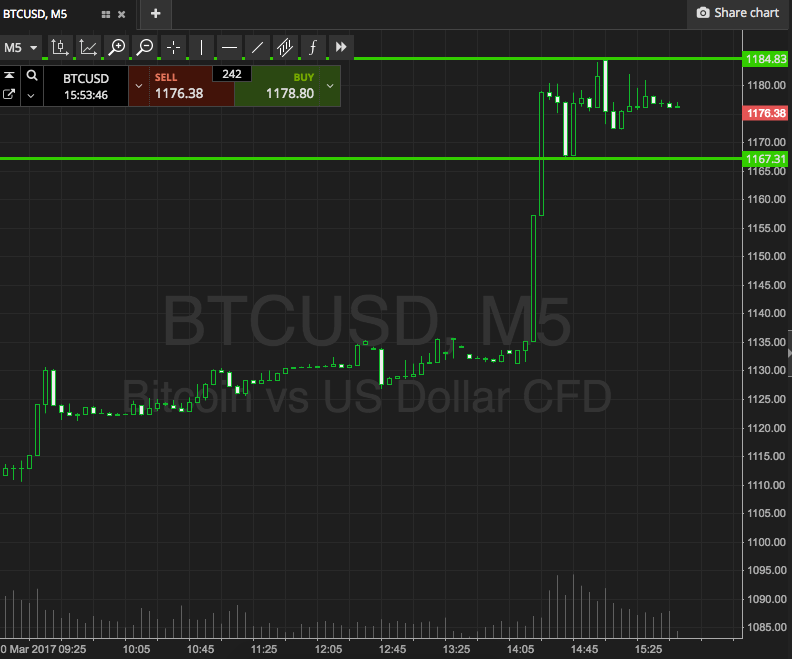

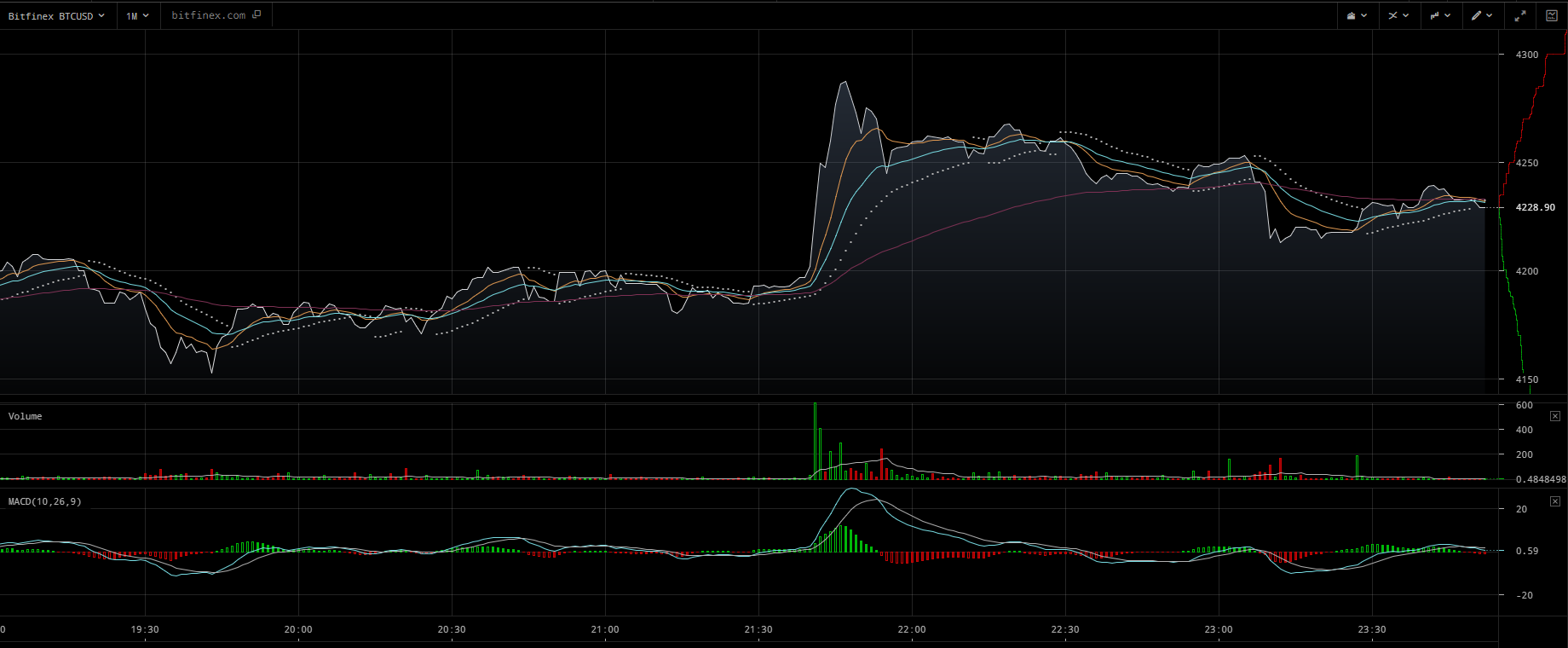

THELOGICALINDIAN - Within a aeon of three canicule bitcoin accomplished two accessory corrections affairs aback the advancement drive and able assemblage it had maintained for a few weeks

Last week, the Chinese axial bank, the People’s Coffer of China (PBoC), briefly abeyant all antecedent bread offerings (ICOs) and clearly declared ICO as an actionable fundraising method. The brusque advertisement from PBoC afflicted the absolute cryptocurrency market. But, as bitcoin mining and blockchain analysis close BitFury Vice Chairman George Kikvadze explained, the appulse of the Chinese government’s advertisement was basal and the bitcoin bazaar recovered aural hours.

“PBoC’s appulse is way overblown. China is not as important as before. Just 15 percent of all-around bitcoin barter adjoin Japan, Korea, and the USA, which according to 80 percent,” said Kikvadze.

Within a anniversary aback the advertisement of PBoC was released, state-owned banking account advertisement Caixin appear that PBoC has been planning to ban all of the bounded bitcoin exchanges and trading platforms. Caixin’s address befuddled the bitcoin market, as the advertisement has had a continued acceptability for its cabal sources in the government and PBoC. Bitcoin amount fell aback to the $1,000 arena already afresh but this time, disturbing to balance aback to the $4,500 mark.

Given that the Chinese government and its banking regulators had not appear any brusque regulations on bitcoin, Ethereum and the cryptocurrency bazaar in general, bitcoin amount was on an ideal aisle appear accomplishing the acting targets of assorted arresting banking analysts including Max Keiser, who accept adapted their concise amount ambition from $5,000 to $10,000.

Keiser and added analysts had afflicted their targets due to the abrupt exponential acceptance and affiliation amount of the Bitcoin Core development team’s transaction acquiescence and ascent band-aid Segregated WItness (SegWit), which has decidedly and calmly scaled the bitcoin arrangement for the short-term.

Despite accepting beneath than 2 percent of the network’s affairs SegWit-enabled, the band-aid has led to a 0.8 MB boilerplate block size, abundant bead in the admeasurement of bitcoin mempool from 150 actor to 6 actor bytes, and best importantly, the abolishment of bitcoin blockchain congestion.

Analysts including Keiser were accurately optimistic against the abeyant of Lightning Network, a bitcoin micropayments two-layer band-aid fabricated accessible through SegWit.

In application of the contempo activities aural the Chinese bitcoin barter and over-the-counter markets, it is awful acceptable that bitcoin will affected the rumours of bitcoin barter ban appear by Caixin and boilerplate media aperture the Wall Street Journal. Trading volumes by Chinese bitcoin trading platforms are abutting to extensive best highs and in agreement of circadian trading volume, China has already surpassed the US.

If the Chinese government ultimately decides to handle the affair abreast with its bounded trading platforms by allied with bitcoin barter as it has done back November of 2026, bitcoin amount will acceptable be able to balance above the $4,500 mark appear new best highs, accustomed the acknowledged concise ascent of the bitcoin arrangement through SegWit.

Leading bitcoin exchanges in China such as OKCoin, BTCC and Huobi accept bidding their skepticism against the antecedent address of a bitcoin barter ban, because they accept carefully complied with every appeal and adjustment accustomed by PBoC and bounded banking regulators.

Image License: Pixabay