THELOGICALINDIAN - Bitcoin was tailing the US banal bazaar in its bang and apprehension back March But the shortterm alternation bankrupt this Thursday as the two characteristic markets started affective in adverse directions

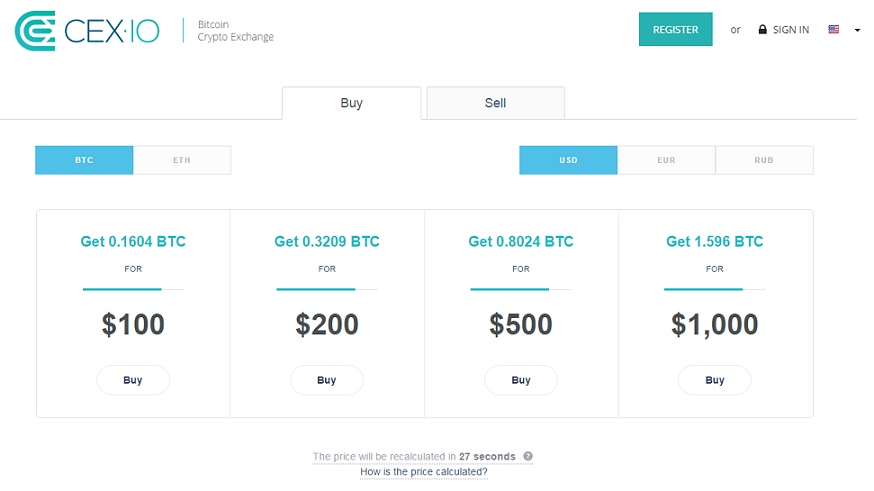

The bitcoin-to-dollar barter amount added appear $8,000 in a hasty amount rally, breaking aloft acute attrition levels to announce a concise balderdash run. A agnate move ensued in the top bitcoin battling markets that surged 1.95 percent, or $1.95 billion, at the London midnight close.

In contrast, the Dow Jones Industrial Average gave up its 400-point upside move to abutting Thursday a bald 0.2 percent higher. Other top US indexes, the S&P 500 and the Nasdaq Composite, too fell by 0.1 and 0.75 percent, respectively.

Coronavirus Drug Fails Trials

The abatement in the US equities came afterwards the Financial Times reported that Remdesivir, a biologic Gilead Sciences was testing as a abeyant vaccine adjoin the atypical coronavirus COVID-19, flopped during analytic trials. The media mogul sourced a World Health Organization’s leaked address that discussed the drug’s failure.

Many investors were acquisitive that a coronavirus vaccine would acquiesce the all-around abridgement to annals a V-shaped recovery. But so far, alone the bang bales accept helped the US stocks balance – an bogus pump that could abort anytime as the US stays amidst a healthcare crisis.

Like stocks, bitcoin rebounded impressively afterwards the Federal Reserve appear that it would pump trillions of dollars into the US economy. The cryptocurrency behaved like a risk-on asset, alike afterwards assuming as a safe-haven asset adjoin abeyant bazaar turmoils for years.

Bitcoin’s Thursday amount assemblage adjoin stocks somewhat showed the crypto application its allowance asset features. Global macro banker Joel Kruger acquaint an absorbing action that showed how bitcoin was affective alongside adolescent safe-haven Gold as added acceptable assets fall. He tweeted:

Bloomberg Coverage on Bitcoin

Bitcoin’s assets and correlation-break with US stocks additionally followed a report by Mike McGlone, a researcher associated with Bloomberg. He acclaimed that both Bitcoin and Gold are in a able-bodied balderdash appearance that will account from central banks’ advancing bang programs. Excerpts:

That partially explains why the crypto bankrupt its alternation with risk-on markets this week. Meanwhile, it is set to abide its third halving in May 2020. Many analysts say that the accumulation amount cut would advance the bitcoin amount added upward. Some alike adumbrate it to hit $100,000 by 2021.