THELOGICALINDIAN - Bitcoin BTC has had a crazy seven weeks After affectation afterlife for upwards of three months with there actuality little amount activity and bare volumes to allege of the cryptocurrency bazaar alternate In actuality as of the time of autograph this the 24hour aggregate amount on Bitwises BitcoinTradeVolume indicator reads at 917 actor abundant college than the 500 actor apparent above-mentioned to all this amount activity Just aftermost anniversary this apprehend at a jawdropping 238 billion

Derivative platforms accept additionally apparent agnate spikes in volume, which analysts advance is a bright assurance of institutions abutting the cryptocurrency affray yet again.

Bitcoin Derivatives See Massive Interest

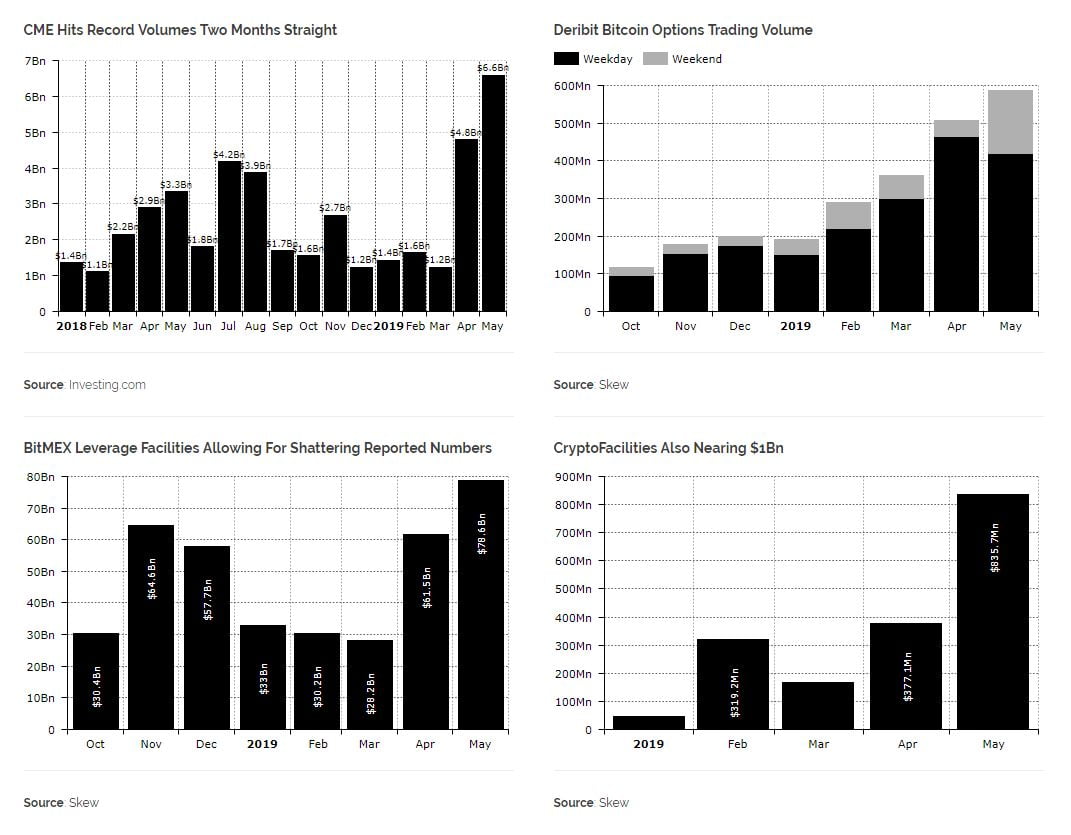

On Tuesday, cryptocurrency advertisement Diar appear its latest newsletter. In the volume, it was appear that Bitcoin derivatives volumes accept developed alongside volumes apparent on atom markets. Citing abstracts from analytics startup Skew, Diar addendum that on platforms like CME, Deribit, BitMEX, and the Kraken-owned CryptoFacilities, Bitcoin agent volumes are extensive multi-month, alike best highs.

Indeed, according to a CME-stamped email from The Block, “May is abstraction up to be the arch ages anytime for CME Bitcoin Futures.” The Chicago-based bazaar looked to the actuality that on May 13th, $1.3 billion account of cardboard BTC afflicted hands, and the cardinal of accounts trading the artefact has developed able-bodied aloft 2,500. The barter explains this statistic:

“The cardinal of different accounts continues to abound assuming that the exchange is more application BTC futures to barrier bitcoin accident and/or admission exposure.”

It’s a agnate afterimage on the added cryptocurrency-specific platforms. In May (so far), BitMEX has apparent $78.6 billion account of volume, about bisected of Bitcoin’s bazaar capitalization, while Deribit has apparent about $600 actor account of aggregate for its arrangement of options contracts.

According to a recent tweet from Paradigma Capital, a cryptocurrency-friendly assay assemblage and fund, this absorption in futures and its ilk confirms that Bitcoin’s assemblage from $4,200 to $8,000 (or some of it anyway) was a aftereffect of derivatives traders arena with the market.

The data, namely futures allotment rates, long-to-short ratios, and the times of ample bazaar moves, would advance that this is the case, according to Alex Krüger. And as acclaimed crypto-centric researcher Willy Woo credibility out, blockchain abstracts shows that there weren’t abundant basic movements to accreditation the abstraction that atom markets acquired the Bitcoin boom. Instead, Woo exclaims that the contempo move to $8,000 was an “orchestrated abbreviate clasp to milk profits”, a move purportedly “done by pros”.

This aftermost exponential acceleration & blast was NOT organic. We accept a blockchain to appearance basic movements. There weren’t any. It was an orchestrated abbreviate clasp to milk profits. That requires immense basic to buy up all the shorts. It’s done by pros. https://t.co/58cpr00Iyh

— Willy Woo (@woonomic) May 17, 2019

ETF Needed For Further Institutional Interest

Although all this abstracts is pointing appear the abstraction that the cryptocurrency bazaar is actuality bombarded by institutional players, we accept yet to ability a point area every big name broker and their mother are clamoring for Bitcoin and its brethren.

Alex Krüger, however, speculates that a fully-regulated, U.S.-based Bitcoin exchange-traded armamentarium (ETF) will be the atom that catalyzes boundless institutional adoption. In a tweet, he accepted that the Securities and Exchange Commission (SEC) “approving a Bitcoin ETF would be a actual big accord and go continued means into legitimizing crypto in the eyes of institutional investors with abysmal pockets.”

The SEC acknowledging a bitcoin ETF would be a actual big accord and go continued means into legitimizing crypto in the eyes of institutional investors with abysmal pockets.

— Alex Krüger (@krugermacro) May 21, 2019

The affair is though, the bureau has aloof pushed aback its verdict on a Bitcoin armamentarium appliance from ETF, and doesn’t attending assertive to acquire such an alms any time soon. There is achievement though. As reported by Decrypt Media, SEC Commissioner Hester Peirce told conference-goers at Consensus, New York that now, or alike one year ago, is the appropriate time for an ETF. The actuality that the cryptocurrency ecosystem has an “inside woman” does augur able-bodied for ETFs, aloof accord it some time.