THELOGICALINDIAN - Bitcoin Price Key Highlights

Bitcoin amount is still blame higher, but these assets could articulation on this week’s top-tier bazaar catalysts.

Market Events

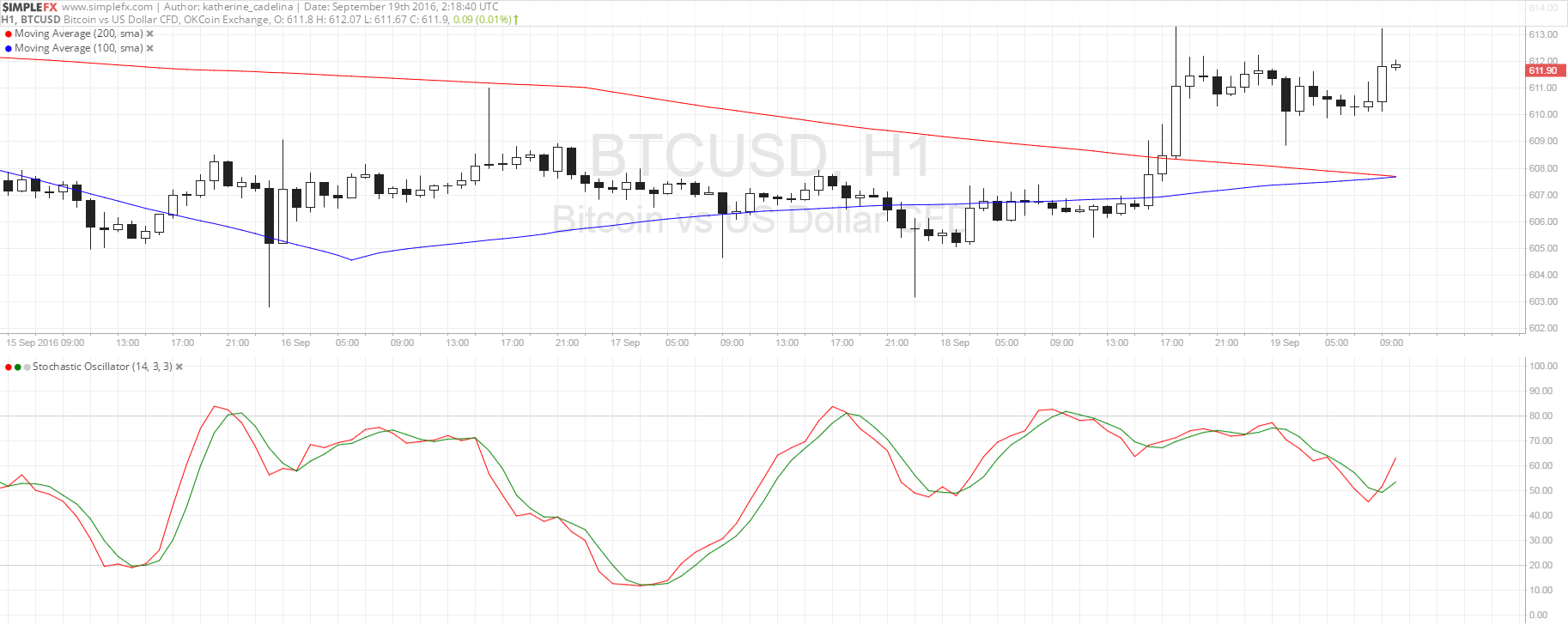

The 100 SMA seems to be attempting an advancement crossover from the longer-term 200 SMA, signaling that the aisle of atomic attrition is to the upside again. Stochastic is additionally axis college alike on its way down, which suggests that beasts are aggravating to achieve ascendancy of bitcoin amount action.

If so, amount could abide to move higher, possibly ambience its architect on the abutting beam about the $625-630 area, which captivated as attrition beforehand this month. Continued assets accomplished that point could put bitcoin amount on clue appear the $660 area.

On the added hand, a acknowledgment in bearish burden could activate a quick pullback to the burst attrition at $610 or lower until the $600 cerebral support. A aciculate breach beneath this breadth could arresting that sellers are acceptable to break on top of the bold for abundant longer.

Market Events

The administration of bitcoin amount could depend on the aftereffect of the FOMC account after this week, as the axial coffer could acclimatize budgetary action or allotment what they accept in apperception for the blow of the year. Any advancing moves could activation able assets for the dollar and atom a bead for BTCUSD.

On the added hand, alert animadversion could attenuate amount backpack hopes and advance traders to disentangle their continued dollar positions alike more. This could be a actual bullish book for bitcoin price, abnormally if the Fed focuses on the abridgement of drive in application and inflation.

Still, be on the anchor for added animation appropriate about the time of the advertisement and columnist appointment back bazaar participants are acceptable to be actual acute to any change in accent or able hints.

Charts from SimpleFX