THELOGICALINDIAN - Interest about the futuresbased Bitcoin ETF has been blah afresh as BITO now holds beneath than 5000 CME affairs for the aboriginal time back November

Futures-Based Bitcoin ETF Now Observes Diminishing Interest

As per the latest account address from Arcane Research, the futures-based BTC ETF, ProShares’ BITO, now holds beneath than 5000 CME contracts. This is the aboriginal time back November that the cardinal has went beneath the 5k mark.

An “Exchange Traded Fund” (or ETF in short) is a blazon of advance artefact that allows the holder to bet on the amount of a article after accepting to absolutely authority it.

The futures-based Bitcoin ETFs were accustomed aback in October of aftermost year, and they went alive with a massive launch. ProShares’ BITO ETF accomplished $1 billion in AUM afterwards actuality online for aloof two days, the fastest any ETF has hit the milestone.

If you are apprehensive why some would adopt to get Bitcoin acknowledgment through such a fund, rather than aloof affairs the coin, there could a few affidavit for it.

One acumen could be that some investors aren’t accomplished with the apparatus of the crypto apple so they may not appetite to cross about exchanges and wallets. While ETF is accustomed area for abounding acceptable investors.

Another acumen is that the futures-based ETFs accommodate the adeptness to brainstorm on the amount of BTC in both directions. In atom trading, holders can alone anon accomplish profits back the amount moves up.

Related Reading | Bitcoin Data: 2nd Half Of 2021 Saw Little Spending Despite ATH

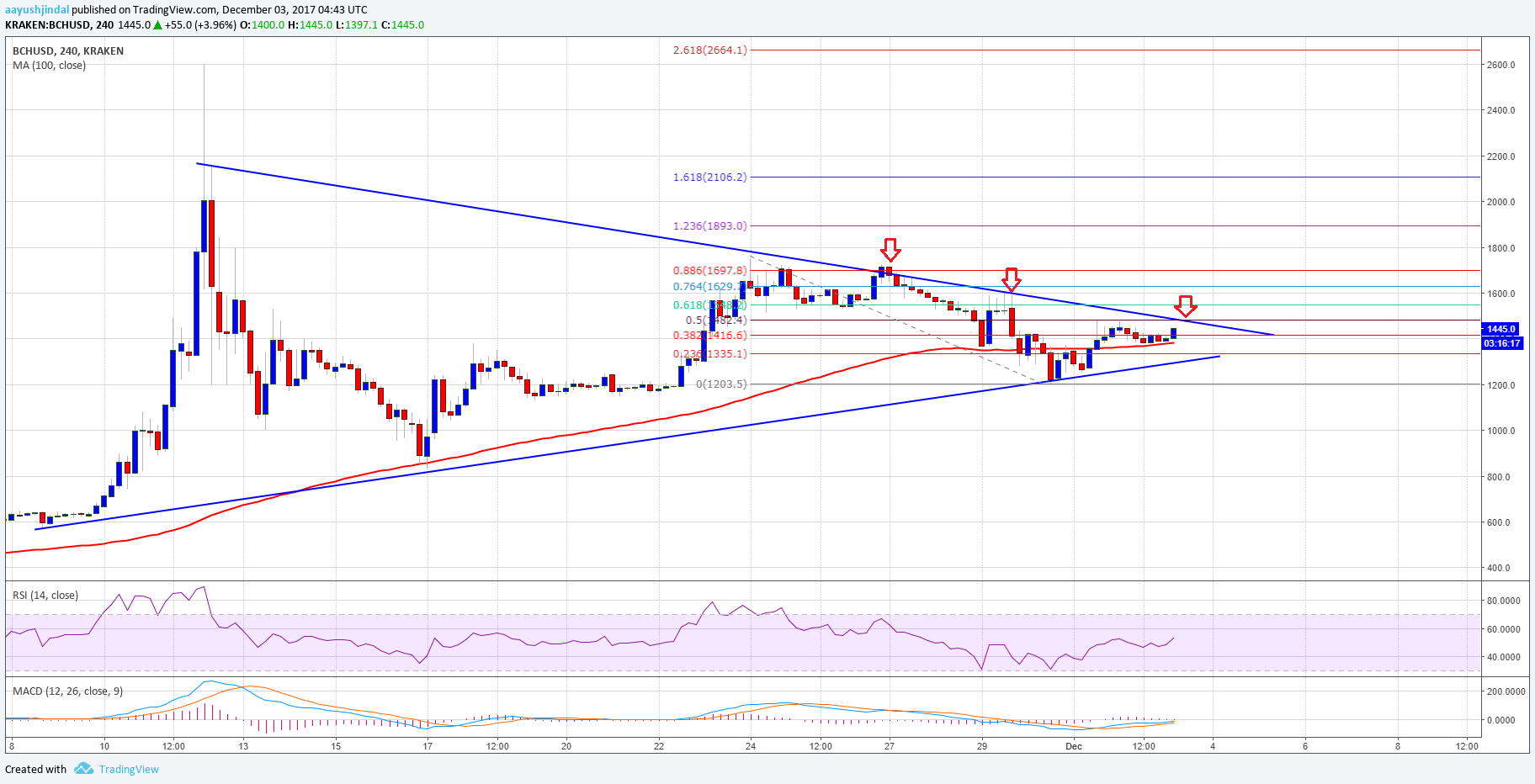

Now, actuality is a blueprint that shows the absorption in the ProShares’ BITO ETF back it started trading:

As you can see in the aloft graph, the BITO ETF now holds beneath than 5000 CME contracts. This is the aboriginal time back November that the amount of beneath than 5000 has been seen.

This may beggarly that the absorption about BTC futures-based ETFs is now fading. A acumen abaft this could be the disturbing amount of the crypto over the accomplished few months.

Related Reading | Boomer Billionaire Investor Puts Half His Net Worth In Bitcoin. But Why?

Another may be the actuality that these futures-based ETF instruments accept aerial active costs. This isn’t the case with spot-based ETFs, but none such armamentarium for BTC has been accustomed yet.

BTC Price

At the time of writing, Bitcoin’s price floats about $43k, bottomward 7% in the aftermost seven days. Over the accomplished month, the crypto has alone 13% in value.

The beneath blueprint shows the trend in the amount of BTC over the aftermost bristles days.