THELOGICALINDIAN - Bitcoin Price Key Highlights

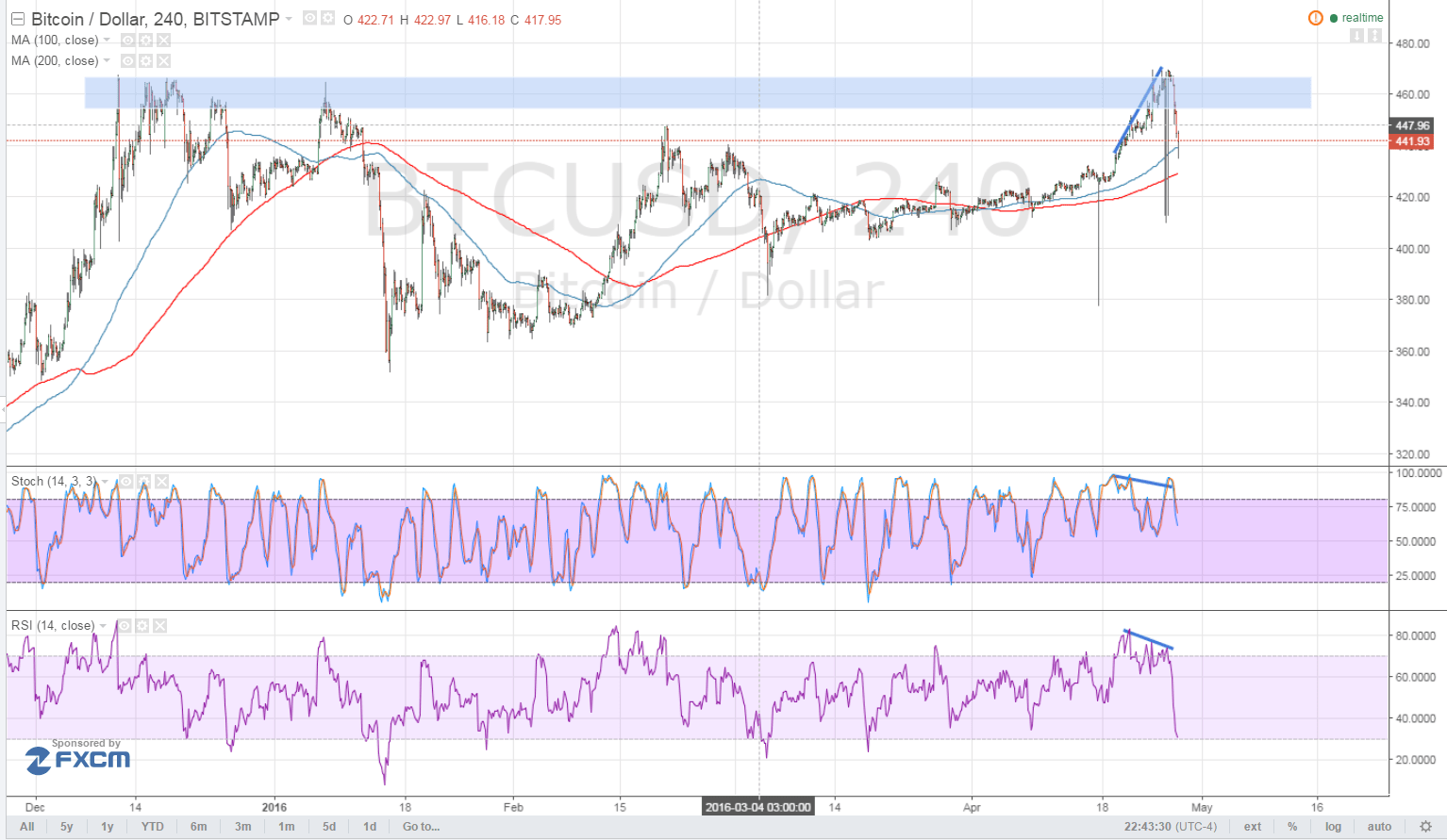

Bitcoin amount angry aloft hitting the attrition at $460 as hinted by the bearish divergence.

Technical Indicators Signals

The oscillators fell from the overbought regions to announce a acknowledgment in bearish momentum. RSI is advancing the oversold breadth so profit-taking ability appear but academic has a continued way to go, which suggests that sellers could be in ascendancy for a continued while.

However, the 100 SMA is still aloft the longer-term 200 SMA so a animation is still possible. Bitcoin amount is still on top of the trend band fatigued to affix the lows back backward January this year so the uptrend could resume from here.

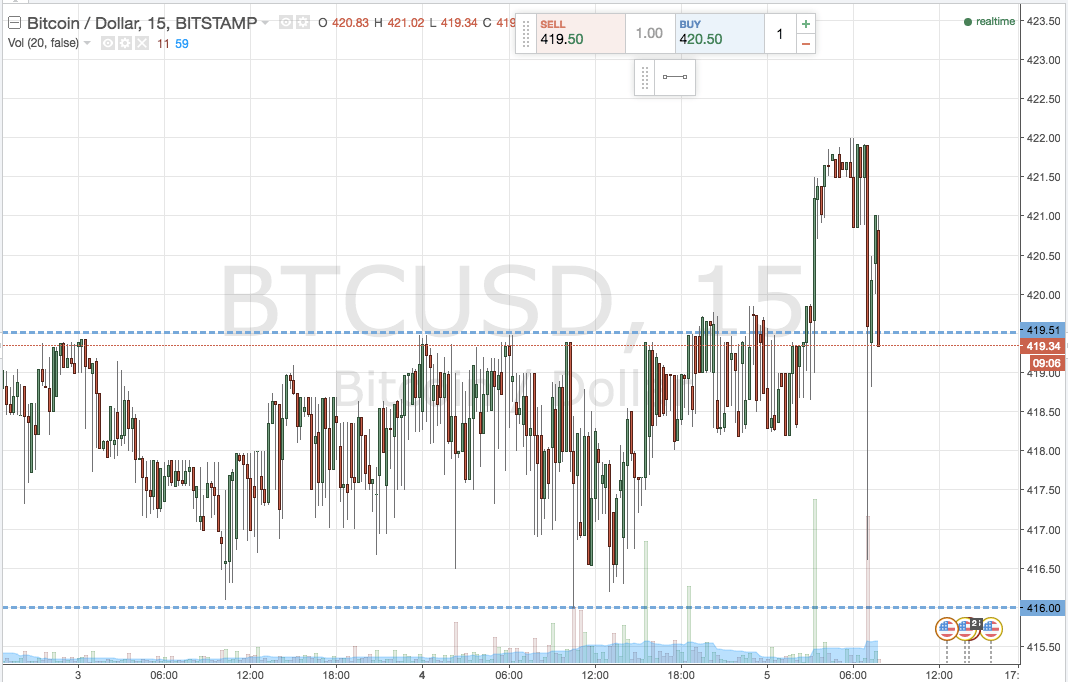

Volatility was additionally in comedy during the FOMC account as predicted, demography amount bottomward to the $420 breadth of interest, which captivated as able support. If bears are clumsy to advance for a able breach beneath this area, beasts could eventually get aback in the bold and advance for addition analysis of the $460 resistance. On the added hand, abiding affairs burden could advance to a bead to the $380-400 levels.

Market Events

The FOMC absitively to accumulate absorption ante banausic but refrained from accouterment any clues as to whether they’re absorbed to backpack in June or not. Their official account no best independent the byword on all-around banking risks but policymakers confused to a beneath upbeat accent back discussing bread-and-butter advance and inflation.

With that, bazaar watchers ability be afraid to accumulation on continued dollar positions in apprehension of a June absorption amount hike. If US abstracts continues to disappoint, traders could abide unwinding their dollar trades and acquiesce bitcoin amount to resume its climb.

The US avant-garde GDP account is up for absolution today and a 0.7% advance amount is eyed, bisected of the antecedent 1.4% expansion.

Charts from Bitstamp, address of TradingView