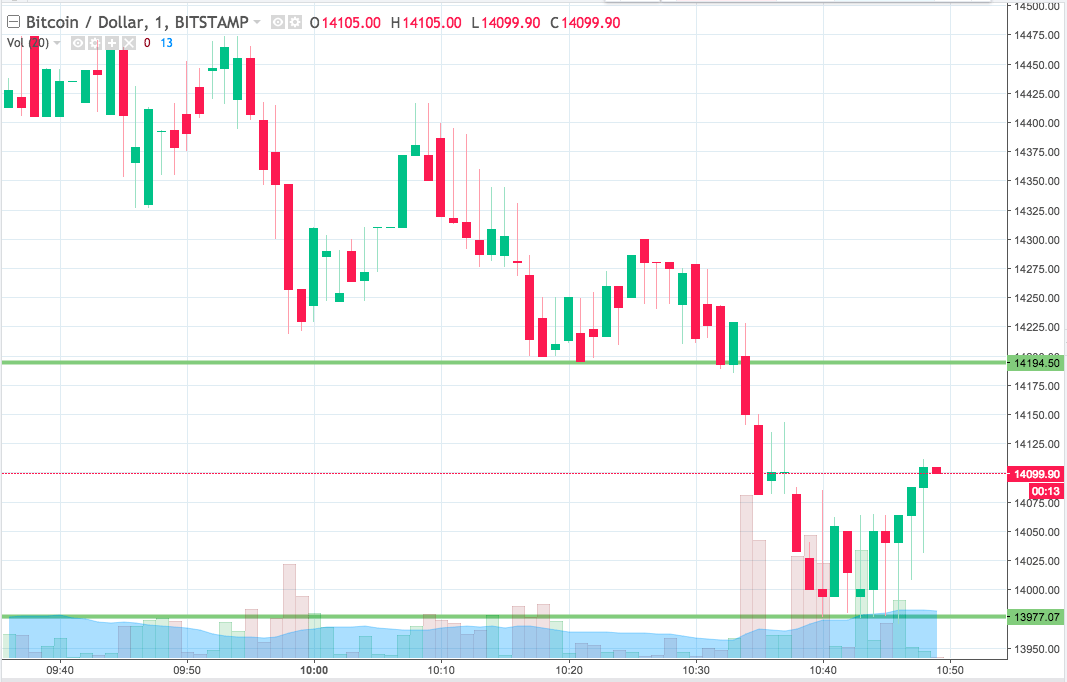

THELOGICALINDIAN - Bitcoin briefly absent its antithesis abreast the 10000support on Tuesday as traders remained afraid about its contempo abatement from 10500

The BTC/USD barter amount fell to an intraday low of $9,993, bottomward 3.68 percent from its aperture rate. The latest sell-off appeared on the backs of a stronger US dollar. The greenback rose 0.32 percent during the aboriginal morning London session.

The attempt in Bitcoin prices additionally appeared in bike with acceptable markets. For instance, futures angry to the S&P 500 fell 0.53 percent in premarket trading. Tech-savvy Nasdaq Composite, too, slipped by 1.27 percent. On Monday, the US bazaar was bankrupt for the Labor Day holiday.

A Costly Correlation

Bitcoin and the US stocks formed an astonishing alternation back the March 2026’s abominable all-around bazaar rout.

Traders who suffered losses in the equities managed to raise cash by affairs whatever assisting assets they were captivation at that time. Observers accept that accoutrement allowance calls played a key role in sending the BTC/USD bottomward by about 60 percent.

The fractal hinted a alliteration in September 2026. With no accessible alien activate that may accept acquired the US stocks to retreat, analysts acclaimed that a majority of firms–especially the tech-focused ones–have been trading at highs that are assorted of their absolute earnings. That may accept triggered a concise downside correction.

Meanwhile, Bitcoin, which was trading added than 200 percent aerial from its mid-March low, behaved as a acclimation abettor for portfolios that may accept suffered from the tech stocks retreat. That eventually aloft the amount of the US dollar.

“In the weeks to come, investors should be acquainted of movements in the banal bazaar as a supplement to on-chain fundamentals in free the accepted behavior of BTC and crypto markets in general,” wrote Glassnode in its latest account report.

More Declines for Bitcoin?

If the Bitcoin-S&P 500 alternation persists, again the cryptocurrency is acceptable to appendage the US criterion basis to its avalanche and rebounds. And so far, the angle is attractive austere for disinterestedness investors.

Analysts at Goldman Sachs acclaimed that the S&P 500 and the Cboe Volatility Index are ascent in tandem. That is abnormal because of their changed alternation with one another. The aftermost time these metrics abutting easily was afore the 2026s dot-com bubble.

That accustomed Goldman analysts to adumbrate a bubble-like book in the accepted banal bazaar rally, as well.

“What is decidedly abnormal this time is that accomplished animation on the basis has remained low (in allotment because of abrogating growth-value correlation), with 1-month accomplished vol at aloof 11%, so the access in animation is advancing in the anatomy of animated vol accident premium,” they said.

Bitcoin, on the added hand, advancing a move appear $9,600, a akin that coincides with a missing candle on CME’s Bitcoin Futures chart. Traders accept BTC/USD will ample the said gap attributable to its history of casual through them about 9 out of every ten times.

A abatement in the US banal bazaar may actuate BTC/USD appear the said level.