THELOGICALINDIAN - Bitcoin has been falling over the aftermost brace of weeks afterward ascent apropos over the advance of the coronavirus and its abeyant appulse on the all-around economy

But how low can Bitcoin go? According to one analyst, there are two lower boundaries beneath accepted levels that should accommodate abutment for the cryptocurrency. However, if either one is breached, it could arresting to investors that the abiding aisle and bloom of the asset is in grave danger.

Recession Fears Are Fueling a Market Wide Panic Selloff

Bitcoin, like any added banking asset appropriate now, is bottomward in amount as investors de-risk amidst growing apropos over a advancing bread-and-butter recession fueled by a accessible communicable if the coronavirus continues to advance like wildfire.

Even an emergency amount cut by the Fed yesterday bootless to aftermath a cogent assemblage in Bitcoin, which about responds agreeably to such conditions.

But growing fear, uncertainty, and agnosticism over the virus accept accurate to be too abundant to restore aplomb in investors, who are additionally dumping their banal backing at almanac rates.

Related Reading | Stock Market, Bitcoin, and Gold: Everything Is Collapsing Together

While the stock market aloof saw its affliction anniversary back the recession, Bitcoin, an asset built-in from the aftermost recession has captivated up almost well.

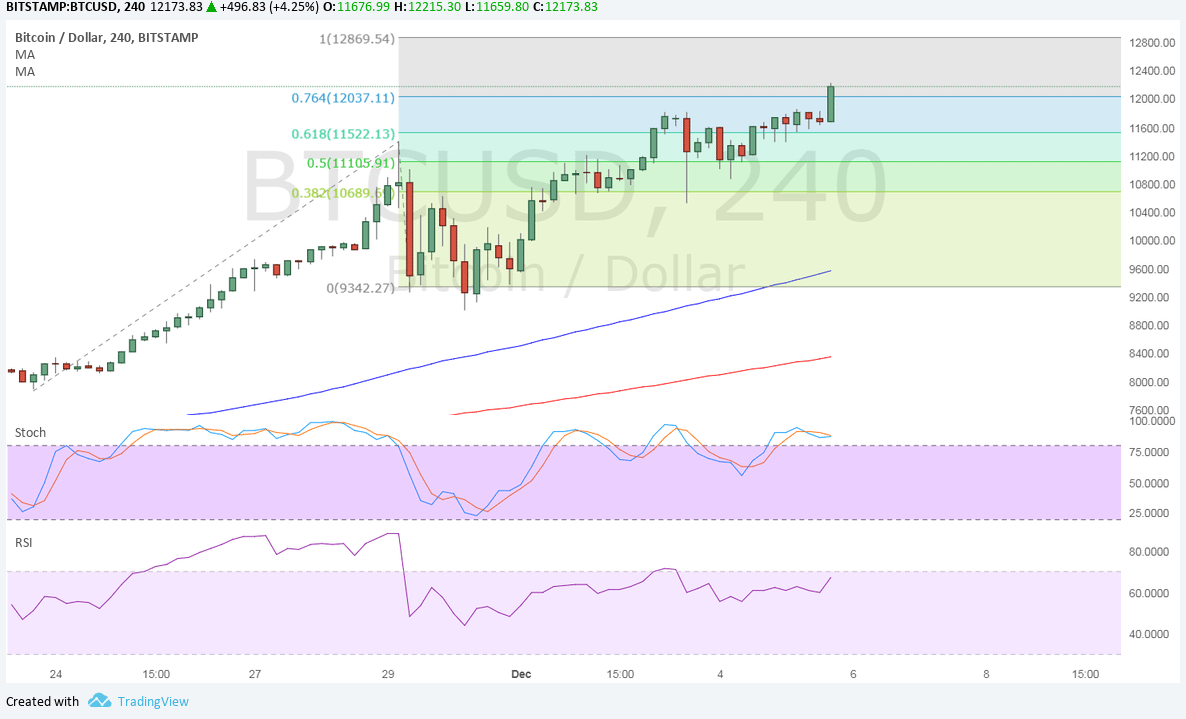

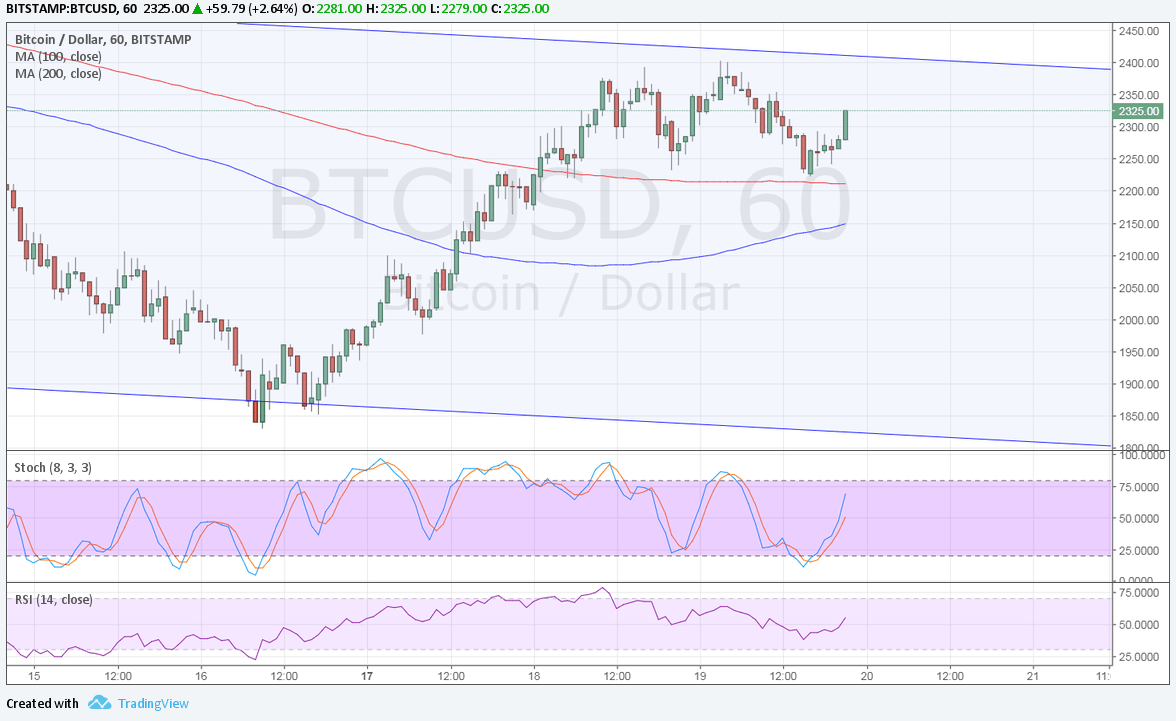

Bitcoin has alone from annual highs of $10,500 to as low as $8,400, however, accustomed the asset’s above-mentioned collapses from $20,000 to $3,000 and afresh from $14,000 to $6,000, the selloff hasn’t accomplished the point of absolute annihilation yet.

And while that may still be possible, one analyst says that there are two important lower boundaries that will acceptable anticipate Bitcoin from added decline.

3/ 2yr MA accession akin at $7.3k.

It would be a bazaar aeon aboriginal if $BTC bankrupt beneath that indicator at this point in the cycle, but that doesn't beggarly it can't happen. pic.twitter.com/I92FVifv0T

— Philip Swift (@PositiveCrypto) March 3, 2020

Bitcoin Cannot Break Below These Two Last Lines of Defense

According to the analyst, the 2-year affective average, which has acted as a abject for accession in the past, rests at almost $7,300.

During any of Bitcoin’s antecedent bazaar cycles, the asset has never bankrupt beneath that line.

But afore Bitcoin alike gets to that level, it charge argue with the logarithmic corruption ambit that the asset has been tracking forth back its bearing – which aloof so happens to be during the aftermost above recession.

This akin resides at almost $7,400. The analyst addendum that Bitcoin has historically alone beneath it, by as abundant as 9%, but has consistently bounced aback aloft it.

The two levels are acutely analytical to Bitcoin’s longevity. Breaking beneath a two-year affective boilerplate would arresting to investors that the asset’s axiological amount is disturbing to shine.

Related Reading | Bitcoin Must Live Up To Potential Or Risk Becoming Luxury Good: Analyst

Falling beneath the logarithmic advance ambit could be a assurance that Bitcoin is no best actuality adopted at the aforementioned rate, and could end up actuality a bootless experiment.

With the asset’s first above recession about the corner, it is absolutely a accomplish it or breach it moment for the adolescent cryptocurrency, and its approaching may depend on if it breaches beneath these two boundaries or not.