THELOGICALINDIAN - Bitcoin Price Key Highlights

Bitcoin amount ability be in for a pullback befalling to these articulation credibility afore resuming its climb.

Technical Indicators Signals

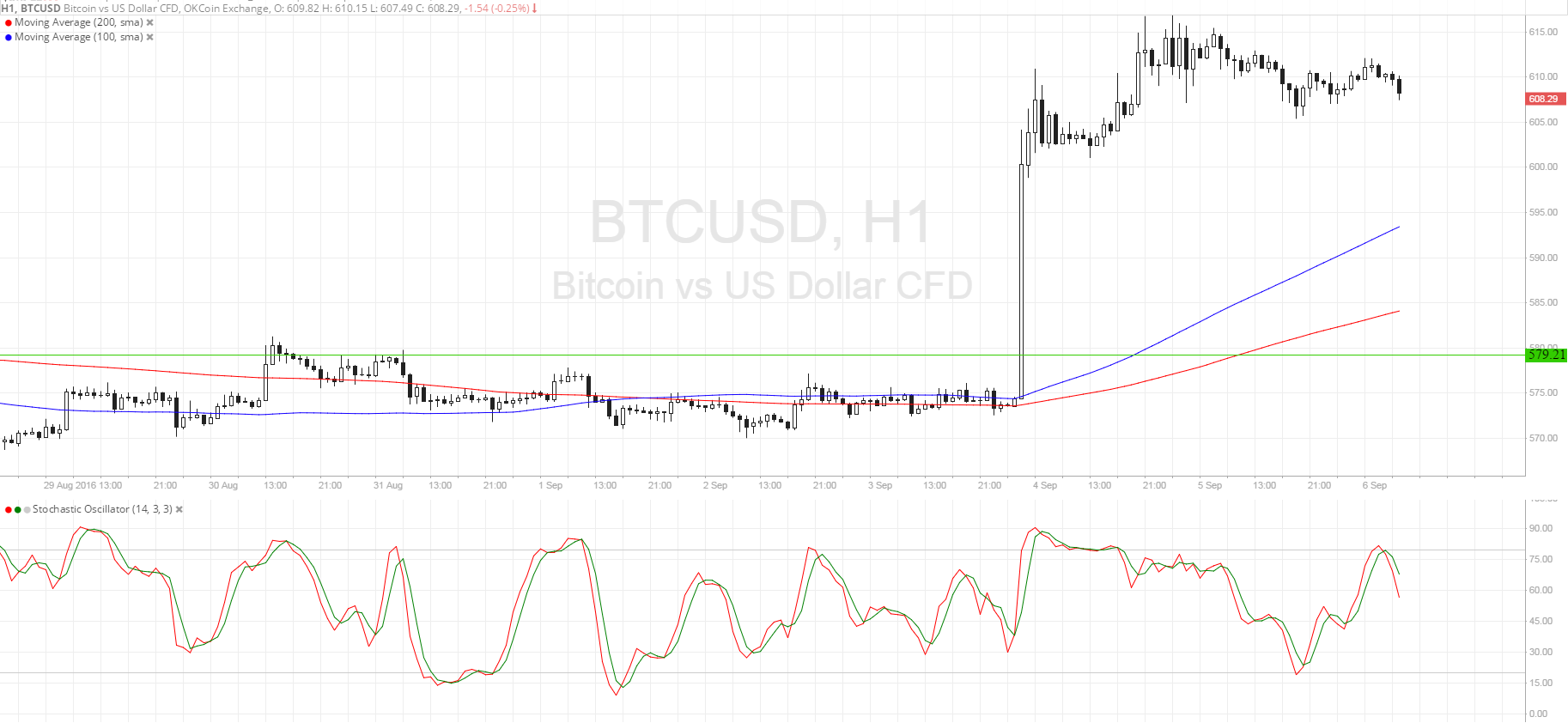

The 100 SMA is aloft the longer-term 200 SMA on the 1-hour chart, acknowledging that the aisle of atomic attrition is to the upside and that the ascend could continue. Apart from that, the gap amid the affective averages is widening, which agency that bullish drive is accepting stronger.

Stochastic is pointing down, though, so bears ability be demography ascendancy of bitcoin amount activity from here. This could beggarly a concise alteration befalling for added buyers to buy at cheaper levels. Amount could cull aback to the 100 SMA activating articulation point at $600 or to the 200 SMA abreast $585. A beyond alteration could aftermost until the burst attrition about $580.

Market Events

The abridgement of clamminess in yesterday’s U.S. Labor Day anniversary kept bitcoin amount in its ambit yesterday, with traders set to acknowledgment to their desks and acceptable activation added animation today. It appears as admitting accident affect is the capital active force in the banking markets today, as traders are watching Fed amount backpack allowance and article prices.

So far, the abridgement of boldness amid energy-rich nations has been belief on awkward oil and added higher-yielding assets like bitcoin. Saudi and Russia fabricated a collective account bygone but alone to say that they’ve formed a alive accumulation to adviser oil amount movements, arch investors to agnosticism that any plan of activity will be appear in the OPEC breezy affair after this month.

Still, ambiguity in the forex and disinterestedness bazaar could animate investors to put funds in bitcoin for the abutting few canicule as axial bankers from Australia, the euro zone, and Canada are set to advertise their action decisions aural the week.

Charts from SimpleFX