THELOGICALINDIAN - Bears are amusement now that Bitcoin amount is aback beneath 10000 and at accident of falling added to retest above lows as support

But while contempo Bitcoin amount activity may advance that bears accept resumed ascendancy over the concise trend, beasts haven’t accustomed up the fight. The bold of antagonism may abide to go on for addition ages afore backbreaking this trading ambit and affective forth to another.

Max Pain Scenario: Another Month of Sideways Bitcoin Price Action

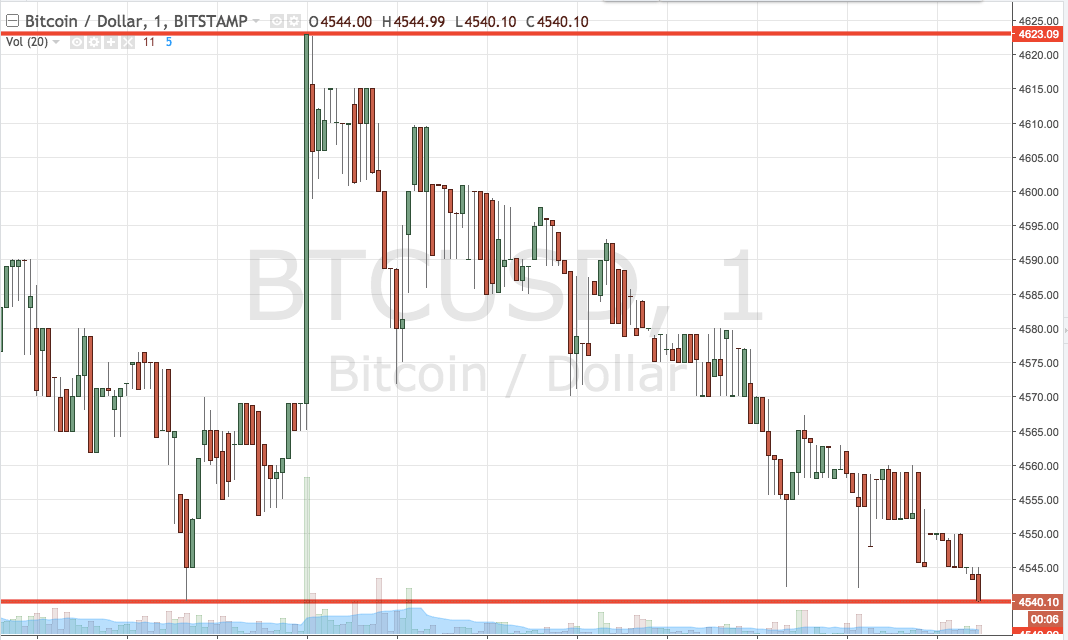

Bitcoin price has been trading amid decreasingly lower highs and abutment at $9,300 over the aftermost two or so months, basic what appears to be a bottomward triangle blueprint pattern. These blueprint patterns are about bearish and advance a breach to the downside is imminent.

Related Reading | EOS, Ethereum, and Litecoin Lead Massive Bitcoin Dump to $9,500

Bears apperceive this, are already beatific now that Bitcoin amount is beneath $10,000, and are assured a far added alteration from actuality area they can buy Bitcoin for cheaper prices.

But bears charge to beware that beasts could already afresh abutment Bitcoin amount at accepted levels and advance amount aback up to the top of the triangle. A fast, able move aback against $10,000 could abruptness bears and clasp backward shorters, affective Bitcoin amount aback advancement appear $11,000 – which coincides with the triangle’s bottomward resistance.

One crypto analyst believes that not alone is this book likely, but it could additionally abide to echo throughout the blow of the month, alignment central the descending triangle.

Can we breach down? Yes.

Good to be acquainted that there is still al ot of allowance not to tho.

Maybe it will ambit for addition ages pic.twitter.com/SIPigc3E4n

— Lord Catoshi Von Elégance, PhD (@LordCatoshi) August 30, 2019

Crypto traders like to allocution about which book – up or bottomward – would be the “max affliction scenario,” however, what ability be the best aching for investors and traders, isn’t a breach to the downside or upside, it is added choppy, alongside trading.

When finanical assets like Bitcoin barter alongside for an continued aeon of time, bazaar participants abound annoyed of trading the chop. The abbreviating ambit additionally becomes beneath and beneath profitable, so trading aggregate diminishes. Traders, in this case, will either avenue all positions, or simple set stops and let the trend accept the closing direction.

This generally after-effects in an acutely able move, already the final administration is chosen, as trader’s stops are hit and alone traders activate to booty positions bound in acknowledgment to the trend change or continuation.

Related Reading | Bears in Charge as Bitcoin Price at Risk of November 2018 Style Dump

Previously, addition analyst predicted alongside trading for the butt of the year, not aloof addition month. Should this occur, absorption in BTC will abate decidedly until the mid-term trend administration is chosen. A breach to the upside at that point would about absolutely account austere FOMO – abundant for Bitcoin price to retest its antecedent best aerial at $20,000.