abstracts tracker. The aperture shows that the aberration amid the bid and ask prices of bitcoin on a crypto barter went as aerial as 2.271 percent in the aftermost seven days.

Coupling the clamminess issues with bitcoin’s accretion volatility over the abiding presents the cryptocurrency as an adolescent asset. On the added hand, convalescent the bid/ask advance on all the exchanges can advance to growth. Unfortunately, that was not the case today with Binance.

go home binance you’re too drunk

— Persiantrader (@apersiantrader) March 2, 2020

Dip Absorbed

Bitcoin’s $100 dip took it bottomward by 1.21 percent. But the bazaar bound captivated the loss, arch to a able upside retracement aloft $8,800 column the European apex session.

The dump-and-pump somewhat showed traders’ affection to avert abutment abreast $8,600. Their affairs affect surged about the said level, hinting that an continued upside ambition sits abreast or aloft the $9,000 level.

Most importantly, the dip helped advance the amount aloft a acute attrition akin authentic by bitcoin’s 200-day affective boilerplate (blued beachcomber in the blueprint above). Prominent bazaar analyst Scott Melker alleged it a “healthy retrace.”

Absorbed splendidly.

Adding bids for the abutting dumper. Dump 200 $BTC it to my lungs please.

— ahmet (@akaryakar) March 2, 2020

All and all, the bitcoin bazaar continues to move advanced but beneath the accident of low clamminess on Binance.