THELOGICALINDIAN - An contrarily decentralized cryptocurrency Bitcoin ability accept become a victim of a centrally orchestrated amount auctioning attempt

According to abstracts fetched by CryptoQuant, a South Korea-based blockchain analytics firm, Bitcoin miners at Chinese mining close F2pool started the massive sell-off that comatose the BTC/USD barter amount by about 20 percent in aloof beneath than 24 hours.

Oversupplied Bitcoin

CryptoQuant CEO Ki-Young Ju listed a alternation of bearish alerts he accustomed back Bitcoin started coast on aboriginal Friday. As per the abstracts he provided, the Miners’ Position Index went aloft 2.5, absorption advance in Bitcoin units that miners confused from their wallets. Meanwhile, the CryptoQuant’s All Exchange Bitcoin Transaction Count Inflow surged, assuming F2pool as a above BTC depositor.

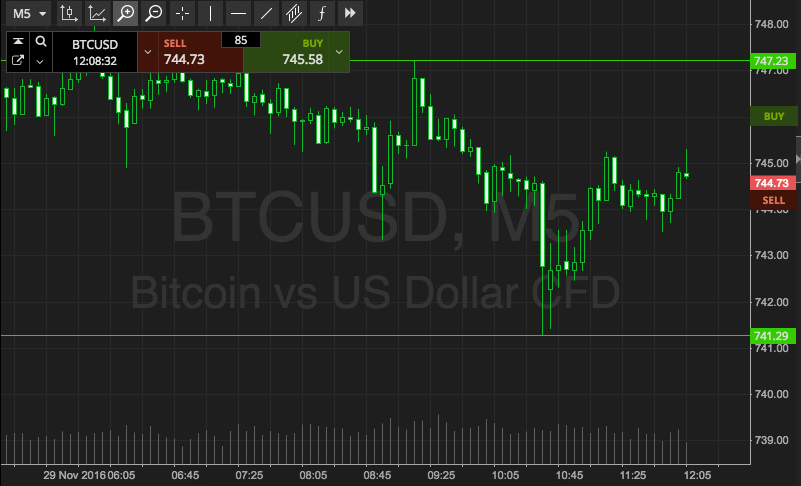

Miners about advertise their BTC rewards to awning their operational costs (including electricity bills, accessories handling, and maintenance). Many of them adopt to authority a allocation of their Bitcoin backing for speculations, thereby finer attached the cryptocurrency’s accumulation from entering the retail markers. That, in turn, acts as an indicator to actuate Bitcoin’s concise bias.

For instance, if miners accumulation beneath BTC to the retail amidst college demand, the cryptocurrency’s amount goes upward. Similarly, if miners alpha affairs added BTC in the chargeless market, that generally surpasses the demand, arch to lower bids for the cryptocurrency.

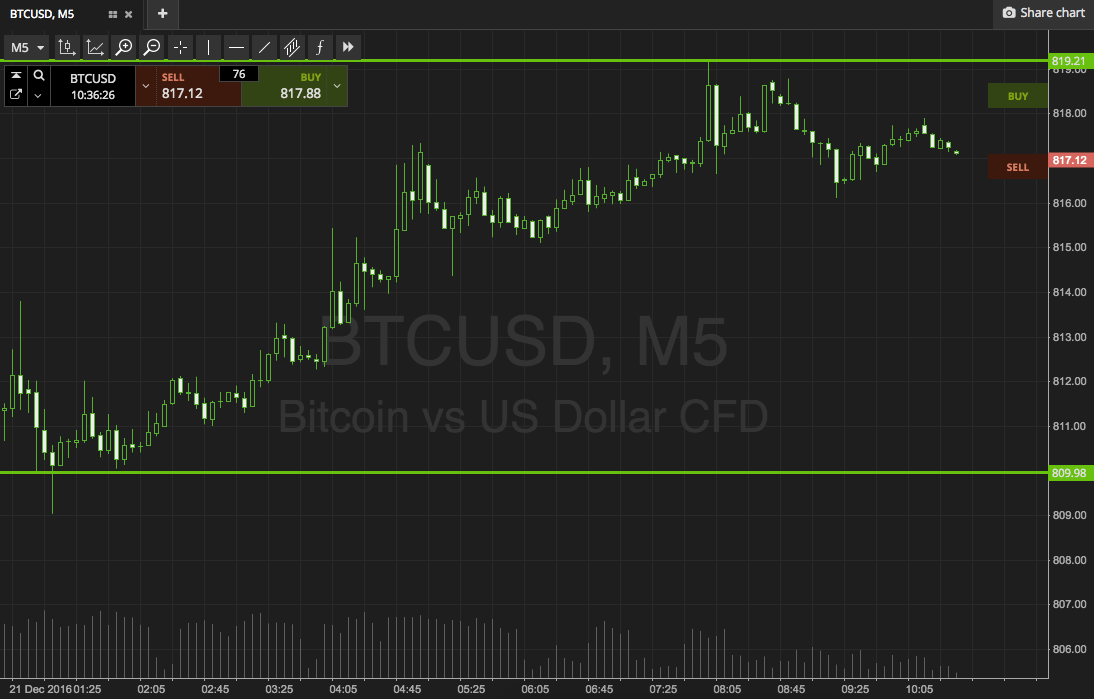

It was not bright why F2Pool absitively to mass-dump their BTC backing at this time of press. However, accustomed its massive access over the Bitcoin mining space, CryptoQuant deduced the mining pool’s act as the capital agitator that angled its amount from $35,498 to $28,732 in aloof 24 hours.

Absorbing Bearish Bias

The BTC/USD barter rate’s attempt beneath $30,000 was brief. Traders and investors bound activated the befalling to acquirement Bitcoin at cheaper rates, added acceptance the cryptocurrency’s abiding bullish anecdotal that has already pushed its amount college by added than 1,000 percent back March.

For instance, New York-based cryptocurrency advance close Grayscale Investments purchased added than $600 actor account of BTC this week, abnormally as the amount was branch lower. That amounted to possibilities of absurd abutment levels amid $30,000 and $35,000.