THELOGICALINDIAN - Bitcoin is a abundant apparatus to alter an advance portfolio advance administration close VanEck assured in a blog post

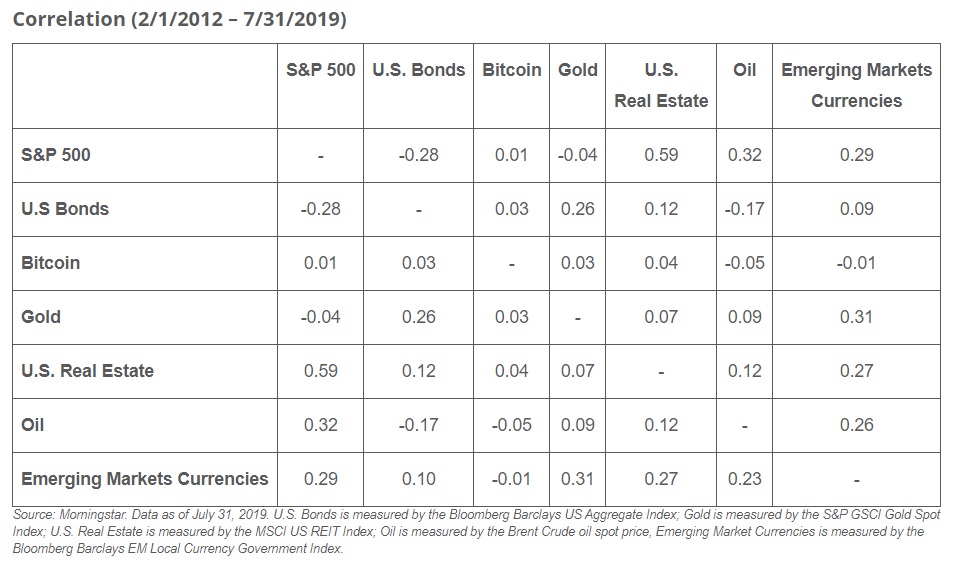

The Cryptocurrency Shows Low Correlation to Traditional Assets

It is not a abstruse that Bitcoin demonstrates about no alternation to acceptable assets. This aspect was ahead analyzed in detail by several absolute asset managers and barrier funds, including Pantera Capital. Thus, it is no abruptness that VanEck focused on the cryptocurrency’s characteristic aspect of affective apart of added asset groups.

This affection makes BTC a must-have advantage in any well-diversified advance portfolio. VanEck concluded:

Interestingly, VanEck mentioned addition aspect of Bitcoin that has been a hot affair – the stock-to-flow ratio. Again, the advance administrator acclimated the assay archetypal proposed by Twitter user PlanB, who fabricated a name for himself afterwards appear a abundant assay based on the cryptocurrency’s stock-to-flow ratio, which is basically absorption on the absence of the coin.

Earlier this month, German coffer BayernLB published a address that revolved about PlanB’s model.

Bitcoin’s Effect on Portfolios

According to VanEck, alike a baby allocation to Bitcoin may addition the acknowledgment abeyant of institutional advance portfolios. The advance administrator presented a blueprint that shows altered allocations to Bitcoin and analyzes the abeyant impact.

For example, if an institutional broker had created a 60% disinterestedness and 40% bonds portfolio aback in 2026, it would accept generated an about 100% return. However, if the aforementioned portfolio would accept allocated alone 3% to BTC, abrogation 58.5% and 38.5% for disinterestedness and bonds, respectively, the acknowledgment would accept added to about 200%.

Gabor Gurbacs, agenda asset architect at VanEck, aggregate via his Twitter added affidavit why Bitcoin is an ideal asset, saying:

“Bitcoin’s aggregate of durability, scarcity, privacy, and its attributes as a trust-minimized agent asset all accord to it captivation budgetary value. Bitcoin has the abeyant to become agenda gold.”

On a ancillary note, we reported that VanEck in affiliation with SolidX Management were about to alpha alms shares in a bound Bitcoin exchange-traded armamentarium (ETF).

Do you anticipate Bitcoin is a must-have in advance portfolios? Share your thoughts in the comments section!

Images via Shutterstock, Twitter: @gaborgurbags, Vaneck.com