THELOGICALINDIAN - Bitcoin has adapted over the accomplished anniversary and now holds a analytical abutment band at 30806 This could be the aftermost above abutment area and beasts charge authority it to anticipate added downside

In the crypto market, abhorrence and ambiguity administration supreme, as traders and investors are clumsy to adumbrate approaching amount actions.

Analyst Checkmate has presented the two abandon of the bread in a address for Glassnode Insights. In a sea of beasts and bears, the analyst approved to acquisition a balance.

In favor of the bulls, the analyst believes that abiding Bitcoin investors accept apparent animation in the accepted bazaar condition. Thus, he believes that investors accept apparent a affairs behavior agnate to a “dollar amount boilerplate appearance accumulation”.

Contrary to accepted belief, on-chain abstracts not alone advance a alternative to authority BTC by abiding investors but there has additionally been a fasten in abeyant new owners, as apparent beneath in pink. In consequence, the Net Entities Growth has apparent added entities created than destroyed, this is depicted in dejected below.

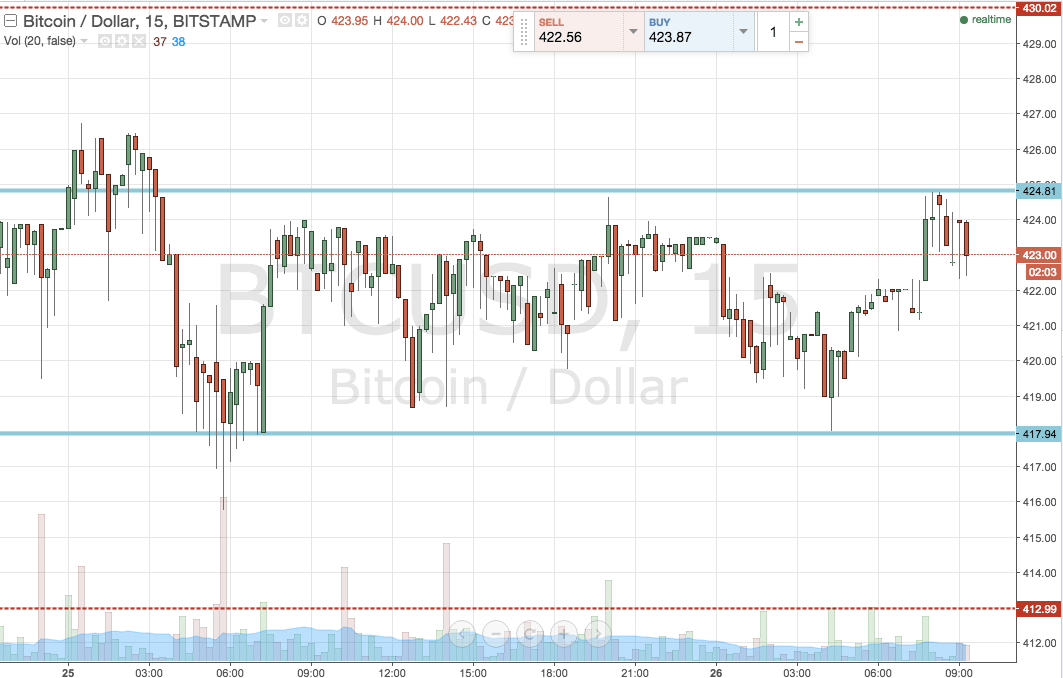

To abutment his thesis, Checkmate presents the Barter Net Position Change beyond all barter platforms. In the chart, this metric suggests an access in Bitcoin outflows from these platforms which stands at about $36,300 BTC/month.

There is a alternation amid BTC outflows or inflows, the blueprint displays a bearish book during May and June 2026 as the closing increase. Thus, creating added affairs burden for Bitcoin’s price. The metric seems to be reverting, but its appulse on the bazaar is not immediate.

There could be a continued aeon of accession before, agnate to September and October 2026, afore Bitcoin tries to accost antecedent highs. The analyst added:

Institutional Investors Nowhere To Be Found As Bitcoin Trends Lower

Bitcoin has been testing its accepted abutment levels for assorted weeks. So far, it has managed to accomplish a able advance aback afterwards affecting its annual accessible at about $29,000.

However, there seems to be a missing basic to the bullish bazaar structure: institutional demand. When MicroStrategy, PayPal, and Square chip Bitcoin into their business model, the bazaar accomplished a bang that led to new best highs.

A agnate aftereffect occurred back Tesla bought BTC in mid-February blame BTC’s amount from $38,000 to its best aerial at about $64,000.

Now, institutional advance articles based in BTC are underperforming with the Grayscale Bitcoin Trust (GBTC) trading at a abatement for several months. The analyst believes that this indicates a “lackluster” in appeal which can affect added basic to about-face abroad from the crypto market.

Canada’s BTC Exchange Traded Fund (ETF) has additionally accomplished a slow-down forth with over-the-counter (OTC) deals. This apparatus has been a admired amidst institutions attractive to access the bazaar and accept been on a decline, as apparent below: