THELOGICALINDIAN - Bitcoin Price Key Highlights

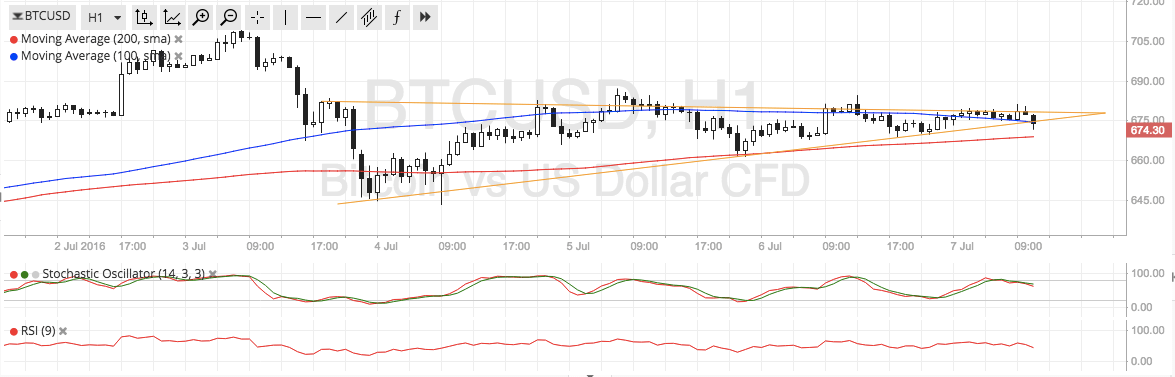

Bitcoin amount could be due for added losses if it break beneath the abutment of this balanced triangle pattern.

Technical Indicators Signals

The 100 SMA is aloft the 200 SMA for now so the aisle of atomic attrition may be to the upside. However, the gap amid the affective averages is absorption so a bottomward crossover ability booty place, advertence that sellers are demography ascendancy of bitcoin amount action.

In that case, amount could bead to the abutting breadth of absorption at $650-660. Stochastic is axis lower from the overbought arena to appearance a accretion in affairs drive while RSI is additionally branch south as well, with bitcoin amount acceptable to chase suit.

For now, the 200 SMA could still authority as near-term support, but that would articulation on how the accessible bazaar catalysts about-face out. Uncertainty in the European arena afterward the Brexit seems to accept subsided, although this alliance could additionally be apocalyptic that a able blemish is brewing.

Market Events

Remaining above accident risks for the anniversary accommodate the NFP report, which ability crop added assets for the dollar beyond the lath if the absolute account comes in stronger than expected. Analysts are assured to see a 174K access in employment, abundant stronger than the antecedent month’s 38K rise, although revisions to beforehand letters are additionally likely.

Stronger than accepted jobs abstracts could beggarly added assets for the dollar as it would animate amount backpack expectations for the year. The FOMC account appear that policymakers already had a aloof bent arch up to the EU election mostly because of the black May NFP figures.

Still, all-around bread-and-butter risks are actual abundant present and abide to prop up appeal for another assets like bitcoin and added cryptocurrencies. China has additionally accurate to be a abeyant risk, which could accumulate investors absorption to bitcoin.

Charts from SimpleFX