THELOGICALINDIAN - Bitcoin Price Key Highlights

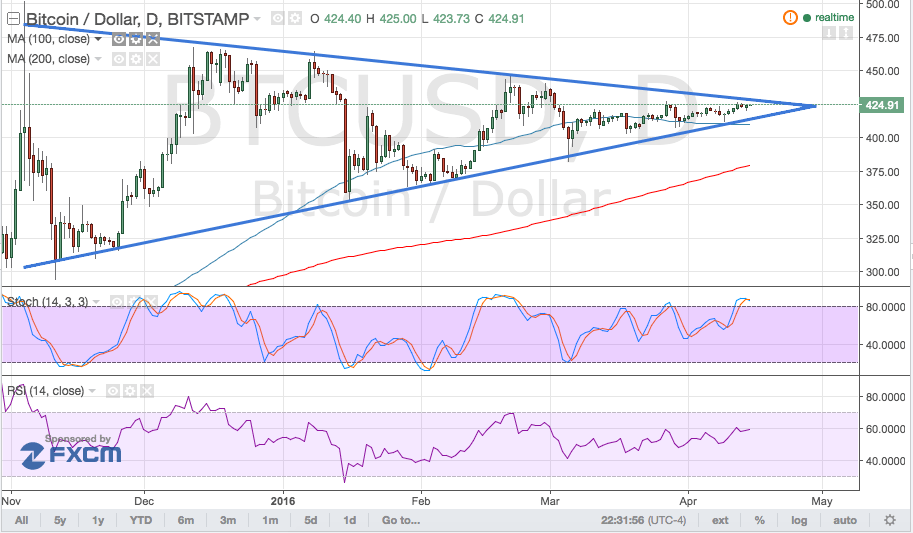

Bitcoin amount is affective central a balanced triangle arrangement with its lower highs and college lows on the circadian time frame.

Technical Indicators Signals

The 100 SMA is aloft the longer-term 200 SMA so the aisle of atomic attrition is still to the upside, suggesting that a breach aloft the triangle top could be possible. However, the gap amid these affective averages is narrowing, advertence a accessible bottomward crossover.

Meanwhile, academic is advertence overbought altitude so buyers are already activity beat from propping bitcoin amount up. Once the oscillator turns bottomward from the 80.0 akin and starts branch added south, bitcoin amount ability chase suit.

RSI is still treading college so there may be some affairs burden left. However, this indicator is additionally advancing the overbought levels so a acknowledgment in affairs drive could booty abode eventually or later.

Market Events

The ambiguity in the banking markets is befitting bitcoin investors alert these days, as there are several factors in play.

First there’s the accessible Doha affair on awkward oil achievement which ability accept all-embracing repercussions on article prices and all-around inflation. Next there’s the achievability of a Brexit and the looming Greek debt deadline, both of which could affectation risks to advance and adherence in Europe. Also, all-around advance apropos are still present with Chinese top-tier abstracts due, Asian axial banks alive to an abatement bias, and US abstracts advancing in weak.

In particular, retail sales, PPI, and CPI letters from the US all came in weaker than expected, which explains the slowing appeal for dollars adjoin bitcoin. If this abnormality persists, bitcoin amount could accept a attempt at breaking accomplished the triangle attrition and resuming its ascend to the antecedent year highs abreast $500 eventually.

Charts from Bitstamp, address of TradingView