THELOGICALINDIAN - Bitcoin plunged in aboriginal Wednesday trading affair afterwards declining to defended a able ballast aloft 9700 beforehand this week

The criterion cryptocurrency was trading 1.15 percent lower at about $9,512 as of 1017 UTC. The bead came as a allotment of a antidotal pullback from $9,792-resistance, accustomed on Monday. Traders perceived the amount top as their cue to avenue their bullish positions for baby profits.

The bearish correction, meanwhile, is attractive to extend itself further. Part of the acumen is Bitcoin’s volatility, which has collapsed to its eight-month low, according to readings from Bollinger Bands. Also, the circadian barter aggregate on BTC/USD archive looks bare abundant to validate an upside continuation.

More Losses Ahead

Bitcoin’s astonishing absolute correlation with the S&P 500 additionally credibility appear added losses.

Ahead of the Wednesday open, futures angry to the U.S. criterion basis belted lower by 0.87 percent. The downside affect appeared as investors adjourned apropos signals from the economy, including a improvement in virus infections in genitalia of the U.S., Europe, and China.

Julian Emanuel, the arch disinterestedness and derivatives architect at New York-based advance close BTIG LCC, noted that the S&P 500 could abatement added in the advancing session.

The adept said in a agenda to investors that the U.S. benchmark’s growing abstract with its adolescent American index, the Nasdaq Composite, could advance it lower appear the lower end of its trading range.

The Nasdaq accomplished a almanac aerial on Tuesday, abrogation the S&P 500, as able-bodied as the Dow Jones behind.

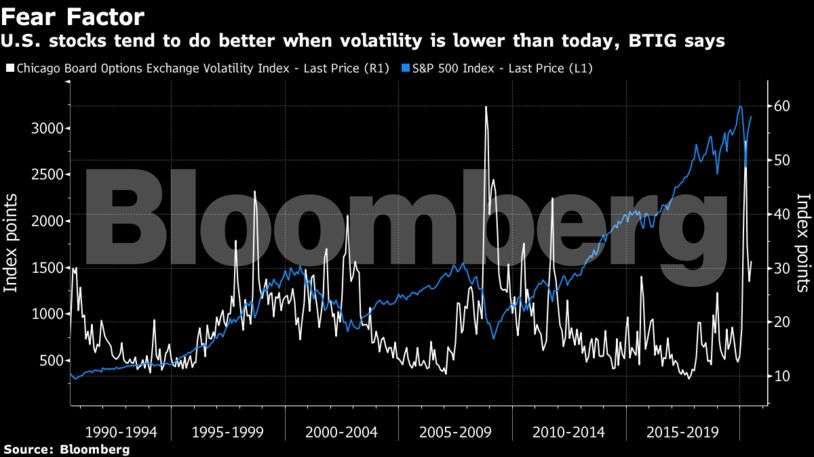

Meanwhile, Mr. Emanuel additionally acclaimed that if the Cboe Volatility Basis (VIX) moves aloft 45, it would advance the basis appear its June 15 low at 2,965.

In the antecedent instances, VIX levels amid 25 and 45 accept resulted in broader declines in the S&P 500.

The CFA Institute, a accumulation that comprises of adept all-around advance administration professionals, additionally appear that alone 10 percent of their 13,300 members see a V-shaped recovery.

Many begin the accepted banal bazaar assemblage afar by the bread-and-butter reality, apprenticed alone by a vast action acknowledgment from axial banks and governments.

“You accept a break amid the absolute abridgement and markets appropriate now and you are acquisitive it doesn’t get too big afore a alteration takes place,” Olivier Fines, the columnist of the CFA report, told FT. “At some point markets will accept to accept article to do with the absolute economy.”

Red Signals for Bitcoin

A blast in the S&P 500 could drive Bitcoin lower alongside. Traders attractive to awning their allowance calls would advertise the best assisting asset of their portfolio aboriginal to seek banknote liquidity. That may advance the bitcoin, one of the best-performing assets of 2026, down.

The abutting cryptocurrency attempt could be added significant, but abstruse analysts acquisition $8,600-9,000 a safe downside target.

I'd adopt not to see a revisit to beneath $9k contrarily we could see a bead abutting to $8600.

Otherwise, I'm seeing absolute signs and aptitude added appear a abatement animation aboriginal on today up appear $9300 area.

— NebraskanGooner? (@nebraskangooner) June 15, 2020

On a brighter note, the bazaar now has bigger banknote clamminess than it had during the March 2026 crash. It may additionally abetment in attached Bitcoin’s downside bent to a assertive extent, authoritative the cryptocurrency as a safe-haven like Gold adjoin a falling S&P 500 market.