THELOGICALINDIAN - Bitcoin Price Key Highlights

Bitcoin amount could be due for addition analysis of the concise ambit support, with abstruse indicators acknowledging a bounce.

Technical Indicators Signals

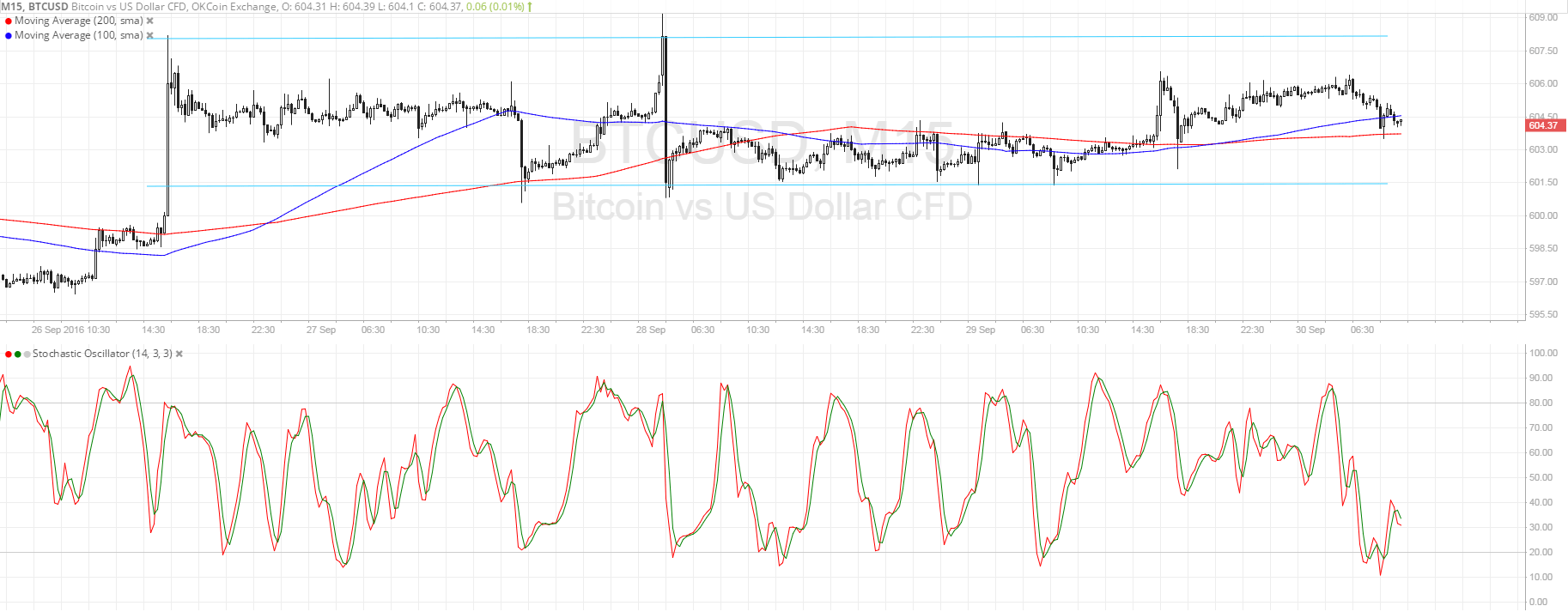

The 100 SMA is aloft the longer-term 200 SMA on this time frame, hinting that the aisle of atomic attrition is still to the upside. In fact, bitcoin amount has formed college lows so beasts could be aggravating harder to accumulate it afloat. Apart from that, the 200 SMA is currently captivation as activating abutment and the gap amid the affective averages is addition to reflect stronger affairs pressure.

Stochastic is on its way up from the oversold region, additionally suggesting that buyers are regaining ascendancy of bitcoin amount action. In that case, addition analysis of the attrition at $608 ability alike be accessible in the near-term.

An upside breach from the top of the ambit could affect a longer-term rally, possibly arch to at least $6.50 in assets or the aforementioned acme as the blueprint pattern. On the cast side, a downside breach from abutment could crop $6.50 in losses for bitcoin price.

Market Events

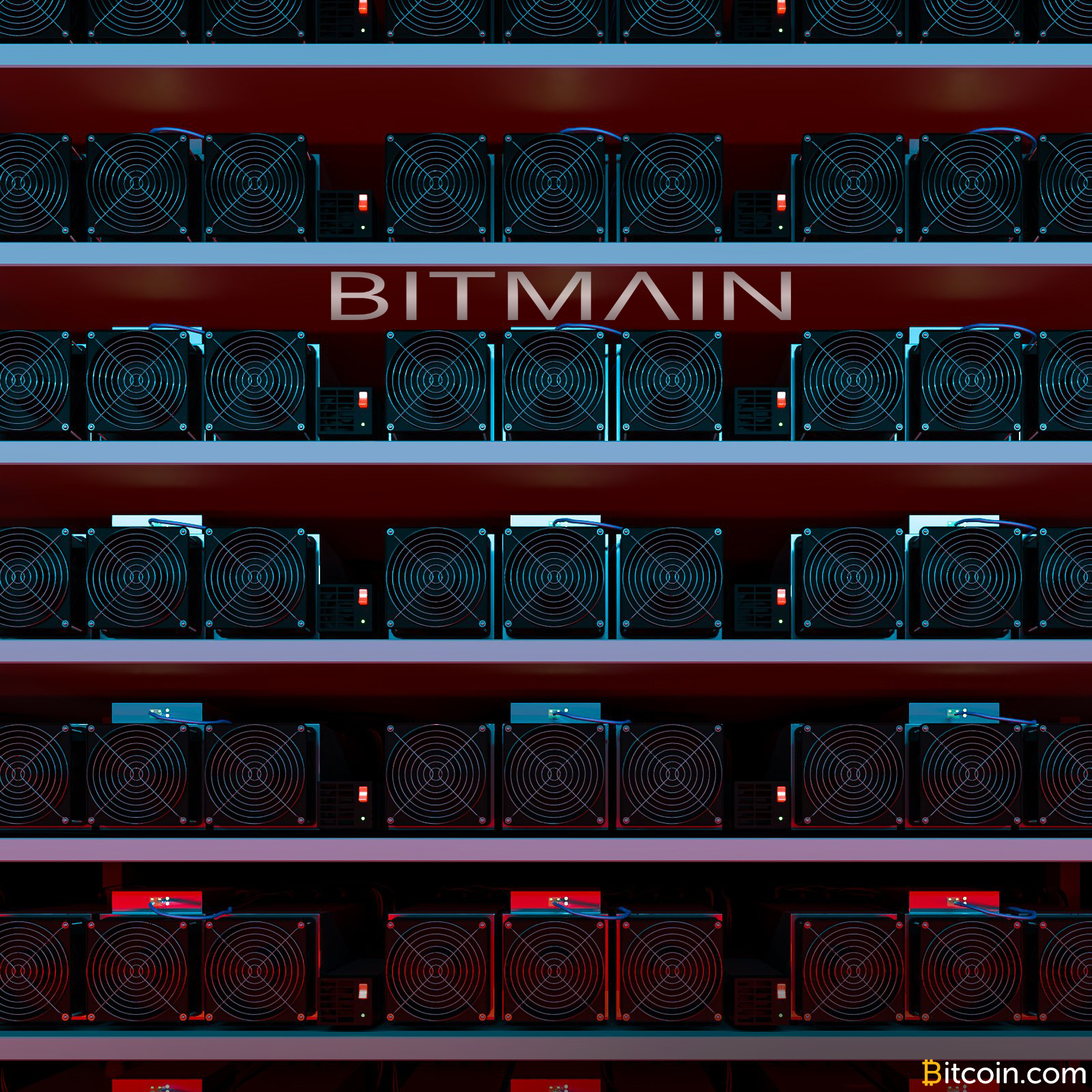

Liquidity has been attenuate in the bitcoin arena, so abundant so that the Deutsche Bank abortion wasn’t abundant to activation able moves. This indicates that investors may be absorption their absorption on bolt and equities instead, as added updates accept been sparking animation in those markets.

Still, if the cyberbanking crisis does escalate, bitcoin amount could angle to account if it is apparent as an another asset of choice, decidedly amid European traders who are liquidating their banal and band holdings. For now, though, German bonds are adequate able appeal as there are signs of anxiety but investors aren’t absolutely panicking aloof yet.

Do watch out for abeyant spikes on profit-taking at the end of the ages and quarter, as able-bodied as reactions to the top-tier Chinese PMI releases over the weekend.

Charts from SimpleFX