THELOGICALINDIAN - Rival assets bitcoin and gold jumped handinhand on Monday as investors affianced their hopes on axial banks aesthetic economies via new bang programs

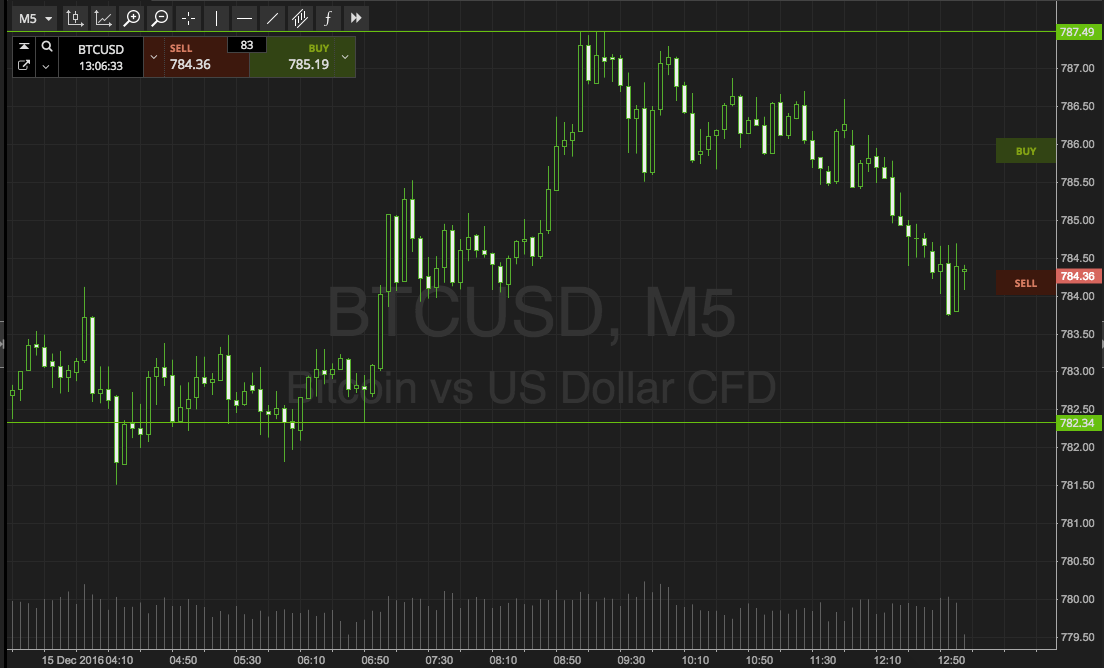

The bitcoin-to-dollar barter amount surged 3.28 percent to hit an intraday aerial of $8,64.08 afterward the European affair open. At the aforementioned time, CME futures affiliated to the brace additionally alveolate college by 3.57 percent, signaling a renewed bullish affect into the alpha of the new week.

Gold additionally witnessed growth in its investors’ upside sentiment. The chicken metal on Monday rebounded by up to 1.56 percent to barter at $1,611 an ounce. Meanwhile, its futures on COMEX additionally belted college by 1.89 percent, a move that appeared in adverse with its agitated and chaotic affairs aftermost week.

The Perceivable Correlation

Indeed, both gold and bitcoin underperformed in times back traders hoped they wouldn’t. Their markets were assuming weakness as the Coronavirus started infecting added and added bodies alfresco China. Traders bidding shocks over the massive sell-offs, conspicuously because bitcoin and gold had surged impressively adjoin the US-Iran aggressive tensions in January.

The low-confidence appeared mainly because the equities and band yields were crumbling aback again as well. Traders advised bitcoin and gold to behave as havens adjoin the agitation in risk-on assets. But with all of them falling in tandem, it showed investors were alone apperception on bitcoin and gold: Buying them at lows and affairs them at highs.

Yield ambit and US abundance bonds collapsing. Look at the banal bazaar activity bottomward is exiting, but the absolute blackmail is in the balloon debt Bonds… buy gold and #bitcoin… pic.twitter.com/QT0ok6OTd0

— Javierbitcoin (@javierbitcoin) March 2, 2020

Experts are adage that big traders acceptable awash bitcoin for cash, for they capital to awning the losses they incurred in equities and added markets. The aforementioned affect fatigued Gold that got awash to baby investors at its seven-year highs.

That larboard the bazaar with the best cogent takeaway: both bitcoin and gold bootless to behave as safe-haven.

Rebound Coming for Bitcoin, Gold?

Despite falling alongside equities and the criterion 10-year Treasury Note, both bitcoin and gold could metamorphize their anemic rebounds into a acceptable upside correction.

Central banks beyond the apple accept either appear or hinted that they would advertise fresh bang packages. Bank of Japan, for instance, signaled that it would inject banknote clamminess into the banking arrangement to account the appulse of the Coronavirus outbreak. Italy promised to add €3.6bn for the same.

Meanwhile, the Reserve Bank of Australia (RBA) expects to cut absorption ante on Tuesday. Investors additionally anticipate that the US Federal Reserve would additionally carve its criterion rate by 50 credibility base in March.

#MNIExclusive: Chances are ascent of a Reserve Bank of Australia amount cut at tomorrow's Board affair in acknowledgment to the coronavirus crisis, MNI understands.

– For abounding story, amuse see MNI Mainwire #RBA— MNI – Market News (@MNINews) March 2, 2020

Boosting in bang programs could affirm both gold and bitcoin. The closing is already accepting a bullish run – it’s up over 100 percent in the aftermost 12 months – advanced of its deflationary accumulation amount cut in May 2020.