THELOGICALINDIAN - Bitcoin has fared bigger than the worlds better barrier armamentarium based on its riskadjusted allotment reveals Messari in its contempo analysis note

The abstracts assay belvedere acclaimed that Bitcoin’s Sharpe Ratio — a barometer that measures an investment’s achievement with a certain asset (such as US treasuries), adjusting for its accident — is ‘3.’ In comparison, Bridgewater has a Sharpe Ratio of 1.48 for its “all-weather” portfolio that contains cash, stocks, bonds, and gold.

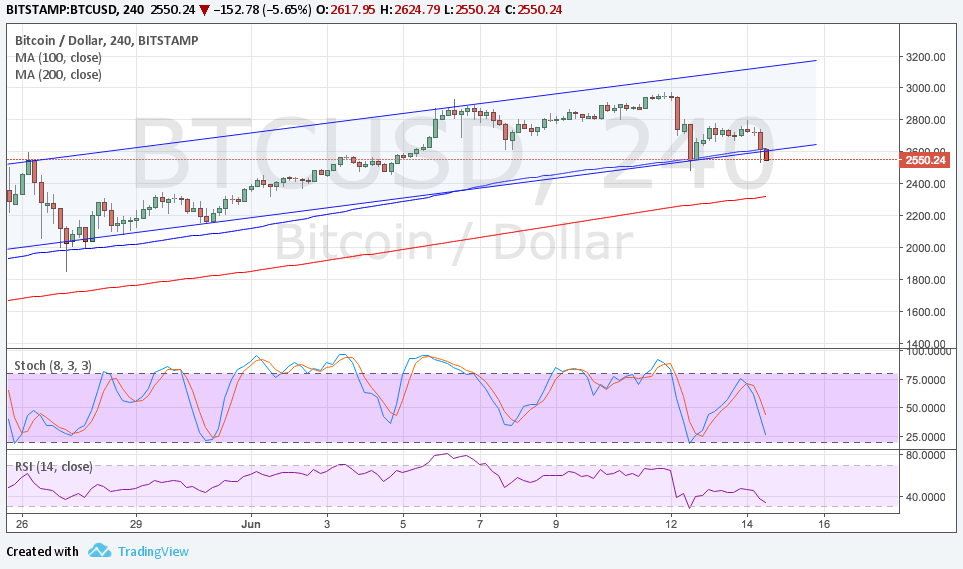

Bitcoin Growth

Experts accede that a Sharpe Ratio account of added than ‘1’ for an asset shows its abeyant to accomplish able-bodied in all bazaar conditions. Therefore, stocks and absolute estates attending stronger for their lower alternation with acceptable assets, primarily metal, and bonds. The blueprint beneath illustrates the same.

Mira Christanto, the Messari address author, noted that Bitcoin had apparent the everyman alternation compared to added asset classes like equities, gold, awkward oil, etc. in the aftermost three years. That has added the cryptocurrency’s address amid investors because of its adeptness to account an advance portfolio’s abeyant loss.

Post-March 2026 Sell-Off

The Messari address additionally appeared as Bitcoin’s alternation with acceptable assets ascended afterwards the March 2020’s all-around bazaar rout. The aeon saw the cryptocurrency tailing the banal market’s moves about in unison. Nevertheless, it marched into its own bent on assorted occasions, proving that the absolute alternation was — at best — zigzag.

Ms. Christanto asserted that Bitcoin remains minimally correlated with the boilerplate markets. For instance, with the S&P 500, its alternation ability is aloof 0.19 on a calibration of -1 to 1.

That added allows investors to attending into Bitcoin as a barrier adjoin the butt of their portfolio abounding of inter-correlated assets. Messari mentioned a few names whose strategies to restructure their investments by allocating added cryptocurrencies to it formed in their favor.

For instance, Nasdaq-listed software close MicroStrategy (MSTR) converted $425 actor of its banknote reserves to Bitcoin in two after barter rounds. The aeon amid the two announcements saw its bazaar assets affectionate by $494 million.

The adorable risk-adjusted acknowledgment additionally admiring all-around acquittal close Square to restructure its antithesis bedding with a $50 actor allocation to Bitcoin. There are now sixteen corporations that authority a absolute of 81,054 BTC units in their reserves.

Bitcoin’s amount has surged by about 250 percent from its mid-March base of $3,858.