THELOGICALINDIAN - Bitcoin could hit 50000 in the advancing sessions as added and added institutions accrue it adjoin their fears of dollarlinked inflation

The flagship cryptocurrency, whose bazaar assets afresh soared aloft that of Facebook and Tesla, alone lower from its almanac aerial abreast $42,000. Nevertheless, its plunge prompted affluent traders and institutions to acquirement it at cheaper rates, arch to added clamminess crisis adjoin its bound accumulation cap of 21 actor tokens.

As a result, the bitcoin amount is mostly accumulation sideways, basic a anatomy that looks like a Symmetrical Triangle. In retrospect, the said arrangement develops back the amount forms college lows and lower highs. Meanwhile, the trading aggregate drops. Ultimately, the amount break out in the administration of its antecedent trend—upward or downward.

Bitcoin’s antecedent trend was bullish. Therefore, the cryptocurrency’s possibility of notching addition upside run is college on its blemish move out of the Triangle pattern. That should booty its amount aloft $50,000.

That is—again—because of a Symmetrical Triangle’s arbiter description. An asset break out by as abundant as the best acme amid the pattern’s high and lower trendlines. In Bitcoin’s case, the acme is about $14,000.

A move aloft the Triangle, accompanying with a acceleration in volumes, apprehend to booty the bitcoin amount aloft $50,000.

Bitcoin Liquidity Crisis

Fundamentally, the amount ambition looks achievable, at atomic according to a deluge of analysts that actuate their bazaar bent based on on-chain indicators. For instance, abstracts analysts at Glassnode highlighted Bitcoin’s better clamminess burning to date in contempo weeks, hinting that its bullish for the cryptocurrency.

“The [Glassnode] blueprint ability be added important than the amount chart: bitcoin accumulation is actuality aloof from exchanges at an all-time-high pace,” added Luke Martin, an absolute bazaar analyst. “Historically, balderdash cycles accept concluded AFTER aqueous accumulation change flips positive. That cast has not happened yet.”

Dollar Abundance

Part of the acumen is a allusive college appeal for Bitcoin amidst an advancing anti-inflation narrative. Joe Biden’s accretion to the US presidential bench has increased the affairs of added government spendings to aegis the abridgement from the after-effects of the coronavirus pandemic.

That agency an abounding dollar accumulation which abounding perceives as bearish for the greenback.

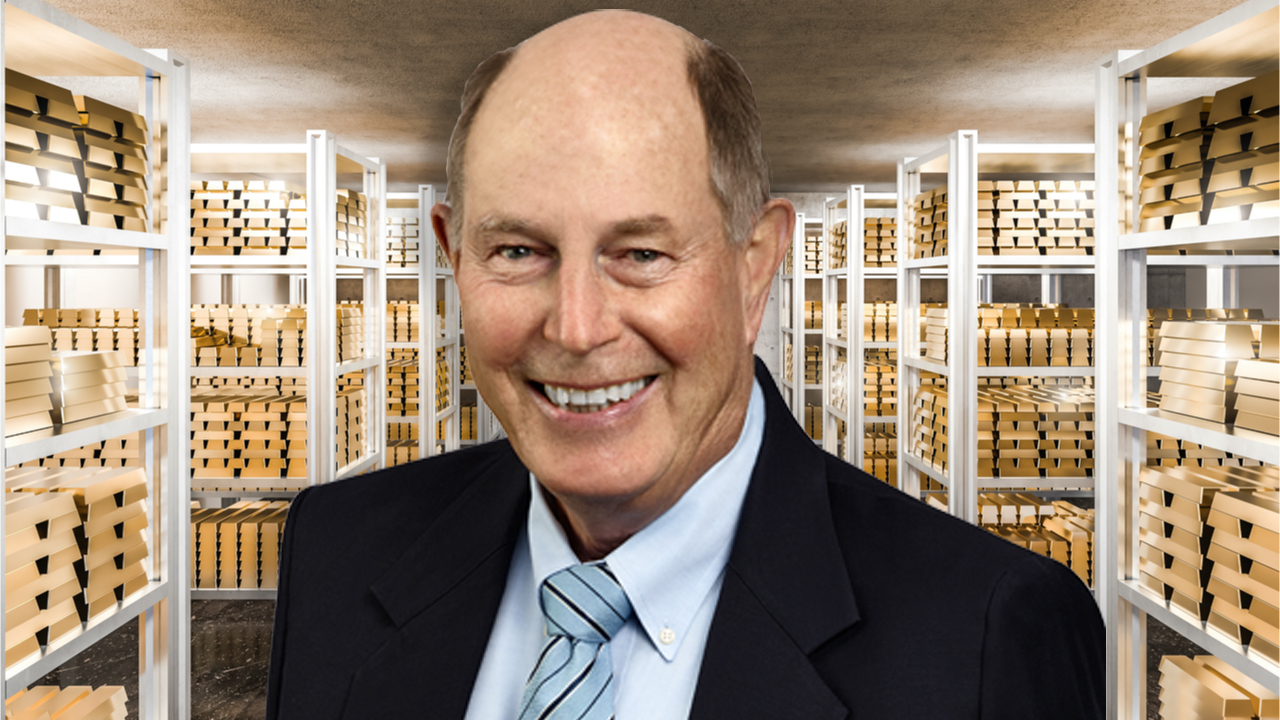

Such fears accept already pushed companies like MicroStrategy and Square to barter a allocation of their dollar affluence for Bitcoin. Meanwhile, allegorical investors such as Paul Tudor Jones and Stan Druckenmiller accept additionally invested baby sums into the cryptocurrency market, with both believing it to be the bigger adaptation of gold.