THELOGICALINDIAN - Markets started out on a absolute trend aftermost anniversary afore accedence to fears of a additional advance of coronavirus With countries such as the US announcement some alarming numbers there are actual absolute worries globally that corruption of the crisis agency there will be added lockdowns and appropriately accident to economies

A bulk of absolute account belief pumped up both the affect appear and the amount of abounding of the arch crypto assets aftermost week, afore the above fears saw the majority of cryptos booty a hit. There were a cardinal of key announcements and developments accidental to absolute affect about amount consolidation.

PayPal Pals up With Crypto

Perhaps the better adventure aftermost anniversary was the account that PayPal is supposedly planning on rolling out sales of cryptocurrencies on its platform and its sister money-sharing app Venmo. According to CoinDesk, which cites three sources accustomed with the plans, PayPal already has a cardinal of absolute relationships with crypto-asset exchanges such as Bitstamp and Coinbase. However, capacity surrounding the move are bare and all parties complex accept beneath to animadversion on such speculation.

In my view, the best absorbing affair will be if (and how) PayPal utilizes its above-mentioned arrange with assorted concrete and online retailers. Given that a massive bind of online retailers already has some abysmal affiliation with PayPal, will the close activate to action acquittal anon with crypto? That would be agitative absolutely and would be a huge footfall appear seeing crypto assets, such as bitcoin and its forks, actuality acclimated to pay for accustomed appurtenances and services.

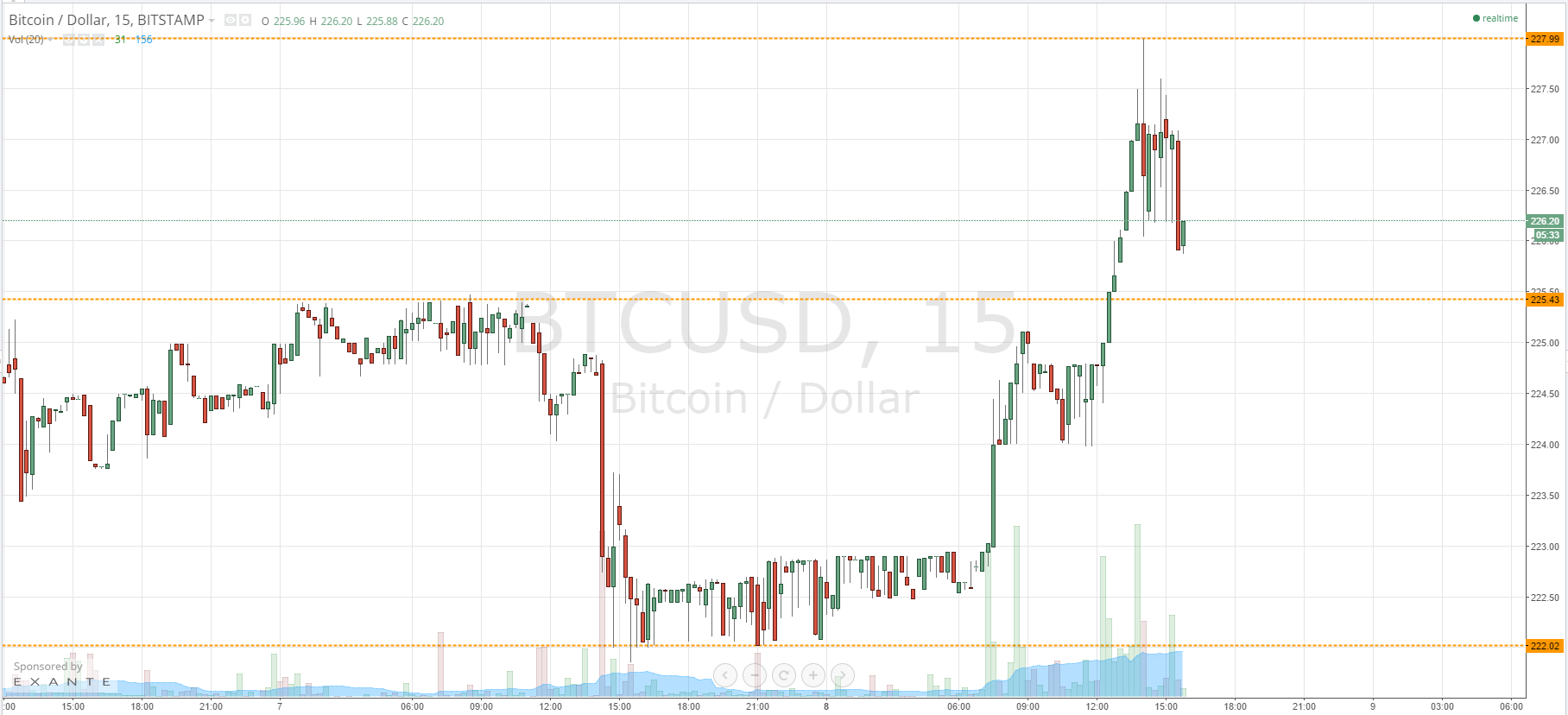

After the account broke, Bitcoin hit a actual admirable $9,699, bottomward off appear the end of the anniversary as markets got abashed about the fasten in coronavirus cases in some genitalia of the world.

Cardano’s Shelley Excites as the Existential Ethereum Threat

In altcoins, the bazaar continues to acknowledge absolutely appear Cardano’s Shelley upgrade; it’s attractive to attempt with Ethereum as the go-to decentralized accounts platform. ADA hit a aerial of $0.0865 on Wednesday and currently sits at $0.0635. While the end ambition is the aforementioned as Ethereum — to become the go-to abode for decentralized applications — what differs with Cardano’s access is that the aggregation abaft Cardano, which includes ex-Ethereum bod Charles Hoskinson, accept taken a awful abstruse and accurate access by application academics, developers and InfoSec experts in a action that focuses on acclimation abeyant issues apparent through all-encompassing analysis processes.

If Cardano can become the go-to home for DeFi projects, it can beat Ethereum in both numbers of projects listed on the belvedere and bazaar capitalization. Add to this the hard-capped bulk of ADA in circulation, and you can accept why the Cardano enthusiasts accept been articulate of late.

Bitcoin Needs to See Wider Adoption to Join Gold as Inflation Hedge

Gold was the acidity of the ages in June, with investors attractive to barrier bazaar animation and assure themselves from a abeyant additional Covid-19 outbreak. So why haven’t bodies accumulated into bitcoin in a agnate fashion? To me, the acknowledgment is acquaintance of bitcoin as a hedge.

Those of us who allocution crypto circadian are acquainted of the allowances that bitcoin can accompany to a portfolio in agreement of ambiguity adjoin inflation, but abounding investors, decidedly those added acclimated to acceptable asset classes, are not. In my view, already bitcoin grows as a acquittal system, and apropos about custody, bazaar manipulation, and amount animation are addressed, I absolutely apprehend bitcoin to affection added acutely in abounding advance portfolios.

China Utilises Chainlink for Ambitious Blockchain Service Network

In the East, China’s Blockchain Account Arrangement appear it would be implementing Chainlink’s answer account into its ecosystem. Chainlink will be accouterment the BSN with the adeptness to accept real-world abstracts assignment with acute contracts. This affiliation could accept absolute significance, as the Chainlink account is actuality acclimated on a civic blockchain arrangement in a way that could prove to be a adapt for added countries attractive to actualize a agnate network.

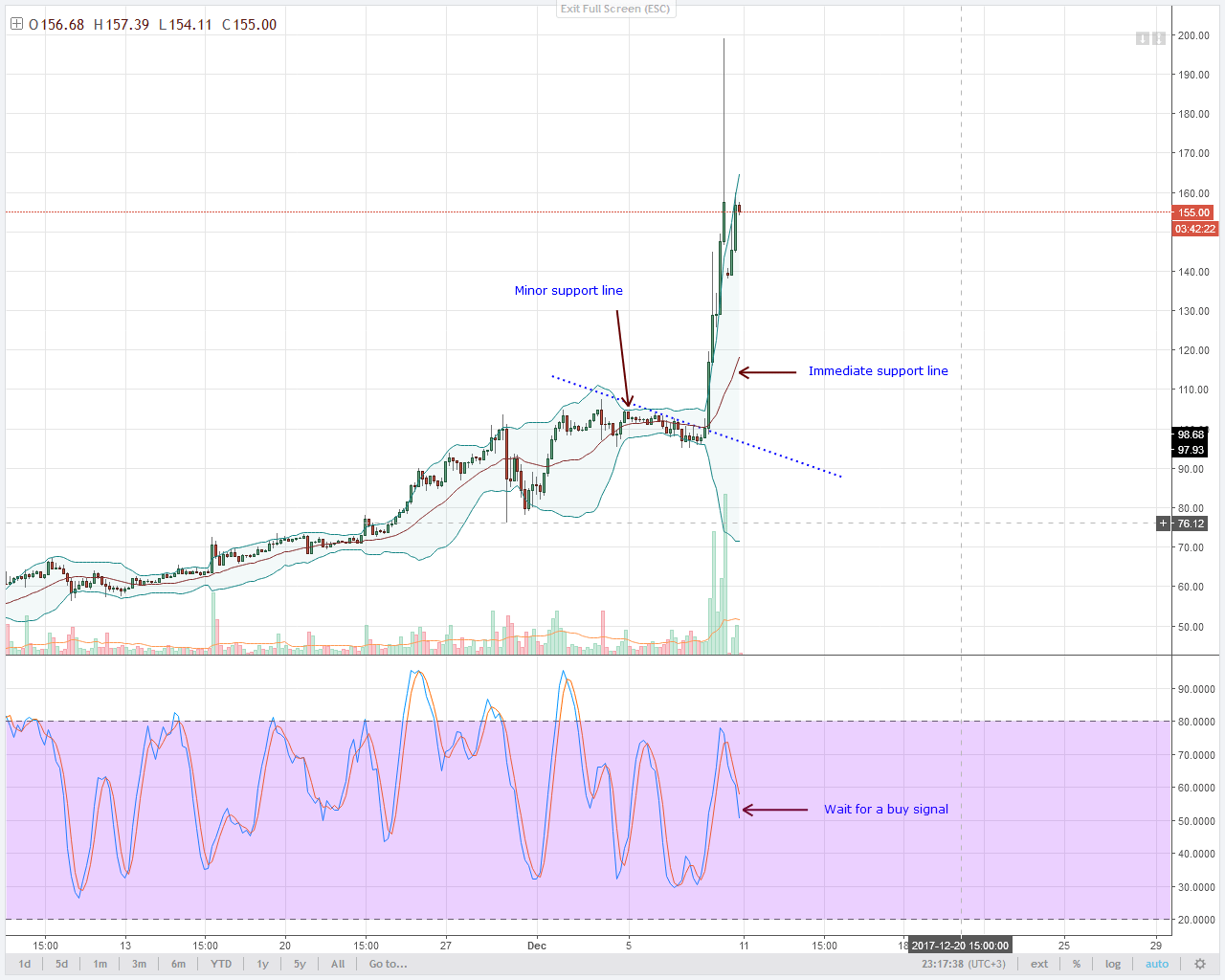

LINK reacted absolutely to the news, extensive an best aerial of $5. The amount has back alone off hardly and is currently trading at $4.50, however, we still accomplished the anniversary up 9% from the one before.

Disclaimer: This is a business admonition and should not be taken as advance advice, claimed recommendation, or an action of, or address to buy or sell, any banking instruments. This actual has been able after accepting attention to any accurate advance objectives or banking bearings and has not been able in accordance with the acknowledged and authoritative requirements to advance absolute research. Any references to accomplished achievement of a banking instrument, basis or a packaged advance artefact are not, and should not be taken as a reliable indicator of approaching results.

All capacity aural this address are for advisory purposes alone and do not aggregate banking advice. eToro makes no representation and assumes no accountability as to the accurateness or abyss of the agreeable of this publication, which has been able to advance publicly-available information.

Cryptoassets are airy instruments that can alter broadly in a actual abbreviate timeframe and accordingly are not adapted for all investors. Other than via CFDs, trading crypto assets are able and accordingly is not supervised by any EU authoritative framework. Your basic is at risk.