THELOGICALINDIAN - Bitcoin Price Key Highlights

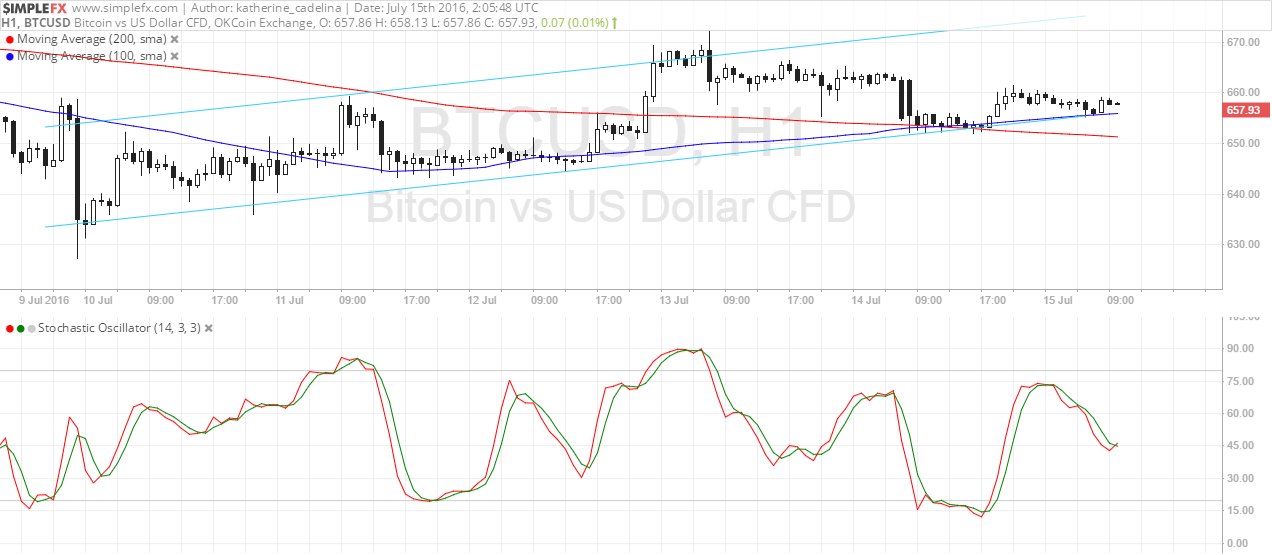

Bitcoin amount is testing the ascendance approach on the 1-hour time frame, still chief whether to go for a assiduity or a reversal.

Technical Indicators Signals

The 100 SMA is aloft the 200 SMA, which agency that the the aisle of atomic attrition is to the upside. In addition, the 100 SMA curve up with the approach support, abacus to its backbone as a floor. A beyond bead could still acquisition abutment at the 200 SMA, which is about the breadth of absorption at $650.

Stochastic is on its way down, which agency that there’s still some affairs burden left. If bearish drive is able enough, bitcoin amount ability breach beneath the approach abutment and $650 area, which would again affirm a reversal.

However, if the oscillator alcove the oversold area and turns college afore a breakdown happens, buyers could achieve ascendancy and advance bitcoin amount aback to the approach attrition about $680 or higher.

Market Events

The Bank of England’s accommodation to accumulate absorption ante banausic for now kept adventurousness in play, abrogation traders to booty advantage of amount activity in equities and authorization currencies. Still, there are affluence of uncertainties actual back the MPC has signaled its ambition to accede added abatement in August.

Also, China is set to book its top-tier letters today and ability appearance a arrest in performance. If so, investors in the acreage ability seek college allotment in bitcoin instead of abrogation their funds in bounded banal markets and in the depreciating yuan.

The world’s additional better abridgement acquaint 6.7% advance for Q2, hardly college than the estimated 6.6% figure. Industrial assembly broadcast from 6.0% to 6.2% instead of falling to 5.9% while retail sales rose from 10.0% to 10.6%. Fixed asset advance is at 9.0% year-to-date, lower than the projected 9.4% amount and the antecedent 9.6% increase.

Charts from SimpleFX