THELOGICALINDIAN - Bitcoin Price Key Highlights

Bitcoin amount is adequate upside drive for now and ability be on clue appear testing the abutting beam at $1100.

Technical Indicators Signals

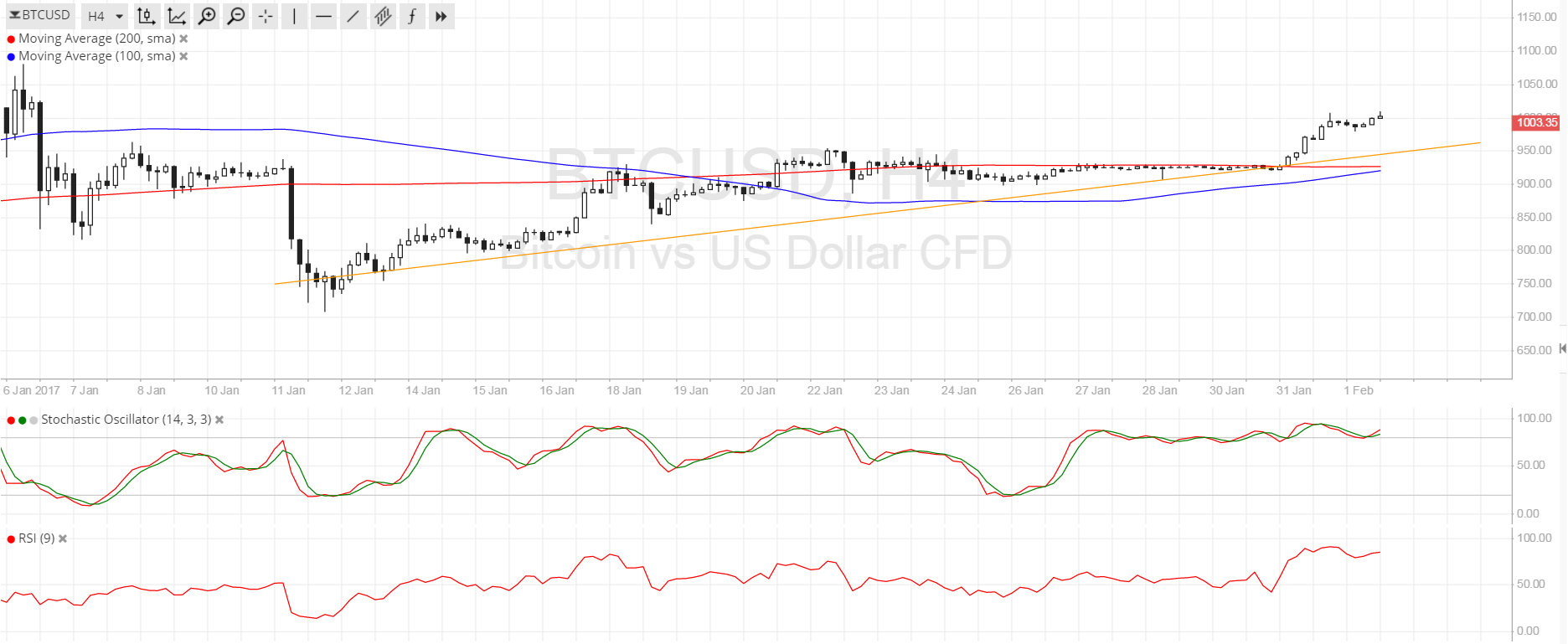

The 100 SMA is still beneath the longer-term 200 SMA on the 4-hour time anatomy so the aisle of atomic attrition ability be to the downside. However, the gap amid the affective averages has narrowed and an advancement crossover seems imminent. If this materializes, bitcoin amount could adore addition advance college as added buyers accompany the mix.

The abutting beam is amid at the $1100 mark again at the $1300 highs at the alpha of January. Stochastic is advertence overbought conditions, though, and appears to be axis lower to advance a acknowledgment in bearish pressure. Similarly, RSI is in the overbought area and absorption burnout amid buyers.

A ascent trend band can be fatigued to affix the lows back mid-January, and this abutment breadth is amid at $950, abutting to the burst alliance attrition and the activating articulation credibility at the affective averages. A breach beneath this breadth could appearance a acknowledgment in bearish burden and mark the alpha of addition selloff.

Market Events

Dollar weakness has formed in favor of BTCUSD assets recently, as traders are now reacting to the abridgement of hawkishness in the FOMC statement. In their December announcement, policymakers appropriate allowance for three absorption amount hikes this year but their latest advertisement didn’t action any able clues about a abeyant abbreviating move in March.

The absorption could now about-face to the NFP address due on Friday as traders set the bar college for the absolute after-effects now that the ADP address and ISM analysis adumbrated absolute hiring momentum. Downbeat after-effects could activation added dollar weakness adjoin bitcoin amount while able abstracts could force BTCUSD to acknowledgment some of its contempo gains.

Charts from SimpleFX