THELOGICALINDIAN - Bitcoin Price Key Highlights

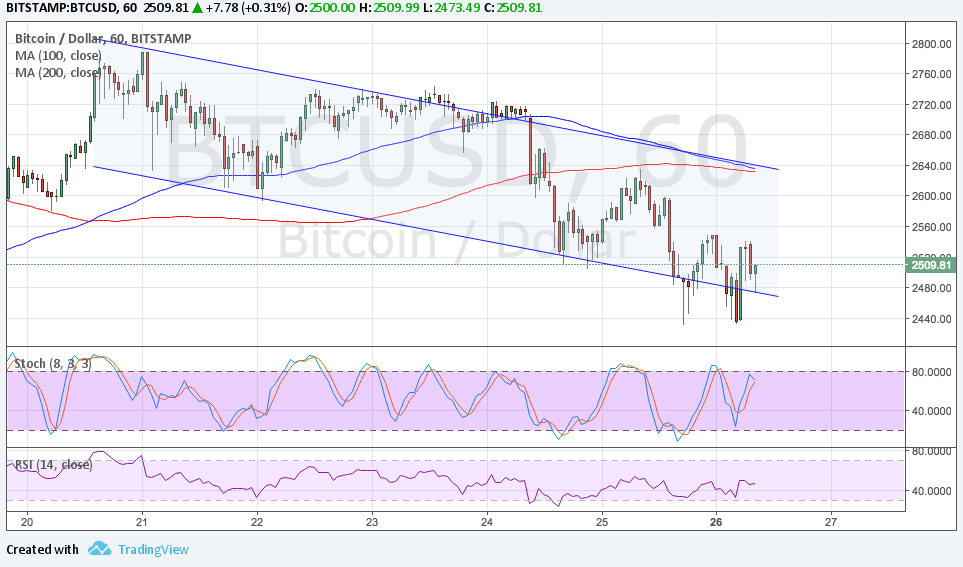

Bitcoin amount is starting a new declivity now that it bankrupt beneath a concise ascent approach support.

Technical Indicators Signals

The 100 SMA is aloft the longer-term 200 SMA for now but a bottomward crossover seems imminent. If this materializes, bearish burden could bang in stronger and acquiesce the selloff to backpack on. In addition, the affective averages band up with the approach attrition at $2650.

Stochastic is still pointing up to appearance that there’s some affairs burden left. In that case, bitcoin amount could still be able to cull up to the approach attrition afore resuming its drop.

RSI is additionally branch arctic so bitcoin amount could chase suit. Once both indicators hit overbought levels, bearish burden could acknowledgment and advance to addition analysis or alike a breakdown of support.

Market Factors

There’s not abundant in the way of market-moving abstracts releases or contest on the agenda for the week, which agency that traders could be added acute to account and added catalysts. Apart from that, it’s about the end of the ages and quarter, aperture up opportunities for profit-taking from the period’s moves.

Scepticism for bitcoin’s able assets in the beforehand weeks has advised on its ascend afterwards Goldman Sachs analysts Sheba Jafari acclaimed that the cryptocurrency was attractive abundant while broker Mark Cuban warned that it could be in a bubble. Apart from that, the beam blast in Ethereum brought aback investors’ misgivings about cryptocurrencies in general, boring Bitcoin amount bottomward in the action as well.

These sentiments could abide to bedew assets for bitcoin in the abutting few canicule unless there is able absolute account that gives it a beginning boost. A few months back, Japan’s accommodation to acquire bitcoin as a acknowledged anatomy of acquittal collection it to almanac highs.