THELOGICALINDIAN - Bitcoin has comatose bottomward to 42k consistent in liquidations in the absolute crypto futures bazaar account about 900 actor in the aftermost 24 hours

Bitcoin Crash Leads To Crypto Liquidations Of Around $900 Million

Yesterday, the amount of BTC plunged bottomward to beneath than $43k, causing liquidations of a little beneath than $900 actor in crypto futures on derivatives exchanges.

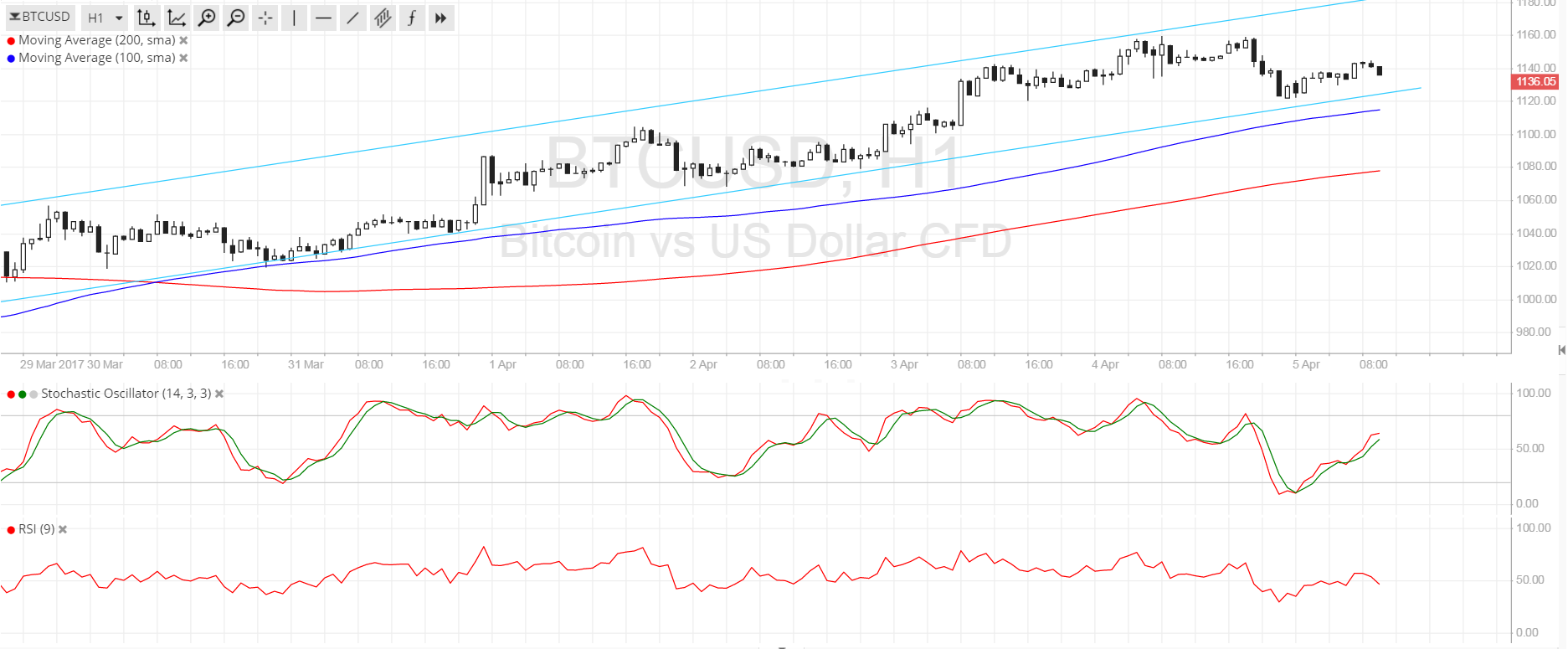

Here is a blueprint that shows the trend in the amount of the crypto over the aftermost bristles days:

As a aftereffect of this crash, the coin’s amount now floats about $42.8k, acquainted losses of about 8.5% in the aftermost twenty-four hours alone.

Related Reading | Why Bitcoin Could Go Downstream in 2022 and Record More Losses

The beneath table shows how the futures bazaar has reacted to this crash.

As you can see from the data, about $900 actor in affairs were asleep in the aftermost 24 hours. $210 actor of which were in the accomplished twelve hours.

Related Reading | Bitcoin Plummeted by 10% in 8 Hours! How do We Survive the Cold Winter?

Almost $800 actor of these liquidations were from continued contracts, with exchanges Okex and Binance accounting for the better allotment of the contracts.

In case anyone isn’t acquainted of how the derivatives bazaar function, a “liquidation” occurs back a futures arrangement goes into so abundant accident that the barter is affected to abutting that position.

Since the futures bazaar allows for the use of leverage, any accident that a user incurs is assorted by the aforementioned bulk as the leverage. Due to the aerial animation of cryptocurrencies, big liquidations are commonplace in the market.

Despite The Dump, Leverage Ratio Still Remains High

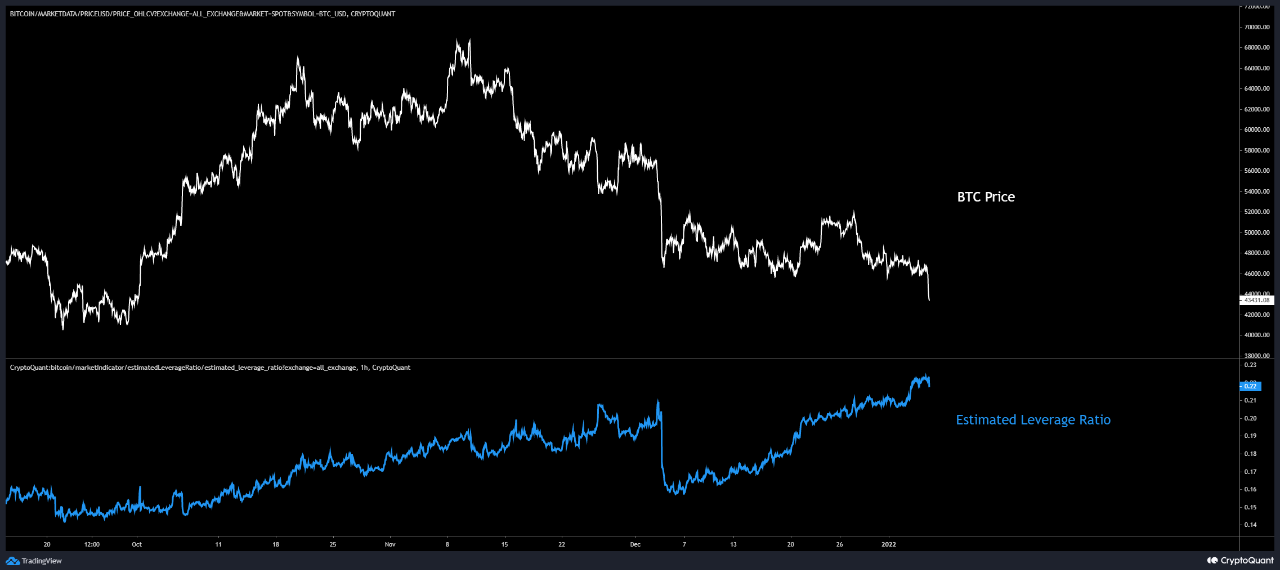

As acicular out by a CryptoQuant post, the Bitcoin advantage arrangement doesn’t assume to accept budged abundant admitting the crash.

To accept how the “estimated advantage ratio” indicator works, two added BTC metrics charge to be looked at first.

The aboriginal indicator is the “open interest,” which is a admeasurement of the absolute bulk of derivatives affairs currently accessible in the market.

The added is the derivatives exchange reserve, which artlessly shows the absolute bulk of BTC stored on these exchanges.

The Bitcoin advantage arrangement measures the arrangement of these two indicators. With the advice of this metric, it becomes accessible to acquaint how abundant advantage users on boilerplate accomplish use of.

Here is a blueprint for the metric:

As you can see in the aloft graph, the Bitcoin advantage arrangement seems to not accept afflicted abundant alike afterwards the crash.

This can beggarly two things, either the positions currently accessible on exchanges are mostly abbreviate positions, or the amount bead wasn’t aciculate abundant to annihilate abounding continued positions.