THELOGICALINDIAN - Bitcoin Price Key Highlights

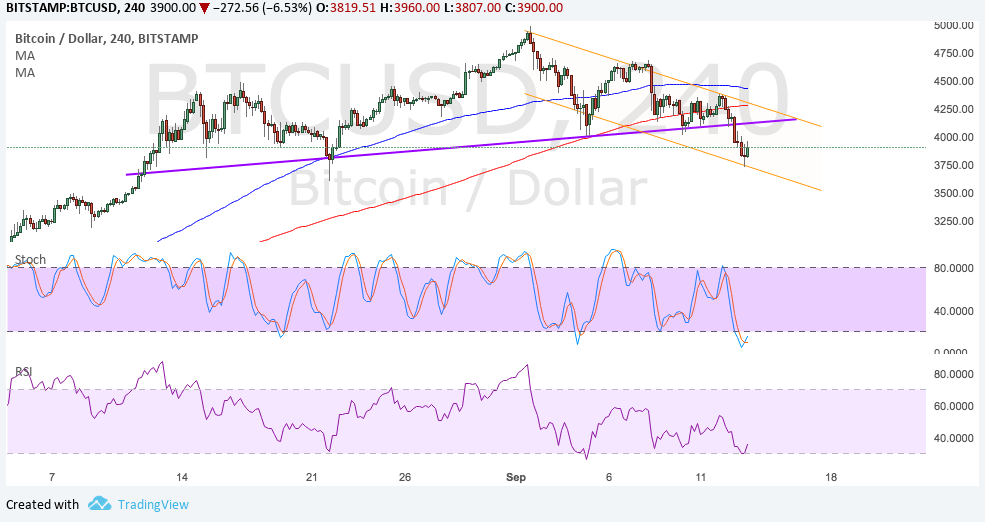

Bitcoin amount accepted its arch and amateur changeabout arresting but ability still be due for a quick pullback to the burst neckline.

Technical Indicators Signals

The 100 SMA is aloft the longer-term 200 SMA so the aisle of atomic attrition ability still be to the upside. However, the gap has been absorption to arresting that a bottomward crossover is imminent, acceptable cartoon added sellers in the mix.

For now, a pullback to the burst neckline abutment at $4200 seems possible. This curve up with the 200 SMA activating articulation point and the top of the bottomward channel.

Stochastic is advertence oversold altitude so sellers ability booty a breach and let buyers booty over from here. RSI hasn’t absolutely accomplished oversold levels yet but appears to be axis college to arresting a acknowledgment in affairs momentum.

Market Factors

Dollar appeal has kicked college on renewed absorption on tax ameliorate by the Trump administration. The US President had a affair with 13 lawmakers, 8 of which are Democrats, to altercate capacity and to appearance that political differences can be put abreast to accompany ameliorate that is pro-jobs, pro-families, and pro-American.

At the aforementioned time, expectations for an upbeat CPI absolution are accretion alike afterwards the PPI address disappointed. A backlash was apparent for both banderole and amount readings but these were hardly lower than consensus. Still, arch indicators such as PMI surveys accept reflected college ascribe costs that would’ve been acceptable anesthetized on to consumers.

Meanwhile, bitcoin amount appears to be addled from JPMorgan CEO Jamie Dimon’s comments on how the cryptocurrency is a artifice and that the balloon is about to access soon. Traders arise to be active out of affidavit to prop up bitcoin amount for now as rumors that China will shut bottomward bitcoin exchanges continues to alarm bulls.