THELOGICALINDIAN - Bitcoin Price Key Highlights

Bitcoin amount has apparent able upside drive over the accomplished few weeks and ability be eyeing a analysis of these abutting ceilings.

Technical Indicators Signals

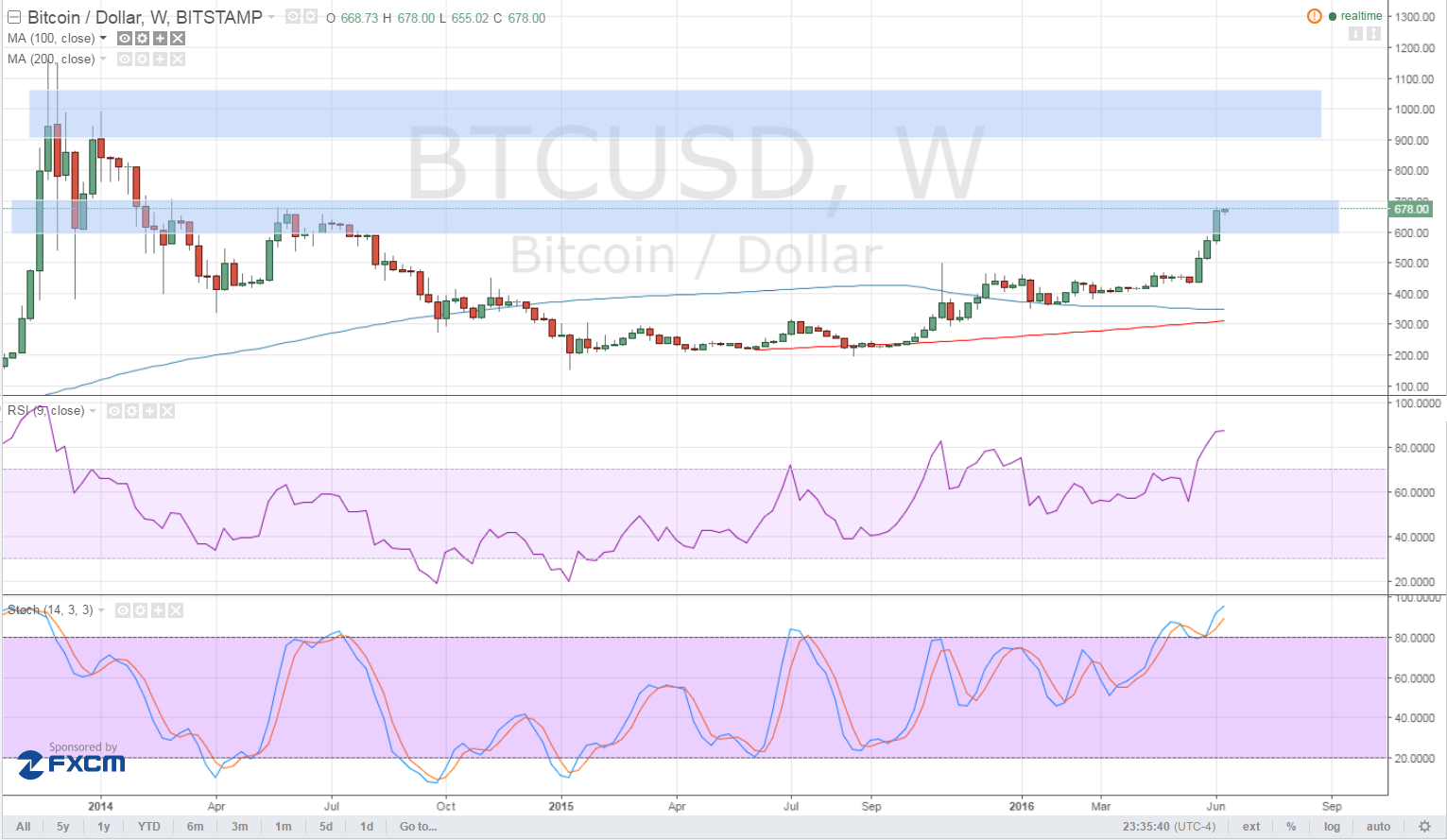

The 100 SMA is aloft the 200 SMA for now so the aisle of atomic attrition is still to the upside. However, the gap amid the affective averages is absorption so a bottomward crossover ability be possible, hinting at a abeyant acknowledgment in bearish pressure.

In that case, bitcoin amount could retreat from the accepted breadth of absorption for a quick pullback to the adjacent abutment at $500. RSI is additionally advertence overbought conditions, which agency that buyers are beat and ability let sellers booty over from here.

Similarly, academic is in the overbought breadth but hasn’t beyond lower yet. This implies that while the rallies may be overextended, beasts aren’t absolutely accessible to accord in aloof yet and ability accept abundant activity to booty bitcoin amount up to the abutting beam at $900-$1,000.

Market Events

Several uncertainties in the banking markets accept fatigued added and added traders to bitcoin aftermost week. For one, this may accept been a aftereffect of bazaar watchers affective money out of the US dollar in apprehension of beat animadversion from the FOMC account this week. Keep in apperception that the latest US jobs address was a huge disappointment so Fed admiral could punch bottomward their advancing bias.

In addition, beat abstracts appear from China over the weekend drew added investors appear bitcoin, agnate to the case on the aftermost anniversary of May. Industrial assembly was banausic at 6.0% while anchored asset advance angled from 10.5% to 9.6%. Retail sales additionally lagged from 10.1% to 10.0%.

To top it all off, the anxiety advanced of the EU election are auspicious traders to dump their backing of authorization currencies and seek another investments for now, thereby propping bitcoin amount up.

Charts from TradingView