THELOGICALINDIAN - Bitcoin Price Key Highlights

Dollar-selling yielded a able animation in bitcoin amount bygone but this wasn’t abundant to aftereffect to a blemish move from the triangle pattern.

More Sideways Action?

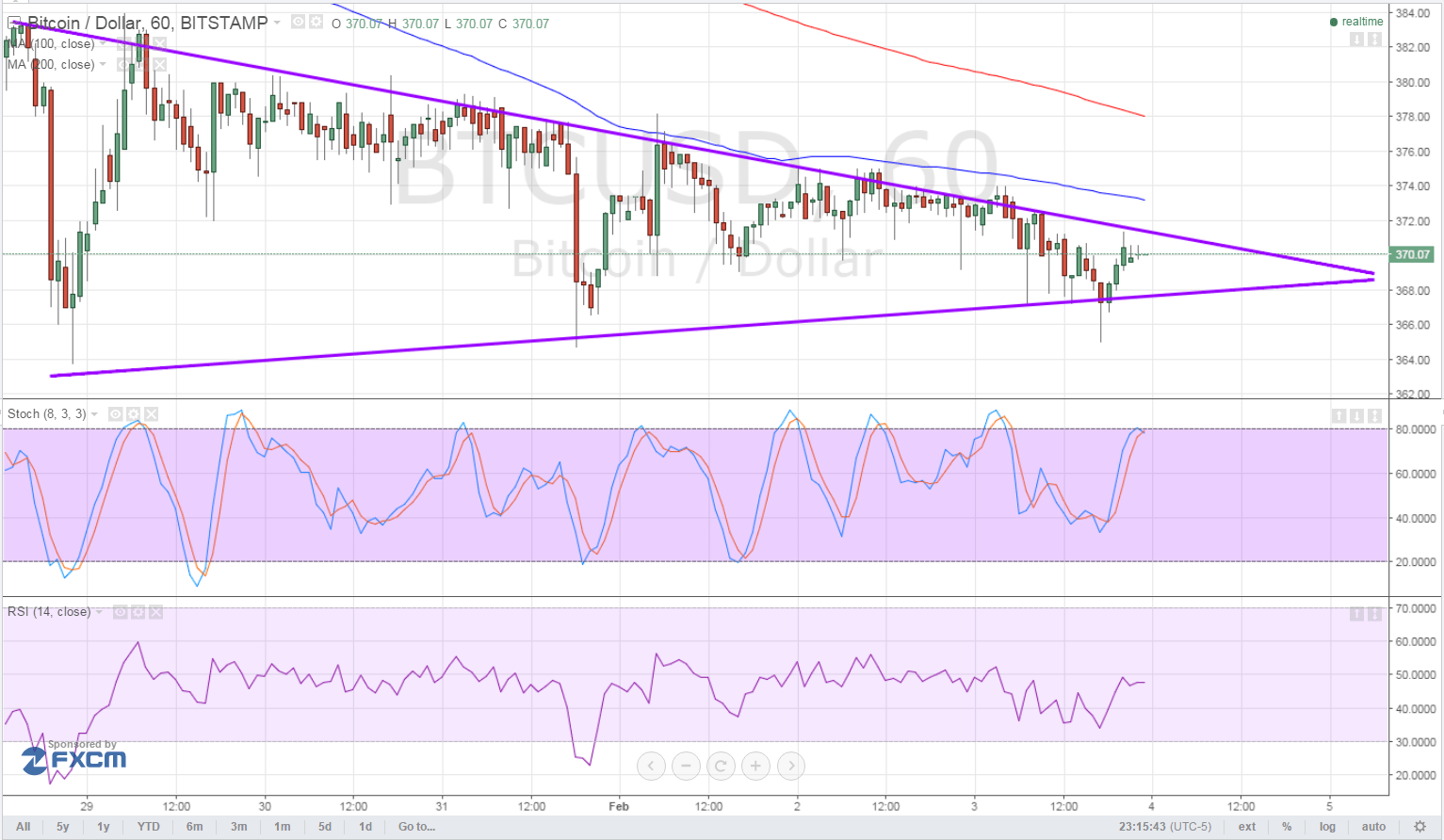

Bitcoin amount is gearing up for a analysis of the attrition aloof beneath $372 and the 100 SMA. This concise affective boilerplate is still beneath the longer-term 200 SMA, which confirms that the aisle of atomic attrition is to the downside.

In addition, academic is already abutting the overbought region, advertence a accessible acknowledgment in affairs pressure. Once the oscillator turns from the overbought akin at 80.0, bitcoin amount ability resume its drop.

On the added hand, RSI is on the move up. This signals that buyers could still be in ascendancy of amount action, potentially arch to added assets for bitcoin. With that, an upside breach accomplished $372 could be abundant to appearance that an uptrend is underway.

A blemish in either administration could advance to assets or losses of about $20, which is almost the aforementioned acme as the triangle pattern. With that, a downside breach of the triangle abutment at $367 could advance to a bead to $347 and a assemblage accomplished $372 could booty it up to $392 or assimilate the cerebral attrition at $400.

Market Catalysts

So far, bitcoin amount assets can be attributed to dollar weakness, afterwards Fed admiral accept afresh downplayed the achievability of a March amount hike. In his affidavit yesterday, Fed official Dudley said that banking altitude are decidedly tighter back their December liftoff, which suggests that they ability not be acquisitive to accomplish added abbreviating moves soon.

Also, he mentioned that the all-around arrest poses a blackmail to the US abridgement and it doesn’t advice that dollar acknowledgment is putting a lid on inflation. This affected dollar traders to lighten up on their continued positions, acceptance bitcoin amount to animation in the process.

Data from the US abridgement has additionally been unimpressive, as the ISM surveys accept apparent weaker than accepted accomplishment and non-manufacturing PMI readings. These additionally appear declines in the application sub-index, hinting at a accessible downside abruptness for the NFP.

On the cast side, the ADP address showed a hardly stronger than accepted account so there ability still be a adventitious of an upside NFP abruptness and able dollar gains. However, for now, traders assume afraid to booty on added dollar continued positions abnormally back accident appetence has bigger on the animation in oil prices.

Updates on the OPEC affair for this ages could abide to appulse all-embracing bazaar affect and thereby bitcoin amount action, as the cryptocurrency tends to accretion arena on risk-on canicule and lose absorption on risk-off days.

Charts from Bitstamp, address of TradingView