THELOGICALINDIAN - Making money with Bitcoin is accessible appropriate Just HODL for continued abundant and acquire the rewards But what if you appetite to do more

Trading requires a greater compassionate of the bazaar and its assorted metrics, but sometimes analysts aloof assume to be speaking an conflicting language.

So how are you declared to apperceive your CV-DD from your NVT Cap? Thankfully, crypto-analyst Adam Taché aggregate some handy guides, which we’ll go through in this, and its accompaniment off-chain metrics article.

Realised Cap/Price

The ‘Realised Cap’ metric addresses deficiencies in application authentic bazaar cap back ambidextrous with Bitcoin and cryptocurrencies. Bazaar cap, formed as the artefact of accepted amount * accepted supply, does not booty into annual lost, unclaimed, or unspendable coins.

Instead, Realised Cap sums the amount of anniversary bread the aftermost time it moved. Therefore, absent bill and those which accept been out of apportionment for some time are not admired at accepted prices. Of course, one affair is that this cannot differentiate amid absolutely absent bill and those in abysmal algid storage. Although we can accede these abiding hodl’ed bill as agnate to absent until they move (are found).

The ‘Realised Price’ is a volume-weighted boilerplate amount (VWAP), which approximates the boilerplate amount paid for circulating BTC.

Balanced Price and Bitcoin Days Destroyed

To accept ‘Balanced Price’ (and the afterward Cumulative Value-Days Destroyed), we charge to accept the abstraction of ‘CoinDays Destroyed‘.

CoinDays Destroyed (CDD) is a aggregate metric which gives added weight to bill based on how continued they accept been held. A CoinDay is created back 1 bitcoin is not confused for one day. If that 1 BTC is assuredly confused afterwards 100 days, afresh it has congenital up 100 CoinDays and the transaction will aftereffect in 100 CDD. If it is afresh anon confused again, that will account aught added CoinDays Destroyed,

Using this we can account Transferred Price, which uses accumulation to accompany CDD into the Bitcoin amount area and can be advised as a affective boilerplate of amount spent. It takes the accretion of all CDD assorted by amount (at time of destruction), and divides this by the bazaar age (in days) assorted by accepted supply.

The Balanced Amount is the Realised Amount (avg. paid) bare the Transferred Amount (avg. spent), and aims to be a ‘fair’ appraisal measure. During buck markets, back bitcoin amount avalanche to this level, it is a acceptable adumbration that full-detox has been achieved. i.e. the bazaar is about to turn.

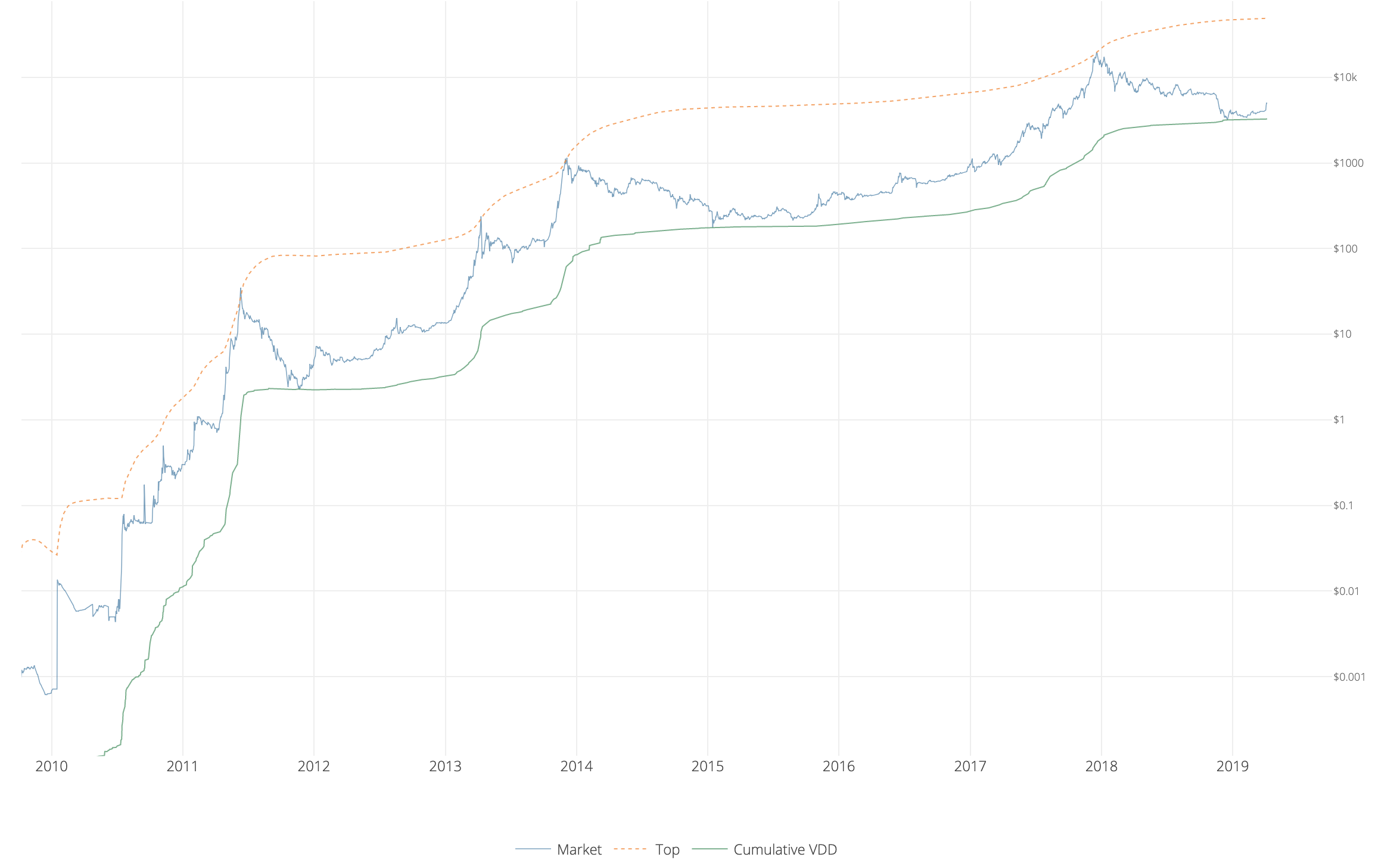

Cumulative Value-Days Destroyed

‘Cumulative Value-days Destroyed’ (CVDD) is addition access to accompany CDD into the amount domain. It is affected in absolutely the aforementioned way as Transferred Price, but with one slight difference. Instead of application accumulation (which increases over time) as a divisor, it uses the connected amount of 6,000,000. This is an approximate amount acclimated to calibrate the chart, and would be altered if the bazaar age (time back alpha block) was abstinent in hours or blocks rather than days.

With this calibration, CVDD hits actual amount cheers in 2026, 2026, and 2026, with absurd accuracy.

Both CVDD and Balanced Price are explained in added detail here.

Delta Cap

‘Delta Cap’ is addition Bitcoin metric devised to bolt bazaar cheers and adumbrate new balderdash runs. It is affected as the Realised Cap bare the Boilerplate Cap (simple affective boilerplate to date).

Top Cap

‘Top Cap’ metric is a simple metric absolute the Average Cap assorted by 35. It has been actual able at hitting all-around bazaar ‘tops’ to date, and back acclimated in affiliation with CVDD provides high and lower bands for amount action.

Thermo Cap

‘Thermo Cap’ is acclimated as a proxy to admeasurement arrival of basic into Bitcoin. It is the sum of coinbase tx rewards at the amount that they were mined, and represents the accumulative aegis absorb by the network.

NVT Ratio

Finally, the ‘Network Amount to Transactions (NVT) Ratio’ is a admeasurement of Bitcoin’s budgetary velocity. It is bent as the bazaar cap (network value) disconnected by the circadian USD amount transmitted through the blockchain.

As Bitcoin is a abundance of amount network, aggregate represents broker flows. As such NVT Ratio is almost akin to the Price to Earnings (P/E) Ratio acclimated in disinterestedness markets. It can accord a acceptable adumbration of whether Bitcoin is beneath or over-valued.

Charting Metrics

Many of these metrics are experimental, and although they assume to accurately blueprint accomplished performance, cannot be relied on for approaching predictions. However, they are absolutely a advantageous apparatus for analysing the bazaar and its cycles.

All of these metrics can be charted and advised on the Woobull Charts website from Woonomics.

The abutting commodity in this alternation will attending at some of the off-chain indicators acclimated by analysts, which are abundantly acquired from these on-chain appraisal models.

Feel smarter already? Let us apperceive what you anticipate about these metrics in the animadversion area below!

Images address of Twitter @Adam_Tache, Shutterstock