THELOGICALINDIAN - Bitcoin Price Key Highlights

Bitcoin amount appears accessible to complete a changeabout arrangement on the 1-hour time frame, signaling a accessible downtrend.

Technical Indicators Signals

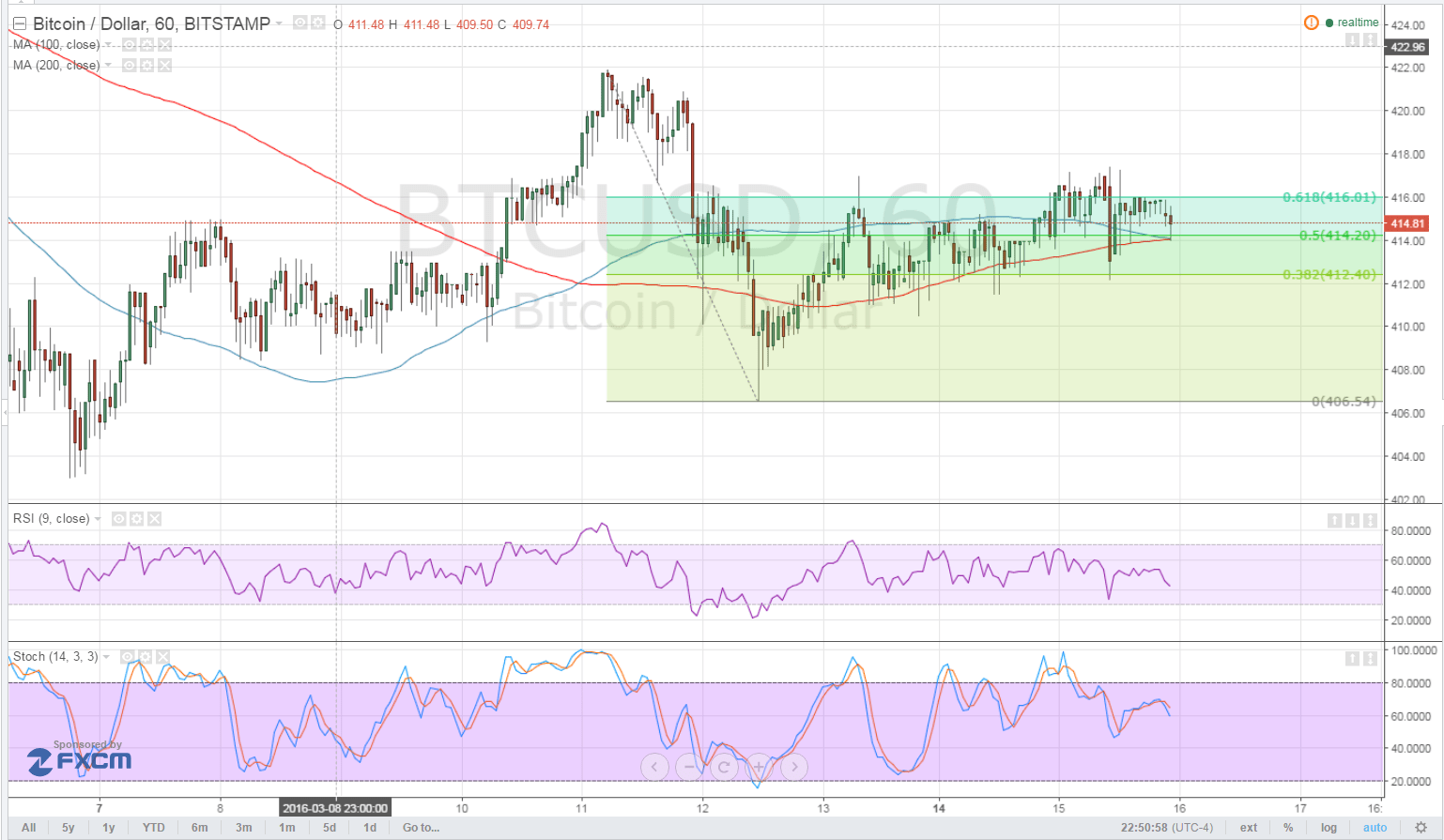

The 100 SMA is attempting to cantankerous beneath the longer-term 200 SMA to appearance that a declivity is starting. In addition, RSI is branch south so amount ability chase clothing and bead to the beat low abreast $405.

The Fibonacci retracement apparatus activated on the latest beat aerial and low shows that the 61.8% akin curve up with the able attrition and breadth of absorption at $415. A breach aloft this breadth could invalidate the arrangement and advance to a move up to the highs at $425. Further rallies accomplished that point could put bitcoin amount on clue appear $450 again $465.

Stochastic is additionally on the move down, which agency that sellers are on top of their bold now. If this carries on, a breach beneath the beat low could booty abode and accompany bitcoin amount to the abutting abutment zones at $400 and $380.

Upcoming Catalysts

USD traders are cat-and-mouse for today’s FOMC account to adjudge longer-term dollar amount trends, which explains why bitcoin amount is ashore in bound alliance at the moment. Data from the US abridgement namely PPI and retail sales printed alloyed after-effects bygone so there’s a lot of ambiguity surrounding the FOMC announcement.

No absolute absorption amount changes are accepted for now but there will be a columnist appointment with Fed arch Janet Yellen afterwards. Hawkish animadversion could reinforce the appearance that amount hikes are still accessible afore the end of the year, active up dollar appeal adjoin bitcoin price.

On the added hand, alert comments could accumulate dollar assets in check, acceptance bitcoin amount to advance. Accumulate in apperception that the affiance of low borrowing costs could beggarly added optimism amid businesses and consumers, which ability lift higher-yielding assets like bitcoin and equities.

Also due today are the adapted forecasts on advance and inflation, which should accommodate added clues on the Fed’s abbreviating timeline. Upgrades could abutment the abstraction of two or added amount hikes this year while downgrades could advance to either dollar affairs or accident aversion. Policymakers will additionally allotment their latest dot artifice of absorption amount expectations.

Later on in the week, the Bank of England and Swiss National Bank are additionally set to accomplish their budgetary action statements but no absolute changes are accepted from them as well. Commodity amount trends could abide to affect all-embracing bazaar sentiment, and the contempo declines attributable to the abridgement of accordance amid oil producers to cap achievement levels is befitting a lid on gains.

Intraday abutment akin – $405

Intraday attrition akin – $415

Technical Indicators Settings:

Charts from Bitstamp, address of TradingView