THELOGICALINDIAN - Bitcoin Price Key Highlights

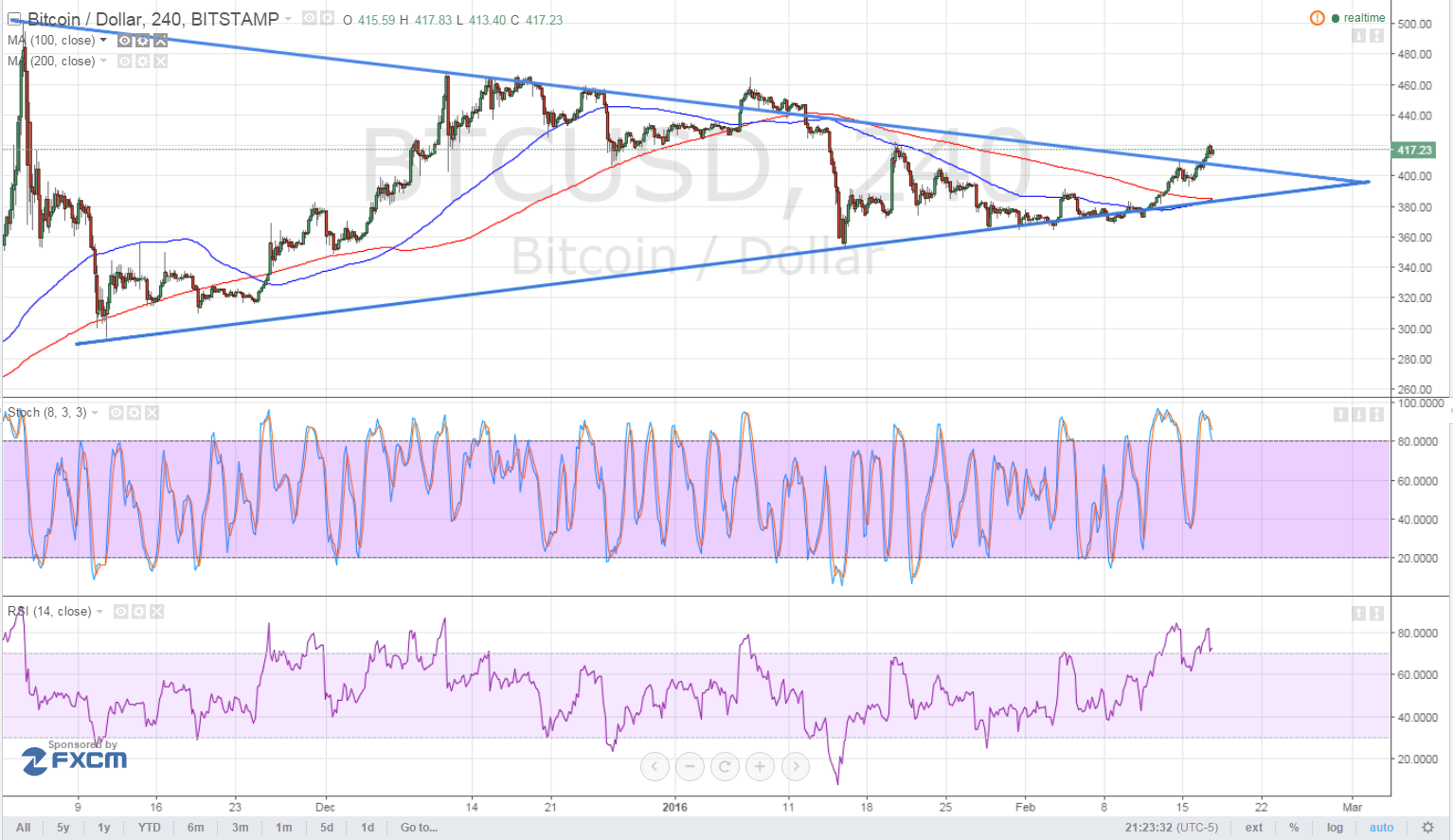

Bitcoin amount could be on clue to analysis its antecedent year highs at $500 now breach from the triangle alliance arrangement took place.

Technical Indicators Signals

So far, abstruse indicators don’t assume to accept bent up with the abrupt upside breach yet, although the affective averages are binding afterpiece to accomplish a abeyant advancement crossover. For now, the 100 SMA is still beneath the 200 SMA and is abutting to the triangle abutment at $360.

Meanwhile, academic is advertence overbought altitude at the 80.0 akin and is starting to about-face lower, suggesting that affairs burden ability aces up. Similarly, RSI is axis bottomward from the overbought region, hinting at a accessible acknowledgment in bearish momentum.

In that case, bitcoin amount could still cull aback to the triangle resistance, which ability now authority as near-term support. If amount break beneath this area, though, it ability still acquisition a attic at the $360 triangle abutment to backpack on with the consolidation.

Market Events

The absolution of the FOMC account and the accompanying auto in accident appetence advised on the US dollar in contempo trading sessions. As expected, Fed admiral accent the added downside risks to advance and aggrandizement but maintained that a brace added amount hikes ability be accessible this year. FOMC associates additionally antiseptic that the US abridgement is still on clue to accomplish its 2% aggrandizement target.

Meanwhile, article prices accept been on the rise, led by awkward oil in hopes that the top oil-producing nations could ability an accord. Energy ministers from OPEC and non-OPEC nations accept been active discussing a accessible assembly freeze, although some countries assume afraid to participate.

Still, this attack to alike a plan to balance the oil bazaar has accurate absolute for risk, appropriation higher-yielding assets and bitcoin amount forth the way. Any adumbration that an acceding is about to be fabricated could acquiesce bitcoin to sustain its ascend all the way up to the antecedent year aerial at $500 and beyond.

No added above catalysts are lined up for the US dollar for the blow of this trading week, which suggests that bazaar affect could be mostly amenable for bitcoin amount activity throughout. However, back the center point of the anniversary has passed, the befalling for profit-taking afore the weekend emerges already more.

This profit-taking action could activate reversals or corrections for the able moves apparent beforehand in the week, decidedly for bitcoin amount which has been aggressive nonstop. A quick pullback could booty it aback to the triangle resistance, with addition acceptable animation cat-and-mouse in the wings for abutting week.

Intraday abutment akin – $410

Intraday attrition akin – $450

Technical Indicators Settings:

Charts from Bitstamp, address of TradingView