THELOGICALINDIAN - Bitcoin Price Key Highlights

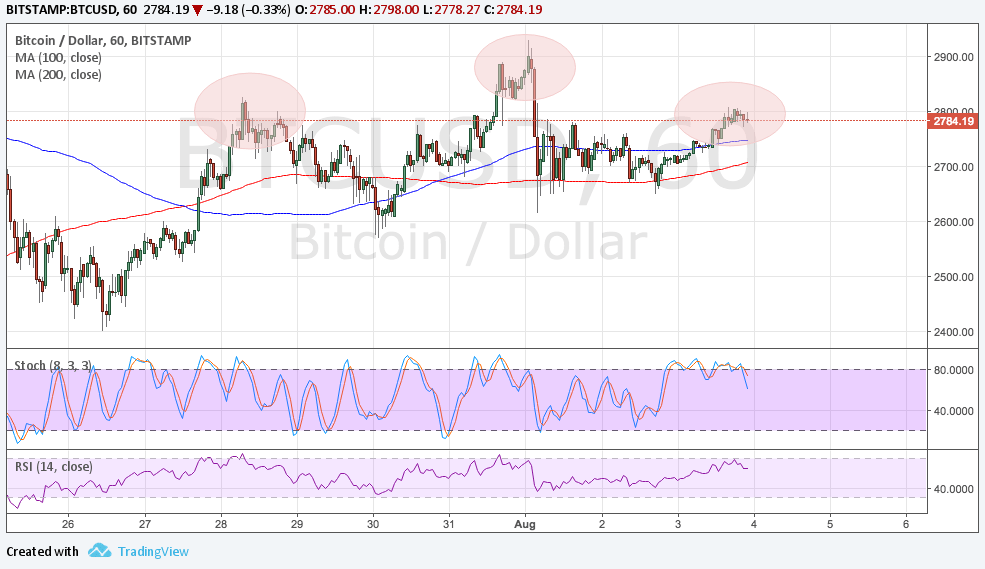

Bitcoin amount is on clue appear basic a arch and amateur pattern, which is a archetypal declivity signal.

Technical Indicators Signals

The 100 SMA is still aloft the longer-term 200 SMA so the aisle of atomic attrition is to the upside. However, the affective averages accept additionally been aquiver so there’s a change that addition bottomward crossover could appear and amount could abatement to the neckline.

This neckline abutment curve up with the 200 SMA activating articulation point, abacus to its backbone as a floor. The blueprint arrangement spans $2700 to $2900 so the consistent selloff could be of the aforementioned size, demography bitcoin amount to $2500 next.

Stochastic has hit overbought levels and is axis lower to announce a acknowledgment in bearish momentum. RSI is additionally accessible to move south so bitcoin amount ability chase suit.

Market Factors

Bitcoin amount bootless to defended abundant bullish activity to breach accomplished the best highs as the cryptocurrency was breach into two altered versions beforehand this month. The abridgement of incompatibilities so far has kept bitcoin amount afloat but it looks like bazaar watchers are not agog on advocacy it either.

For now, the absorption accouterment aback to the dollar as the US abridgement will absolution its July NFP report. This could set the accent for approaching Fed activity action as beat readings could adjournment the abutting amount backpack to December or abutting year while an upside abruptness could accumulate September abbreviating expectations strong.

Leading indicators accept already set the bar low as the ISM surveys and ADP amount signaled a arrest in hiring. Analysts are assured to see a 188K acceleration in application for the month, slower than the antecedent figure, but revisions to beforehand letters are additionally expected.